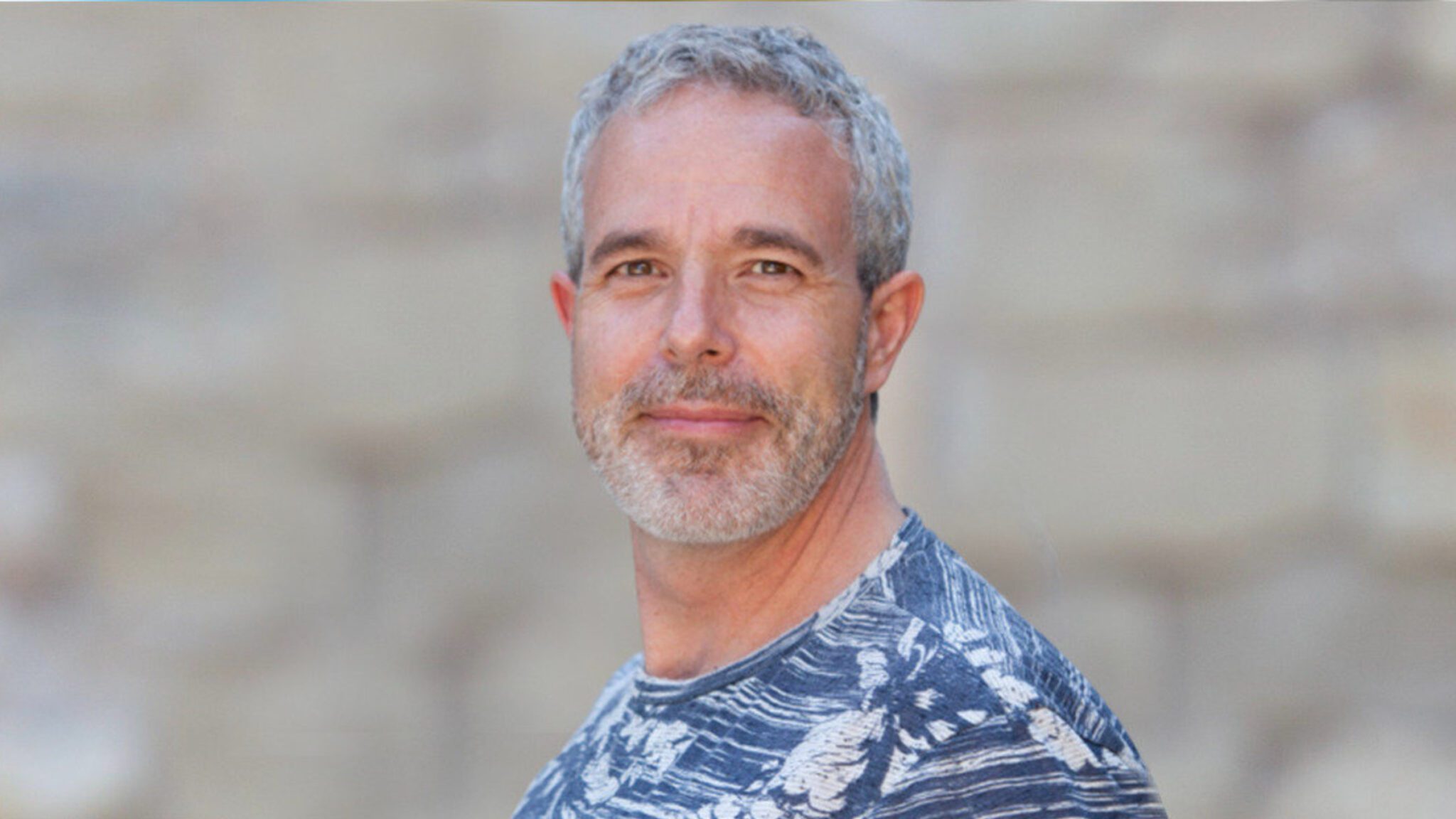

Brendan Frey (Deep Genomics)

Deep Genomics, now flush with cash, plans to take dozens of RNA therapies to the clinic

It was 2002 when Brendan Frey noticed a huge gap in biotech. The human genome had just been sequenced, allowing scientists to map genetic mutations …

Sign up to read this article for free.

Get free access to a limited number of articles, plus choose newsletters to get straight to your inbox.