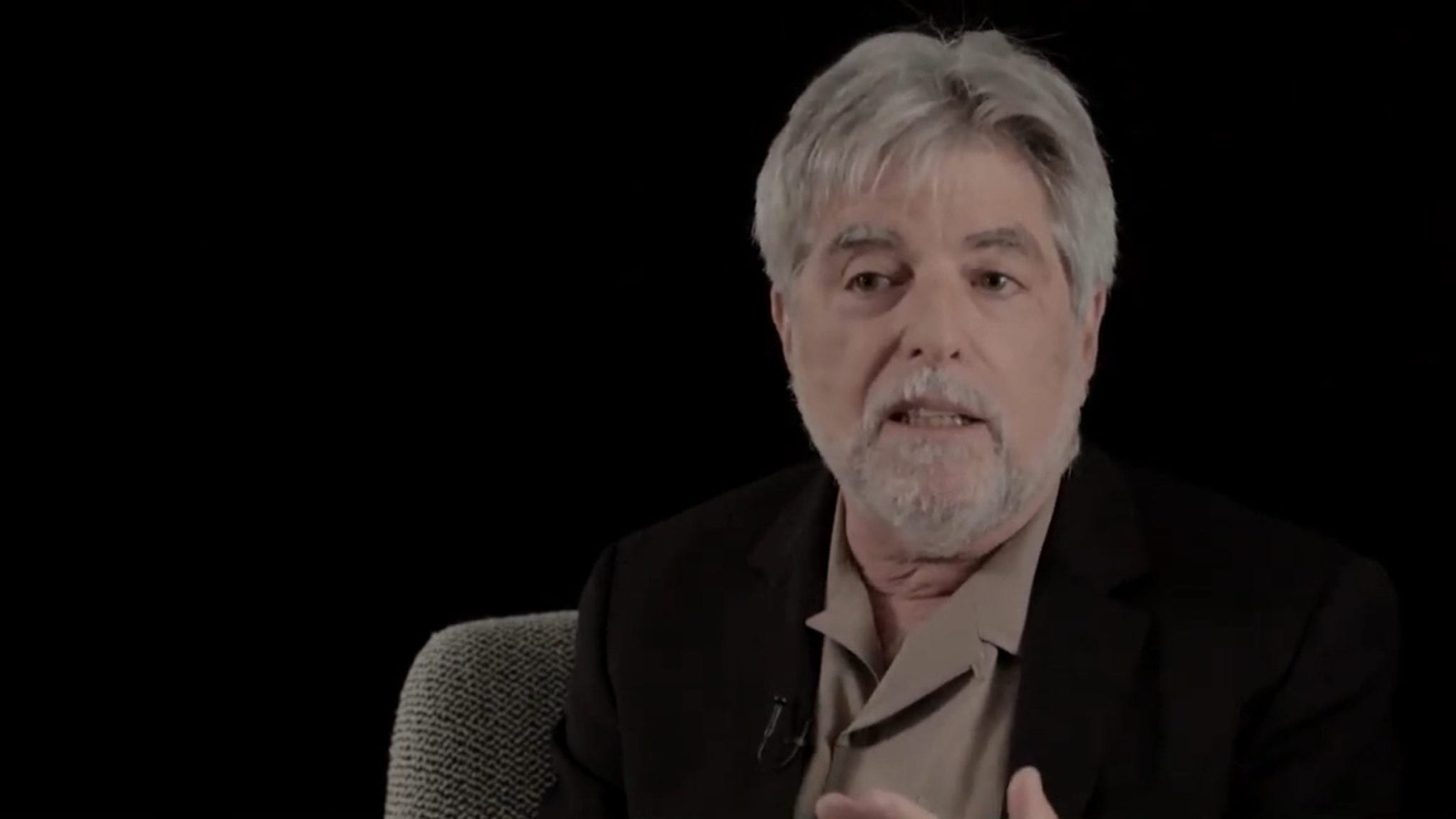

Jeffrey Bluestone, Sonoma co-founder and CEO (Tessa Therapeutics via YouTube)

Jeffrey Bluestone recruits a trio of biopharma vets to the startup team at Sonoma — while adding $30M to the launch round

Jeffrey Bluestone’s startup in the Bay Area just added a packet of venture money to its cash reserves. But more importantly, the ex-chief of …

Sign up to read this article for free.

Get free access to a limited number of articles, plus choose newsletters to get straight to your inbox.