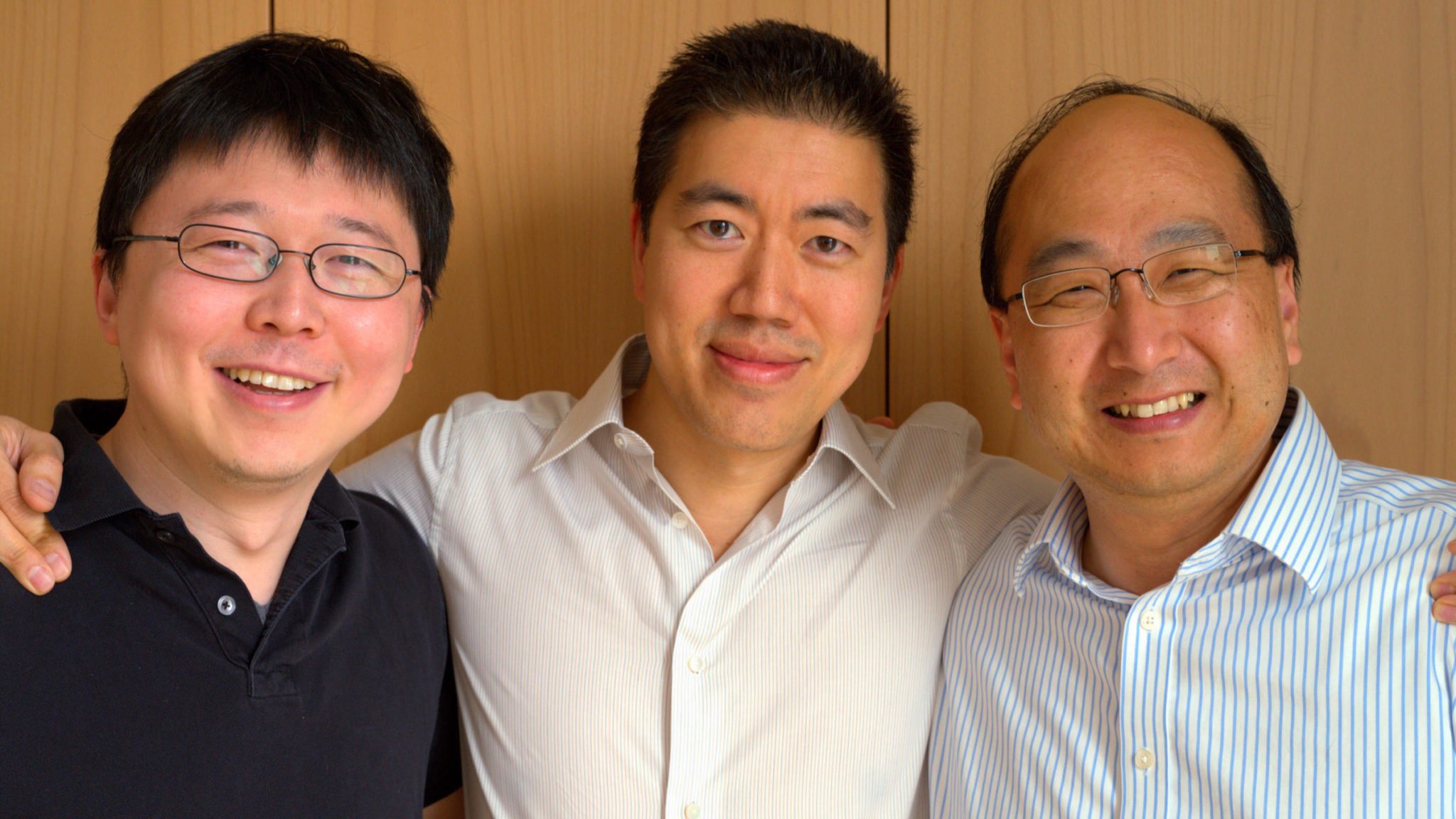

CRISPR trailblazers Zhang, Liu and Joung join forces to launch Beam with $87M and cutting-edge gene-editing tech

Three of the founders behind the high profile gene-editing company Editas are taking their scientific prowess to a new venture, launching a startup this week …

Sign up to read this article for free.

Get free access to a limited number of articles, plus choose newsletters to get straight to your inbox.