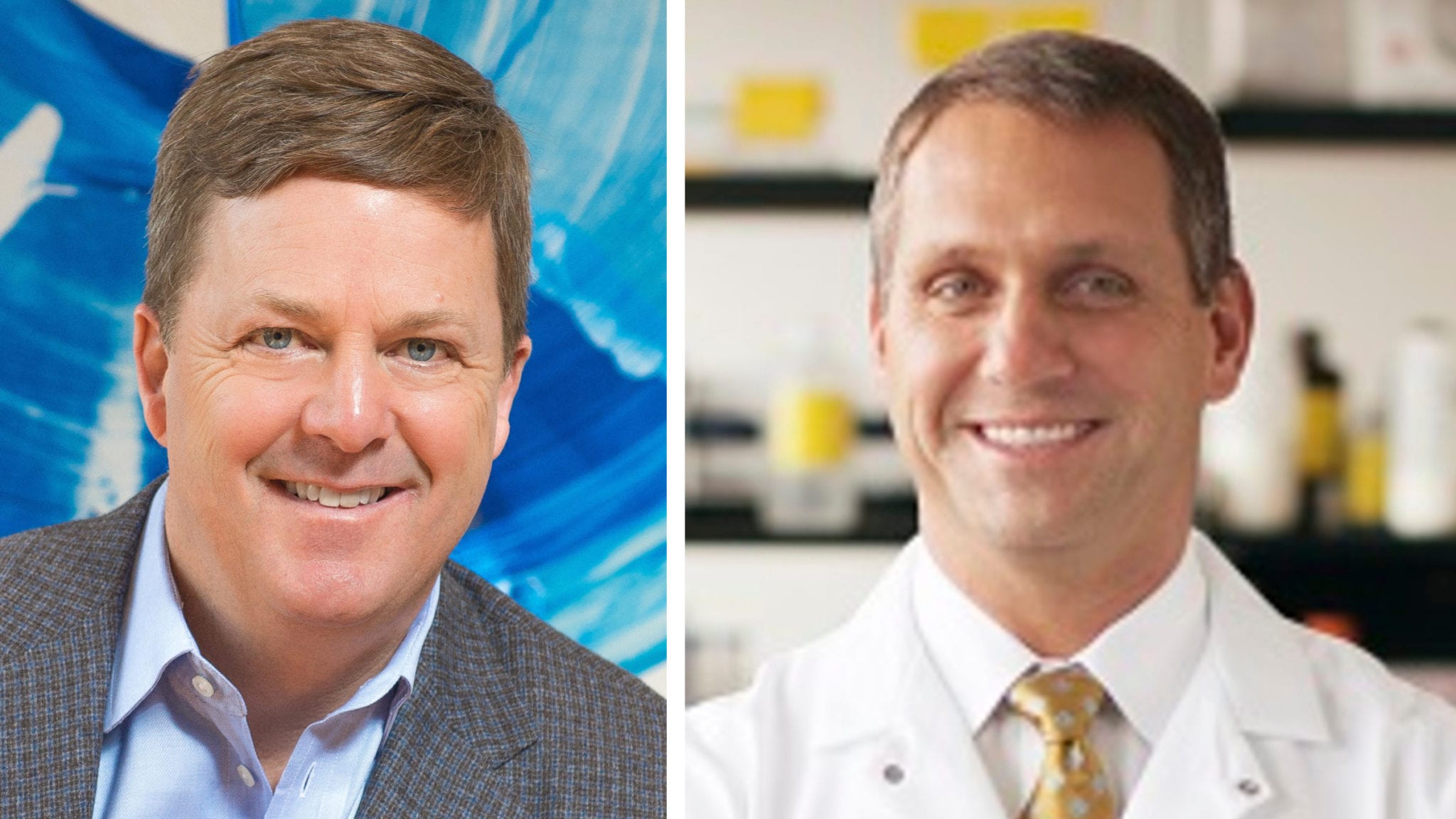

David Southwell (L) and Christoph Westphal

Harvard spinout kicks off 2021 with a crossover round and sights set on the clinic

Several months after striking an alliance with Novartis, TCR therapy-focused TScan Therapeutics has reeled in a crossover round that should hold it over for the …

Sign up to read this article for free.

Get free access to a limited number of articles, plus choose newsletters to get straight to your inbox.