FDA nomination in hand, Gottlieb prepares to disentangle himself from a long list of biopharma jobs and investments

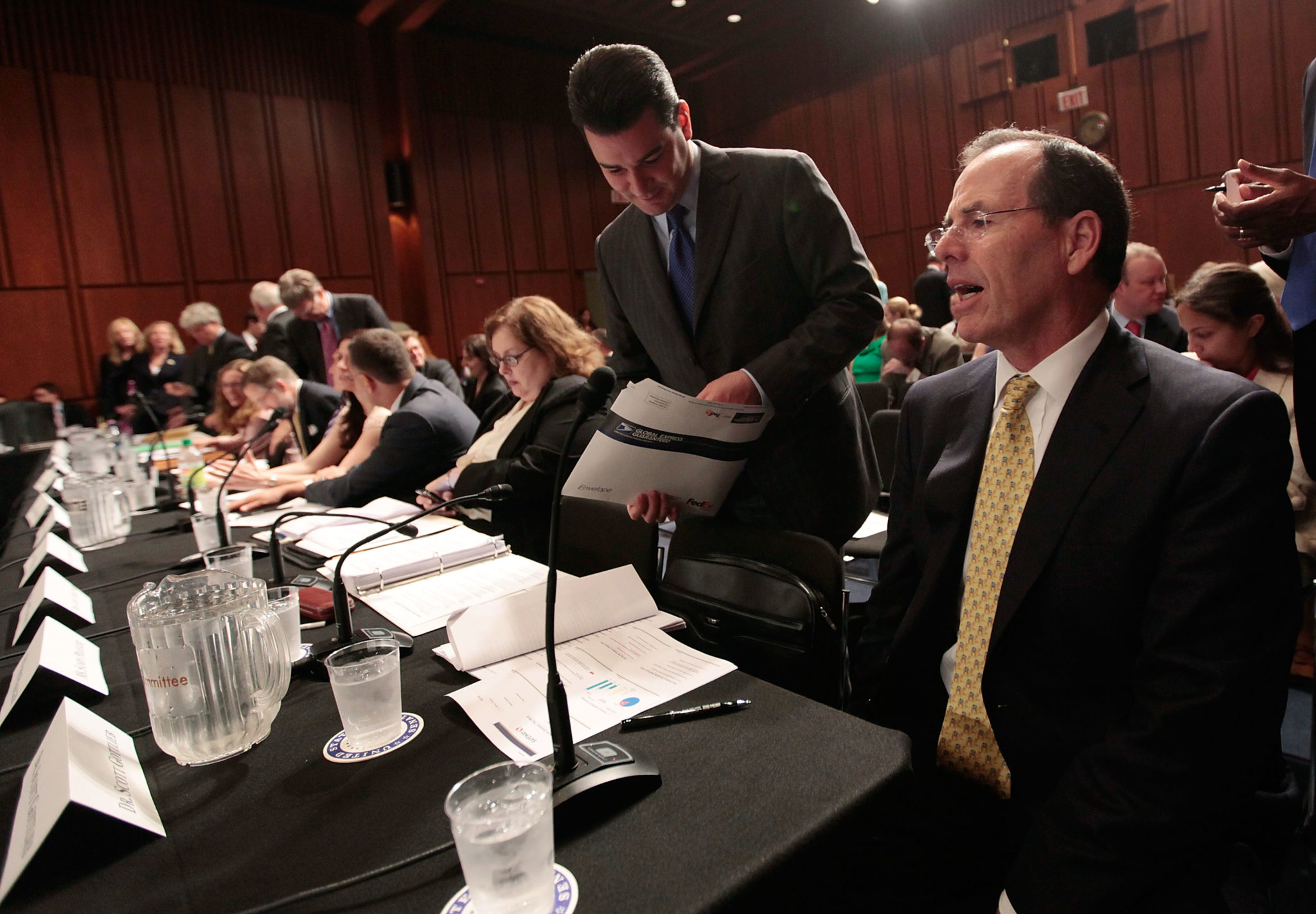

Steve Burd (R), president and CEO, Safeway, Inc. and Scott Gottlieb (L), resident fellow at American Enterprise Institute participate in a Senate Health, Education, Labor …

Sign up to read this article for free.

Get free access to a limited number of articles, plus choose newsletters to get straight to your inbox.