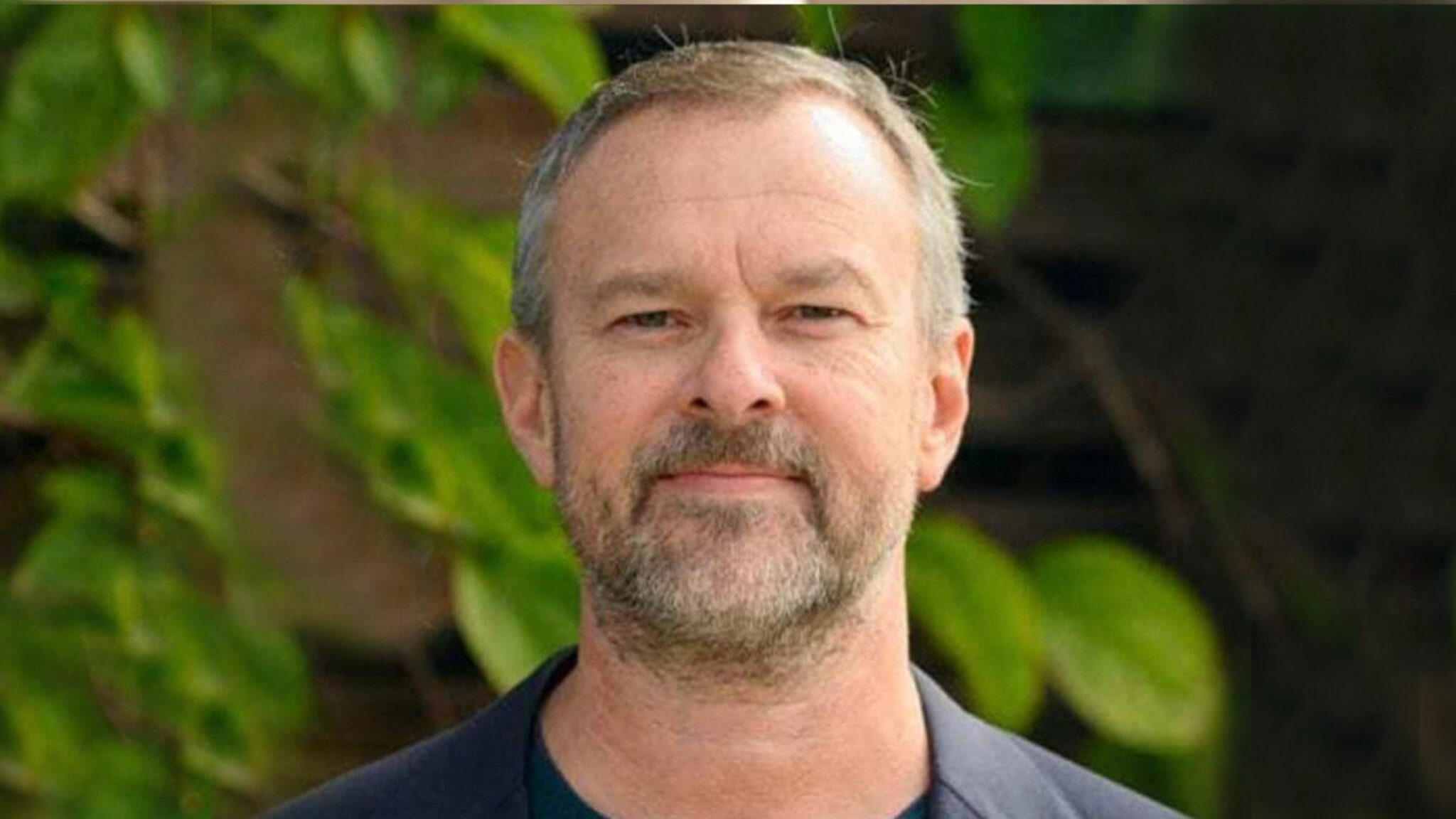

Brian Thomas, Metagenomi CEO

Ionis partners up with Metagenomi on drug discovery pact, shelling out $80M upfront

Ionis is no stranger to large deals and working with other entities, but its latest deal will see the company work Metagenomi to go after …

Sign up to read this article for free.

Get free access to a limited number of articles, plus choose newsletters to get straight to your inbox.