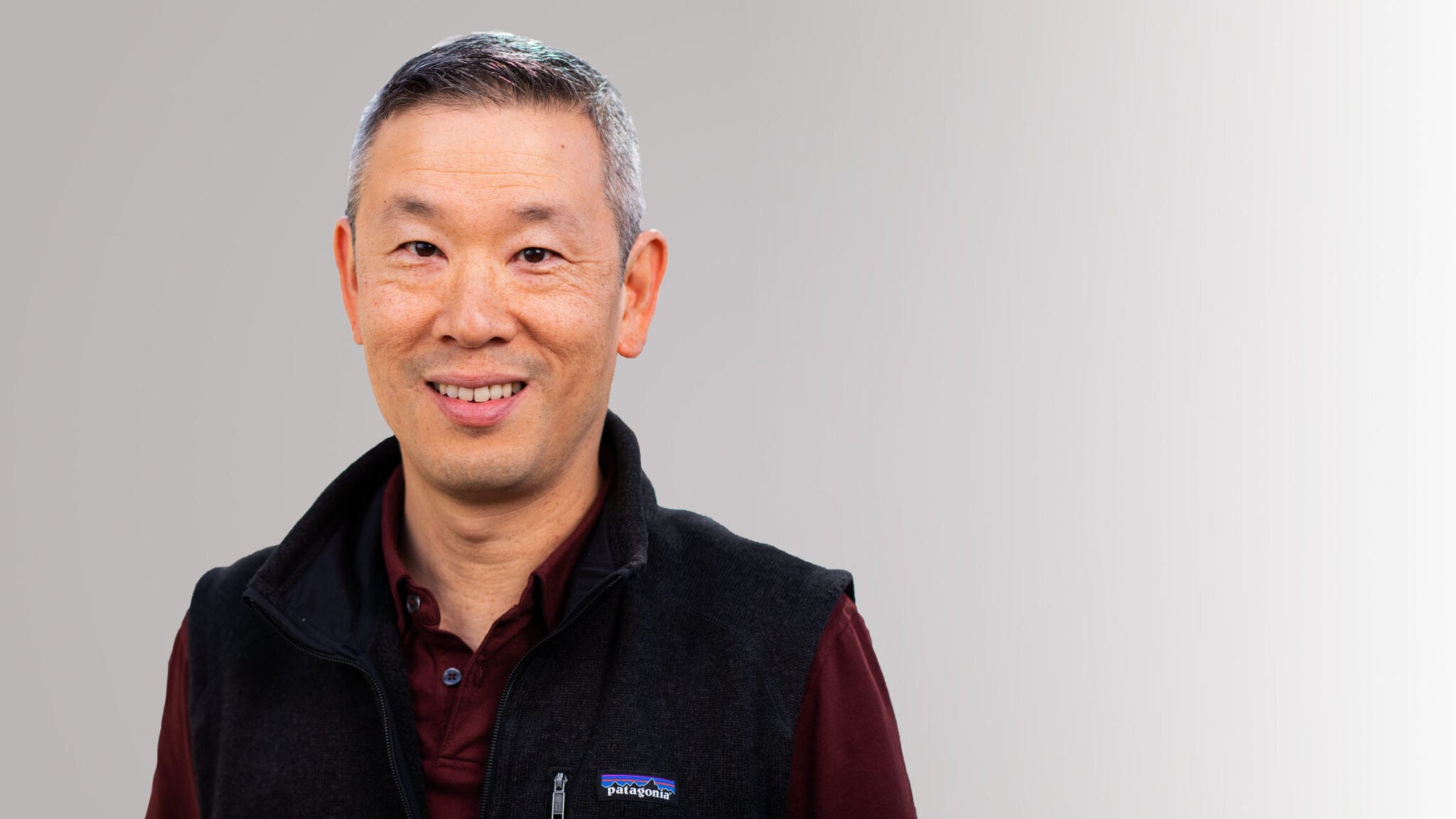

Jonathan Lim, Erasca CEO (Arch Venture Partners)

Nasdaq rings in Jonathan Lim's next cancer play, Pfizer-backed startup and Harvard spinout with collective $534M raise under their belts

Editor’s note: Interested in following biopharma’s fast-paced IPO market? You can bookmark our IPO Tracker here.

IPOs are booming in 2021, and companies are …

Sign up to read this article for free.

Get free access to a limited number of articles, plus choose newsletters to get straight to your inbox.