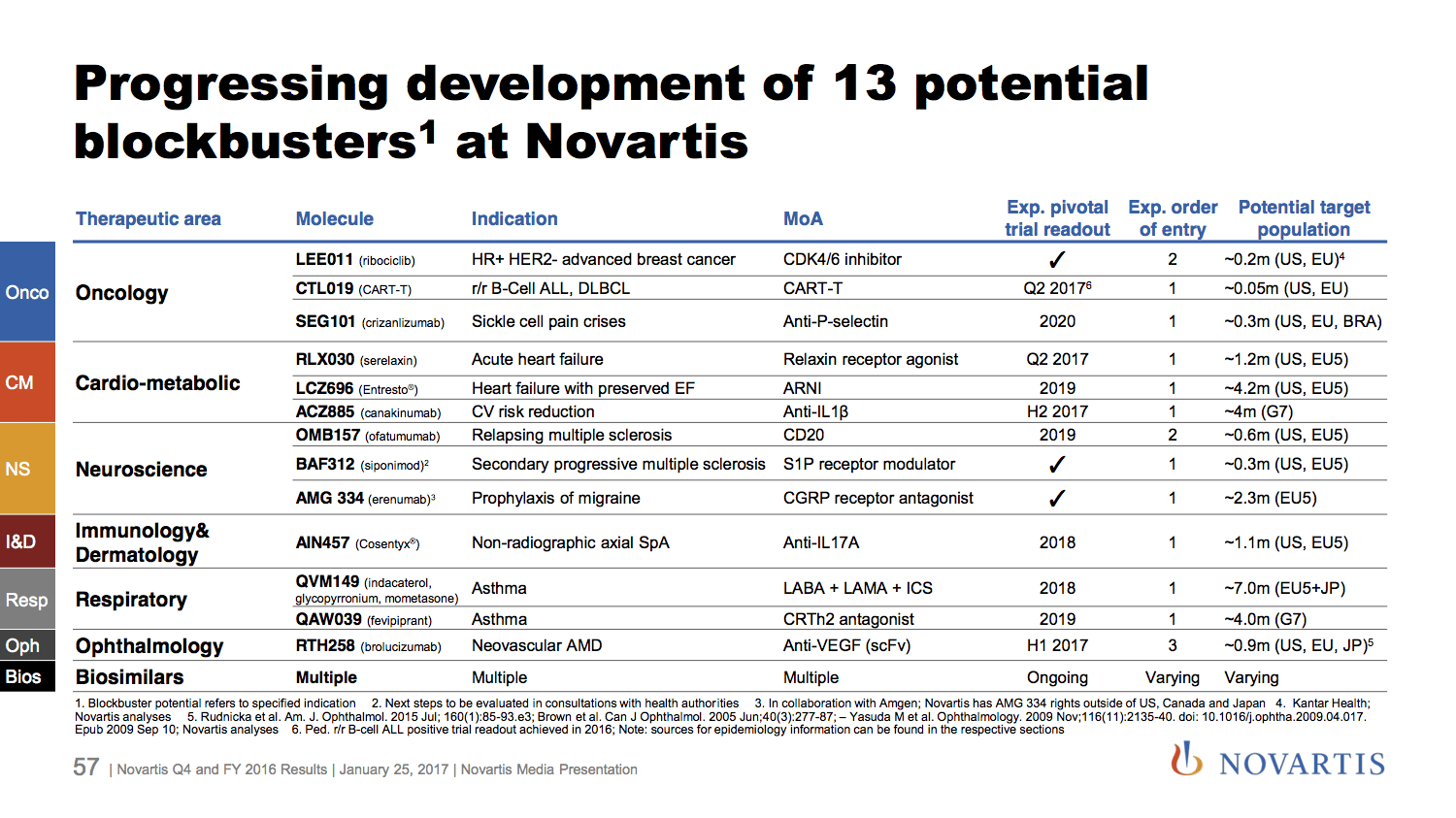

Fighting a generic onslaught, Novartis adds CAR-T to its growing list of late-stage blockbusters

One of the reasons why Novartis isn’t being forced to bid into the stratosphere for late-stage drugs is that its industry-topping R&D budget — $9 billion …

Sign up to read this article for free.

Get free access to a limited number of articles, plus choose newsletters to get straight to your inbox.