Immetas Therapeutics nabs $11M Series A to narrow their bispecific work targeting inflammation in age-related diseases

How does a biotech celebrate its two-year anniversary? For Immetas Therapeutics, it’s with an $11 million Series A round and a game plan to fight age-related disease.

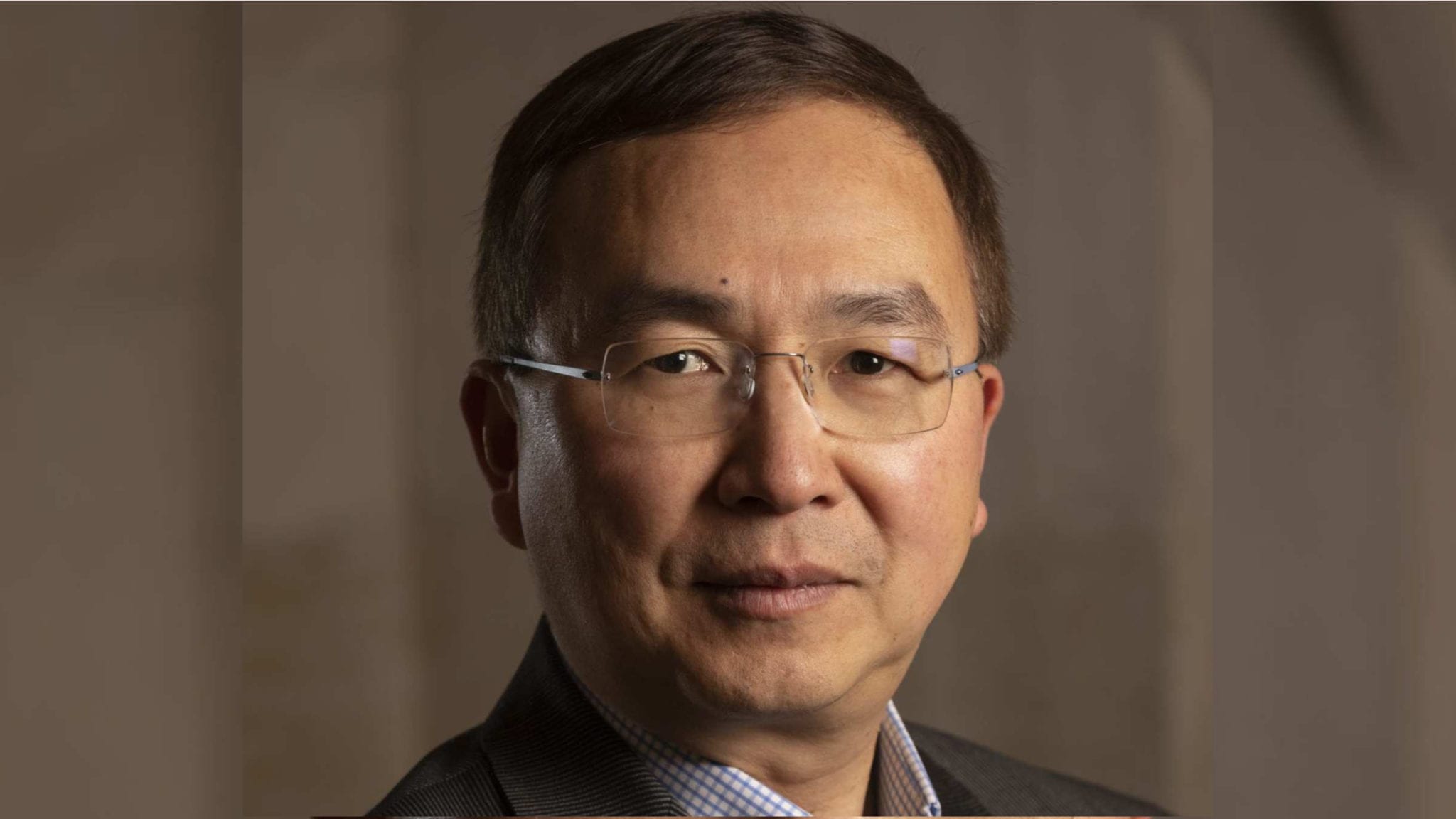

Co-founders Gene Wang and David Sinclair came together years ago around the idea that inflammation is the ultimate process driving age-related illnesses, including cancer. The duo launched Immetas in 2018 and packed the staff with industry experts. Wang, who says he’s always had an entrepreneurial spirit, has held lead roles at Novartis, GSK, Bristol Myers Squibb and Merck. He’s worked on blockbuster drugs like Humira, Gardasil, Varubi and Zolinza. And now, he’s channeling that spirit as CEO.

Unlock this article instantly by becoming a free subscriber.

You’ll get access to free articles each month, plus you can customize what newsletters get delivered to your inbox each week, including breaking news.