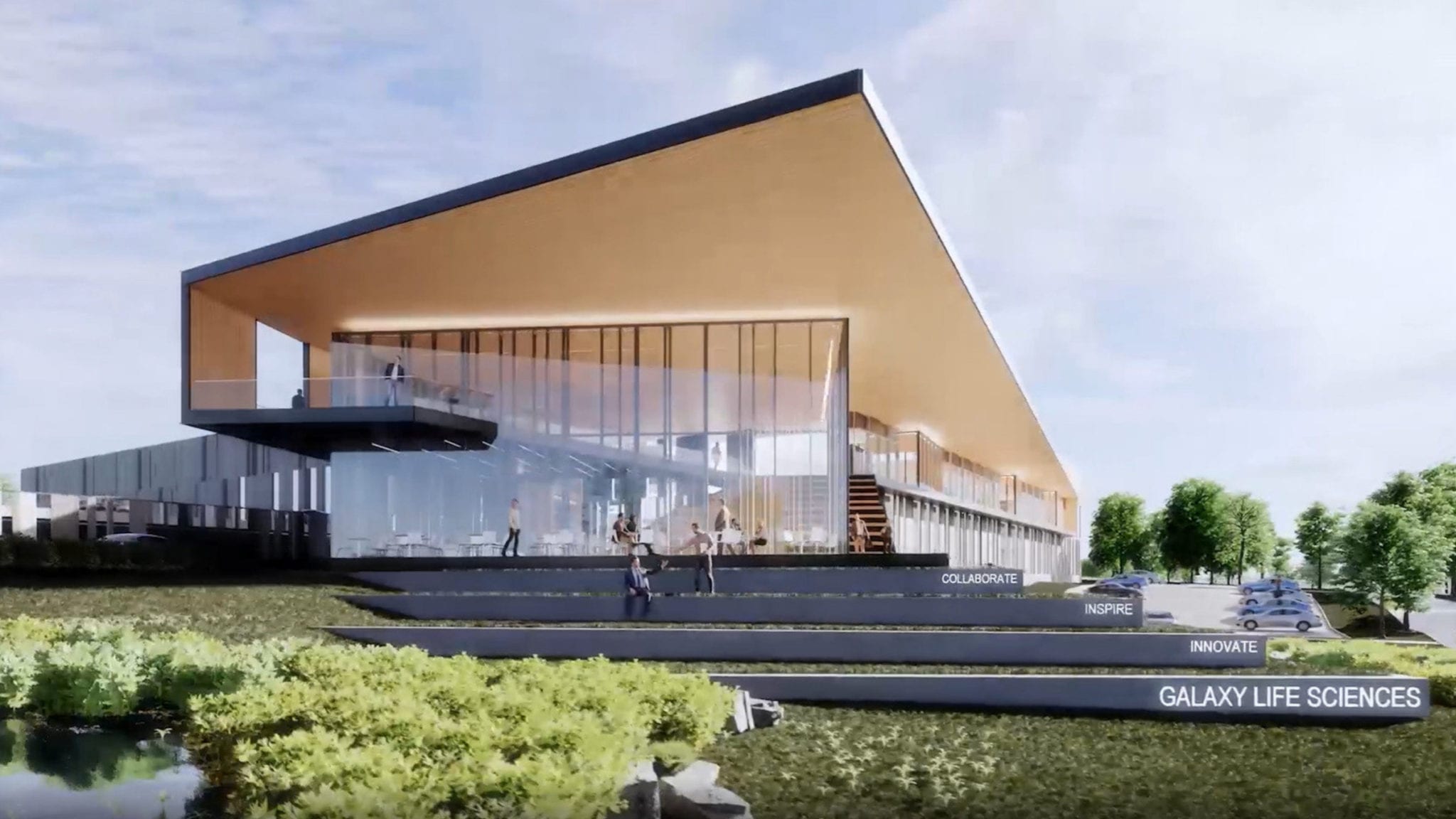

Credit: Galaxy Life Sciences

Galaxy Life Sciences lands $50 million deal to build in central Massachusetts biomanufacturing park

Webster, MA-based real estate developer Galaxy Life Sciences struck a roughly $50 million deal to build in a biomanufacturing park in Worcester, an up-and-coming biotech …

Sign up to read this article for free.

Get free access to a limited number of articles, plus choose newsletters to get straight to your inbox.