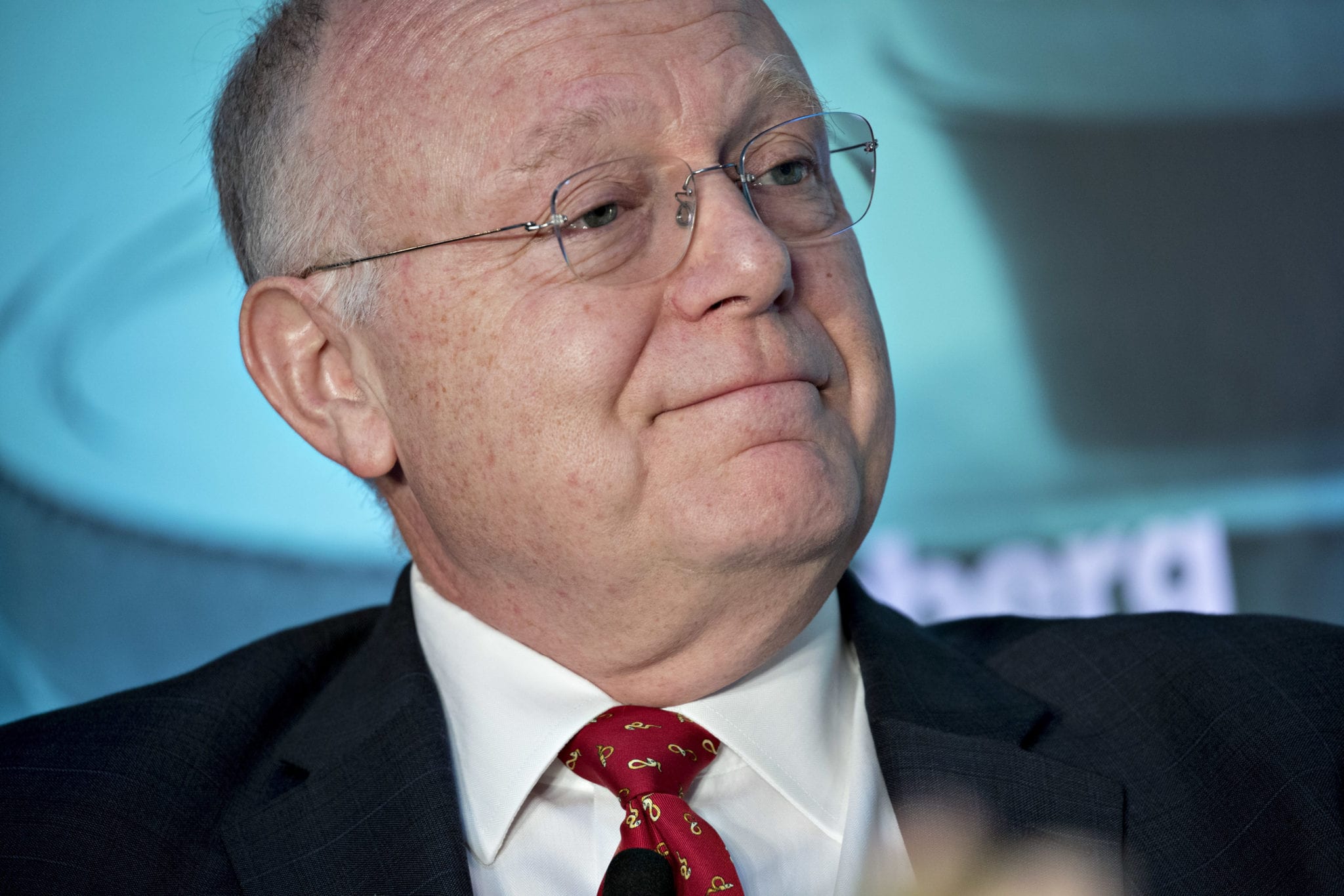

Ian Read bags $19.5 million, taking a big pay cut for his swan song as Pfizer CEO and leaving the pharma giant at a crossroads

Ian Read passed the CEO title on to his hand picked successor Albert Bourla at the beginning of this year, but not before one last …

Sign up to read this article for free.

Get free access to a limited number of articles, plus choose newsletters to get straight to your inbox.