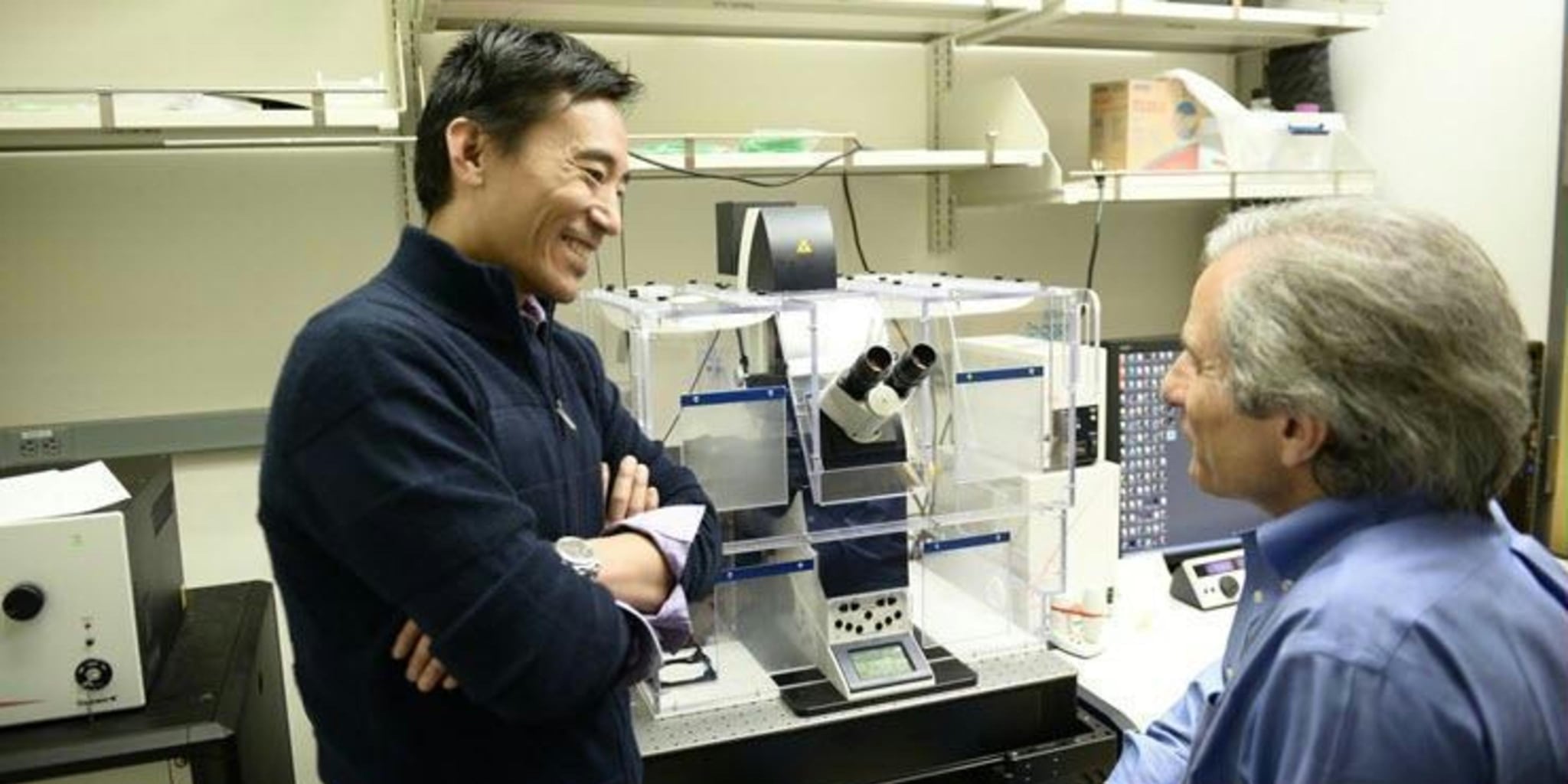

Genentech I/O chief Dan Chen heads to an upstart biotech looking to create a landmark advance on antibodies

One of the top scientific leaders behind the emergence of PD-1/L1 checkpoint inhibitors has left Genentech to take the chief medical officer’s job at a low-profile biotech upstart looking to make antibody history.

Dan Chen, who led the development of Tecentriq from start to post-market stardom, has taken the CMO’s job at IgM Biosciences in Mountain View, CA.

I couldn’t find much about them. No venture rounds or high-profile endorsements. But the website includes some lofty claims about their goal to revamp the way antibodies are developed, building on a blueprint that can significantly increase the ability of an antibody to bind with multiple domains using a much more complex IgM structure, rather than the IgGs that dominate the industry.

Unlock this article instantly by becoming a free subscriber.

You’ll get access to free articles each month, plus you can customize what newsletters get delivered to your inbox each week, including breaking news.