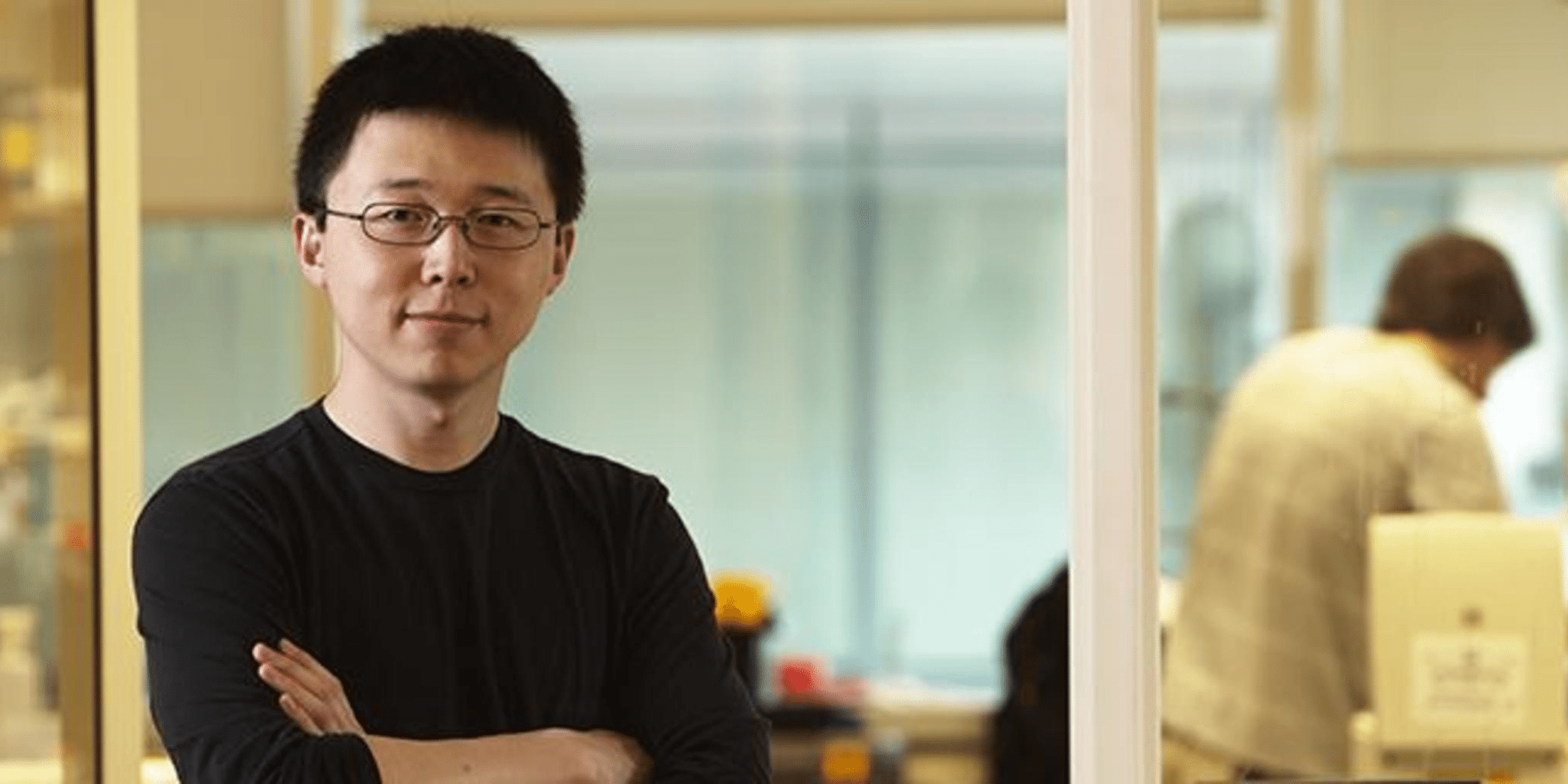

CRISPR pioneer Feng Zhang co-founds a 'limitless' biotech upstart with big plans for speeding new drug development

One of the key scientific players involved in the emergence of the incredibly buzzy gene editing tech CRISPR/Cas9 is backing a biotech startup called Arbor …

Sign up to read this article for free.

Get free access to a limited number of articles, plus choose newsletters to get straight to your inbox.