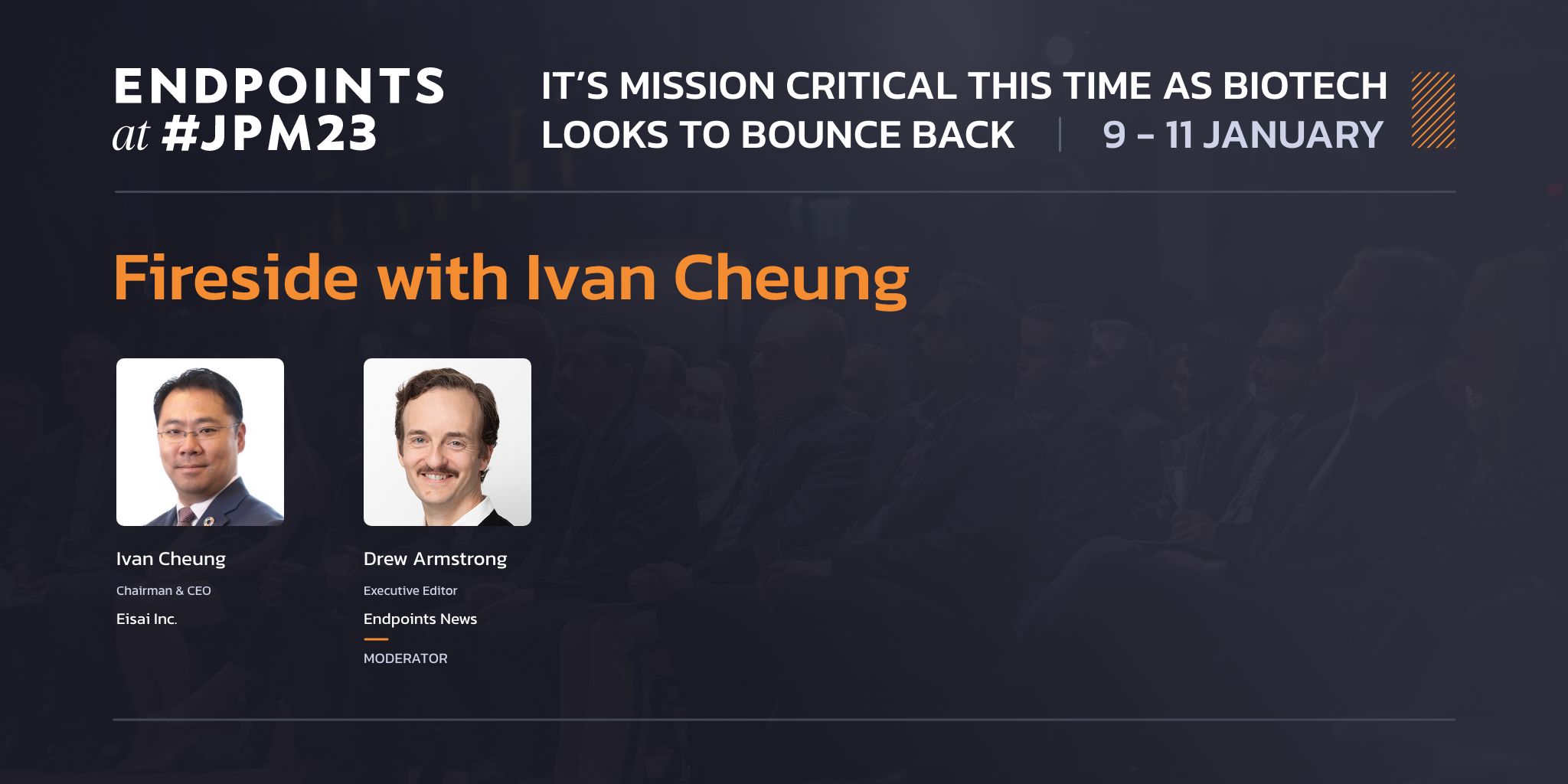

#JPM23: Fireside chat with Eisai's Ivan Cheung

Less than a week after Eisai and Biogen won accelerated approval from the FDA for their Alzheimer’s drug lecanemab, Executive Editor Drew Armstrong spoke one …

Sign up to read this article for free.

Get free access to a limited number of articles, plus choose newsletters to get straight to your inbox.