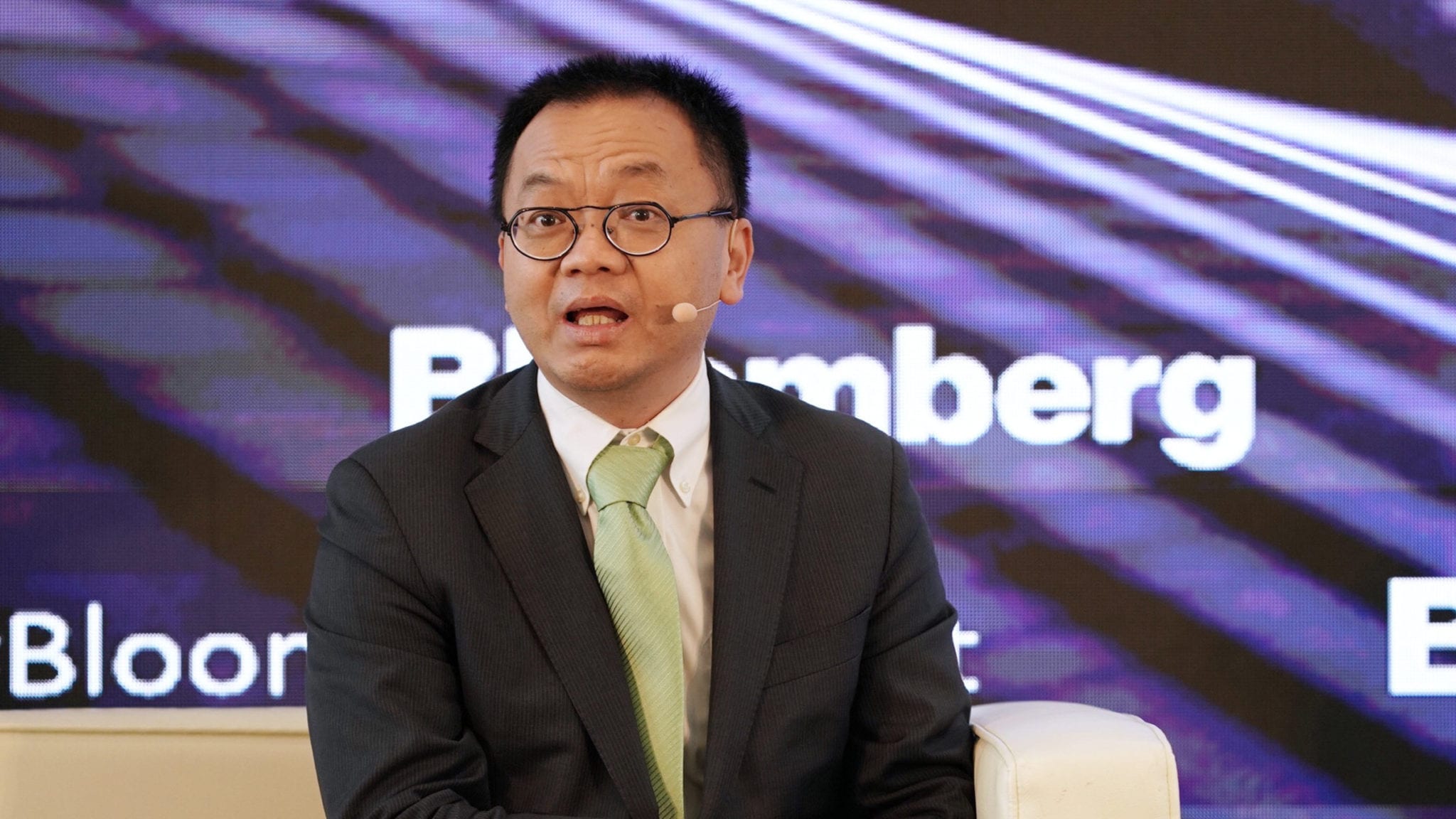

WuXi Biologics CEO Chris Chen

Looking to build a 'dual sourcing' supply chain, WuXi Biologics shells out $183M for Bayer drug substance plant

Biologics have been particularly hot in 2020 with big drugmakers looking to bolster their portfolio — a trend that has been a serious boon for contract …

Sign up to read this article for free.

Get free access to a limited number of articles, plus choose newsletters to get straight to your inbox.