Investors trapped for another 28 days as suspension of Woodford flagship fund drags on

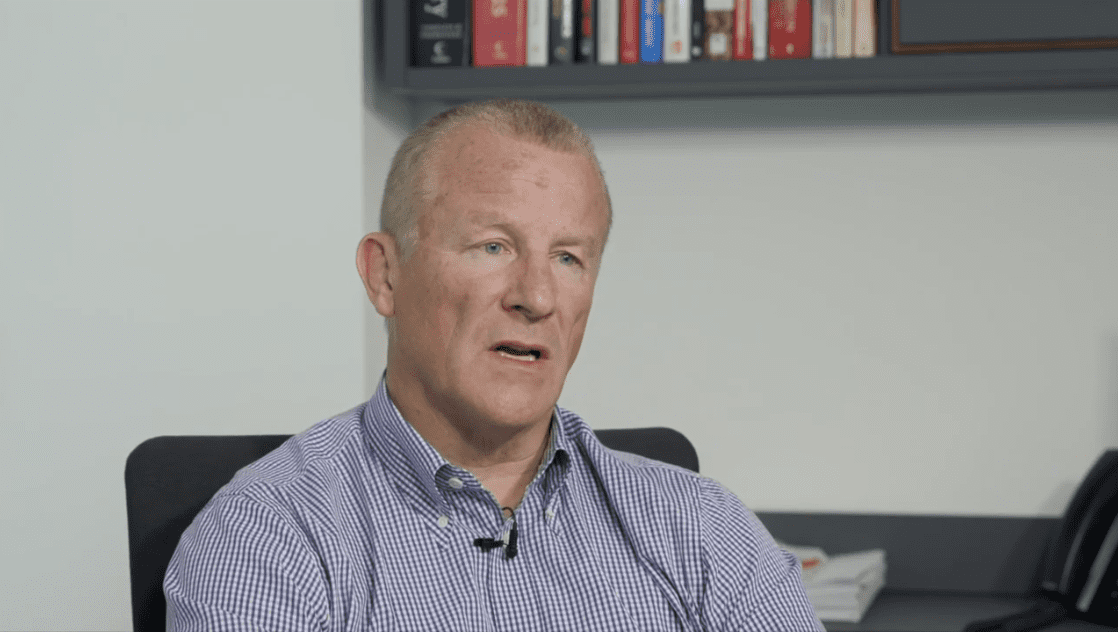

So when will Neil Woodford’s main fund be reopened? Not in the coming 28 days, investors learned after the markets closed in the UK Monday.

Link Fund Solutions, the official holder of the Woodford Equity Income Fund, has decided to continue blocking redemptions, sales or other transactions of the fund. It’s hardly a surprising outcome, but one that is likely to further frustrate investors, many of whom said they were blindsided by the ban.

Unlock this article instantly by becoming a free subscriber.

You’ll get access to free articles each month, plus you can customize what newsletters get delivered to your inbox each week, including breaking news.