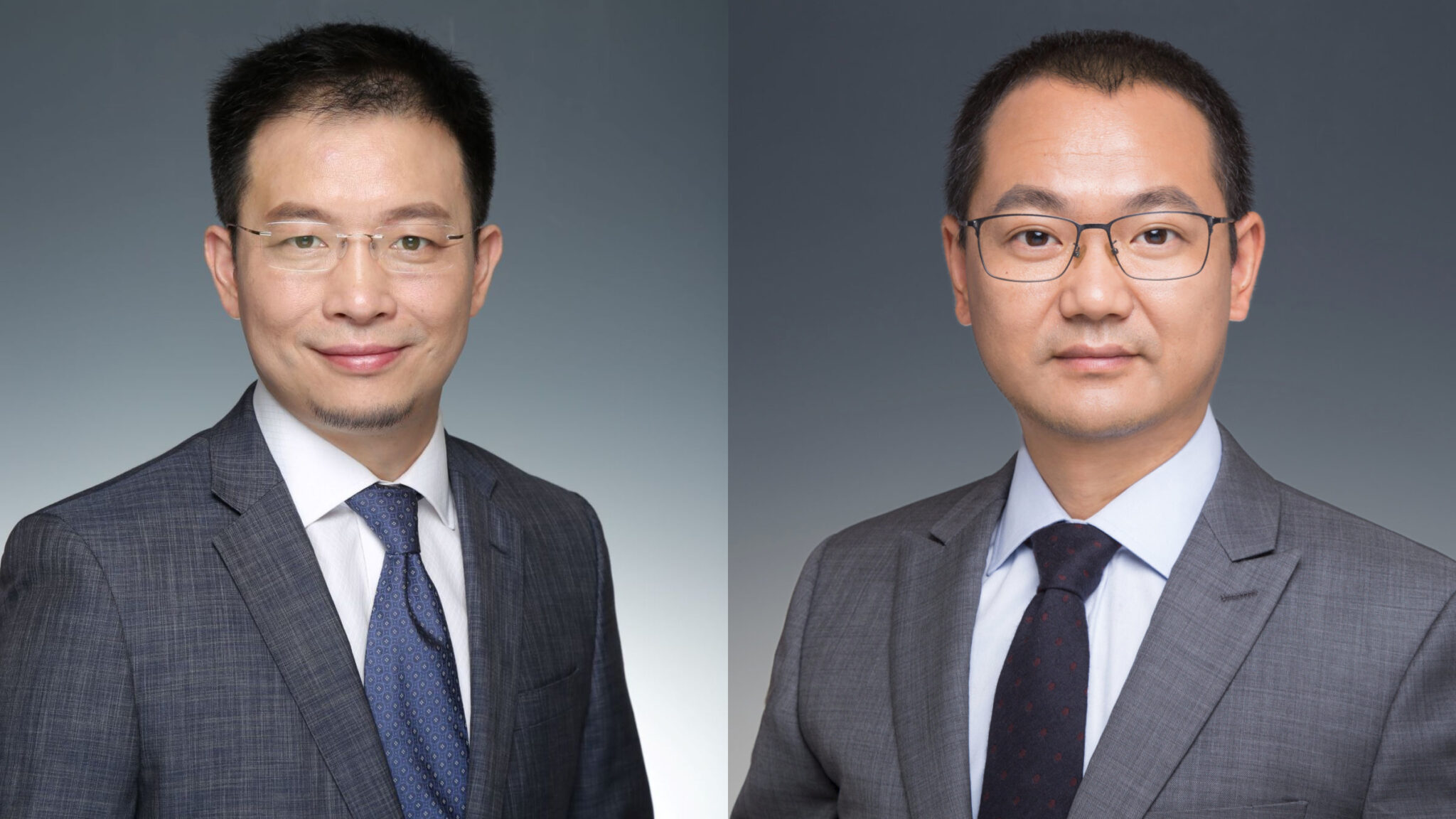

AnHeart Therapeutics co-founder and CEO Jerry Wang (L); co-founder and CBO Lihua Zheng (R)

Lining up a filing for lead ROS1 inhibitor, transpacific oncology biotech AnHeart Therapeutics raises $61M

In China, the character 安, pronounced An in English phonics, has a few different translations — yet they all come to the same general meaning: calm …

Sign up to read this article for free.

Get free access to a limited number of articles, plus choose newsletters to get straight to your inbox.