Juno/WuXi's cell therapy venture buys out solid tumor player in China, gaining a discovery engine and portending more M&A to come

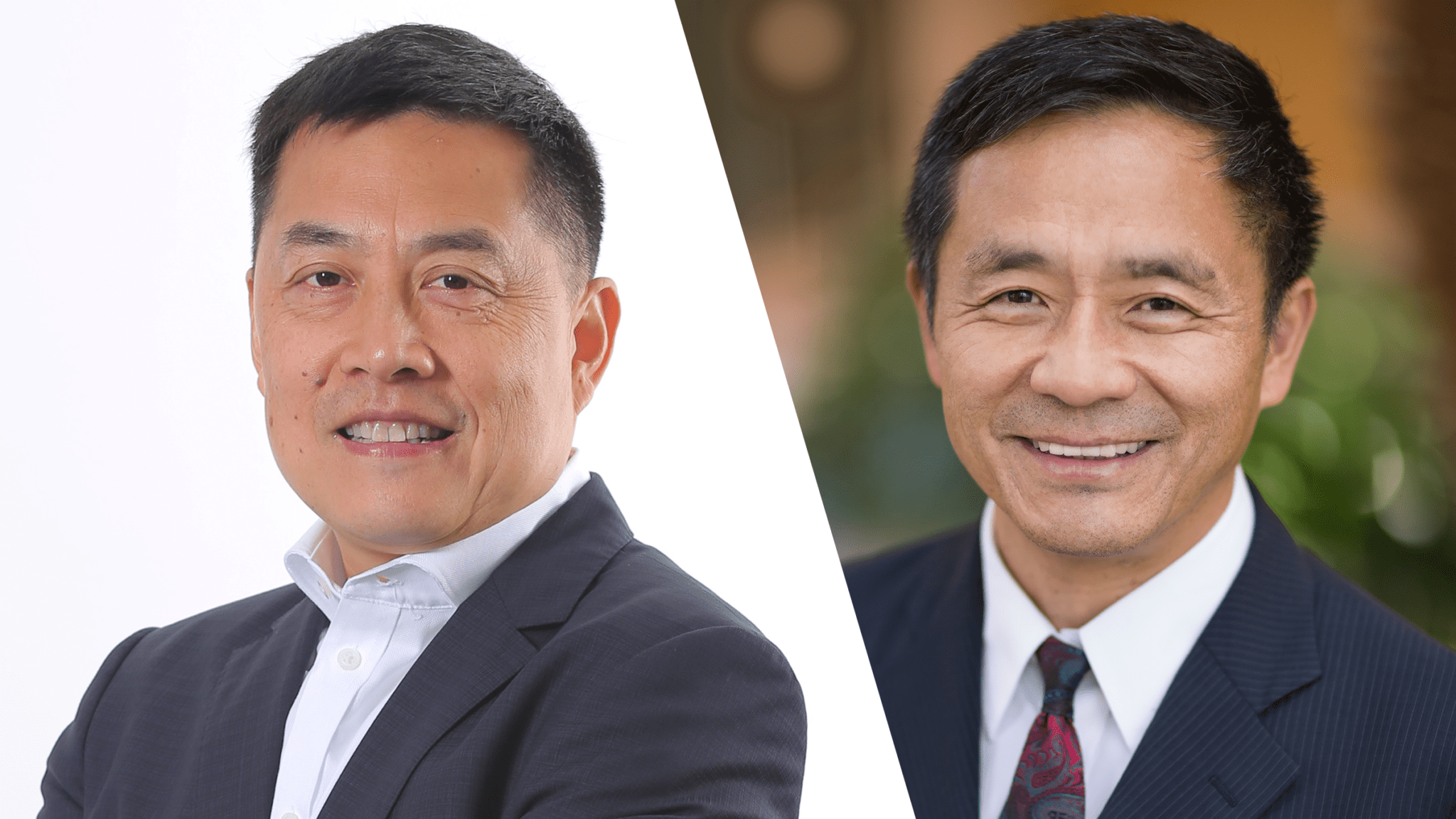

If the cell therapy field in the US is just getting started with two commercial CAR-T players, China represents an even bigger untapped market for James Li, the CEO of JW Therapeutics.

“The whole space is wide open,” he said.

His company, a joint venture created by Juno and WuXi AppTec, has been at the heels of its US counterparts. It has a BLA at China’s drug regulators for the lead program targeting CD19, a revised version of Juno’s JCAR017; is developing a BCMA therapy to follow; and more recently got into NK cells. The team, consisting of 200-plus employees, covers everything from process development and manufacturing to regulatory affairs and quality control.

Unlock this article instantly by becoming a free subscriber.

You’ll get access to free articles each month, plus you can customize what newsletters get delivered to your inbox each week, including breaking news.