Checkpoint combos for cancer are all the rage as trial sponsors line up hundreds of new studies — report

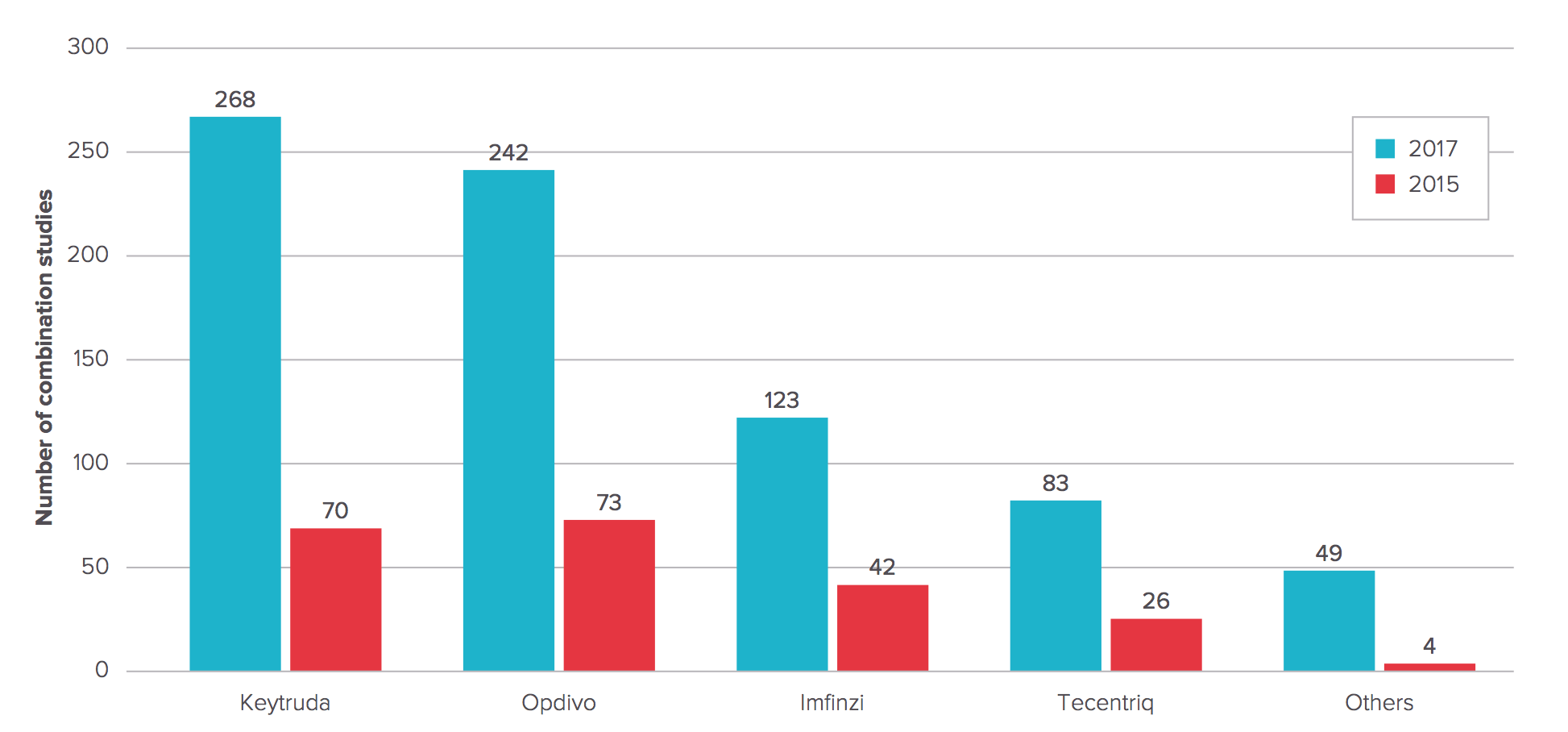

Number of Anti-PD-1/PD-L1 MAb combination studies 2015 vs. 2017

Full Report: Evaluate Ltd. May 2017

Over the last few months it …

Sign up to read this article for free.

Get free access to a limited number of articles, plus choose newsletters to get straight to your inbox.