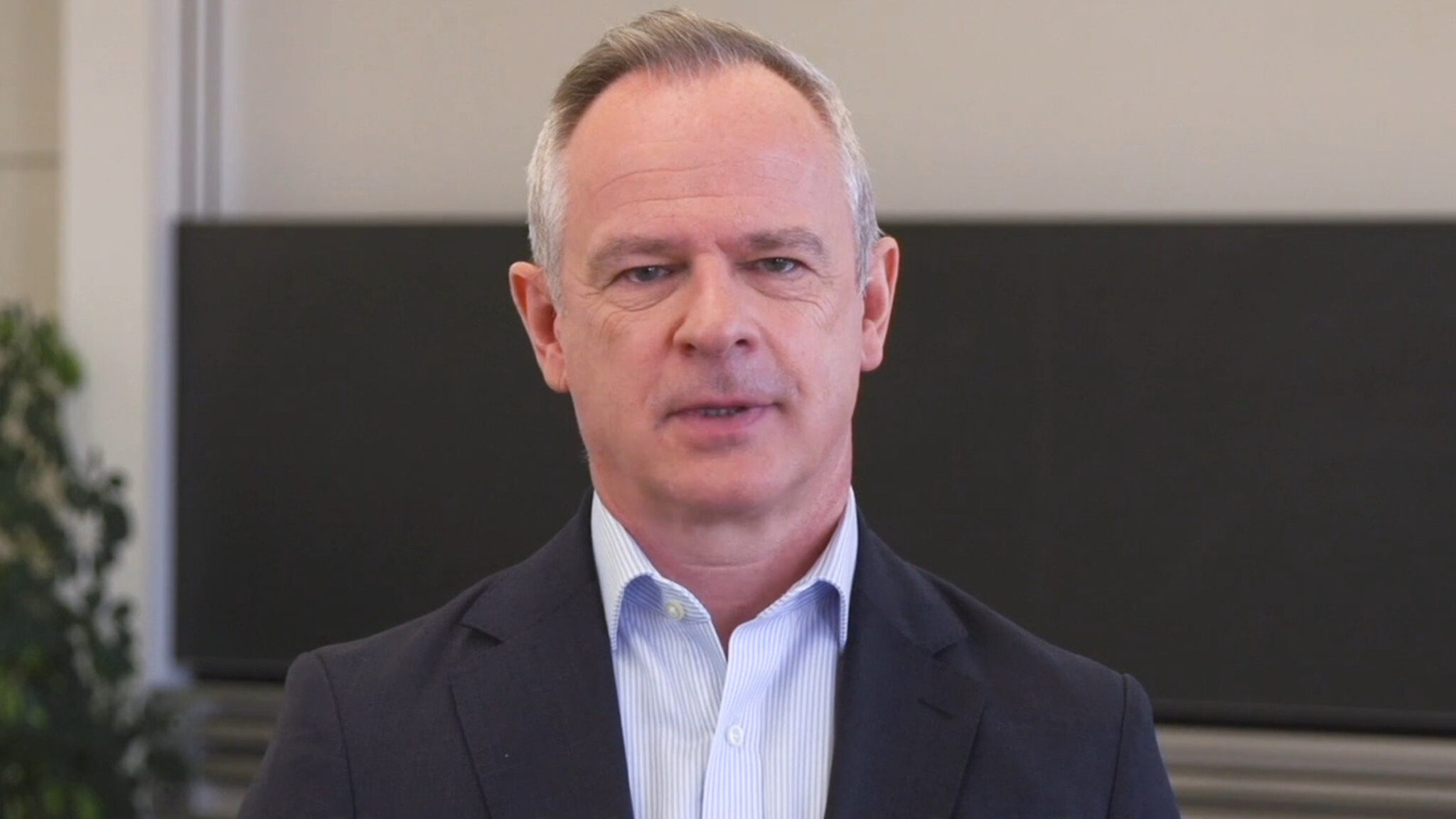

David Veitch, Basilea CEO (Vimeo via Basilea website)

In an unusual pivot, Swiss biotech Basilea looks to ditch cancer pipeline in favor of — anti-infectives?

Oncology has been the single largest driver of revenues across biopharma for years now, and you’re more likely than ever to see a company ditch …

Sign up to read this article for free.

Get free access to a limited number of articles, plus choose newsletters to get straight to your inbox.