Neurocrine bags an FDA OK for tardive dyskinesia, trumping Teva as it preps first commercial launch

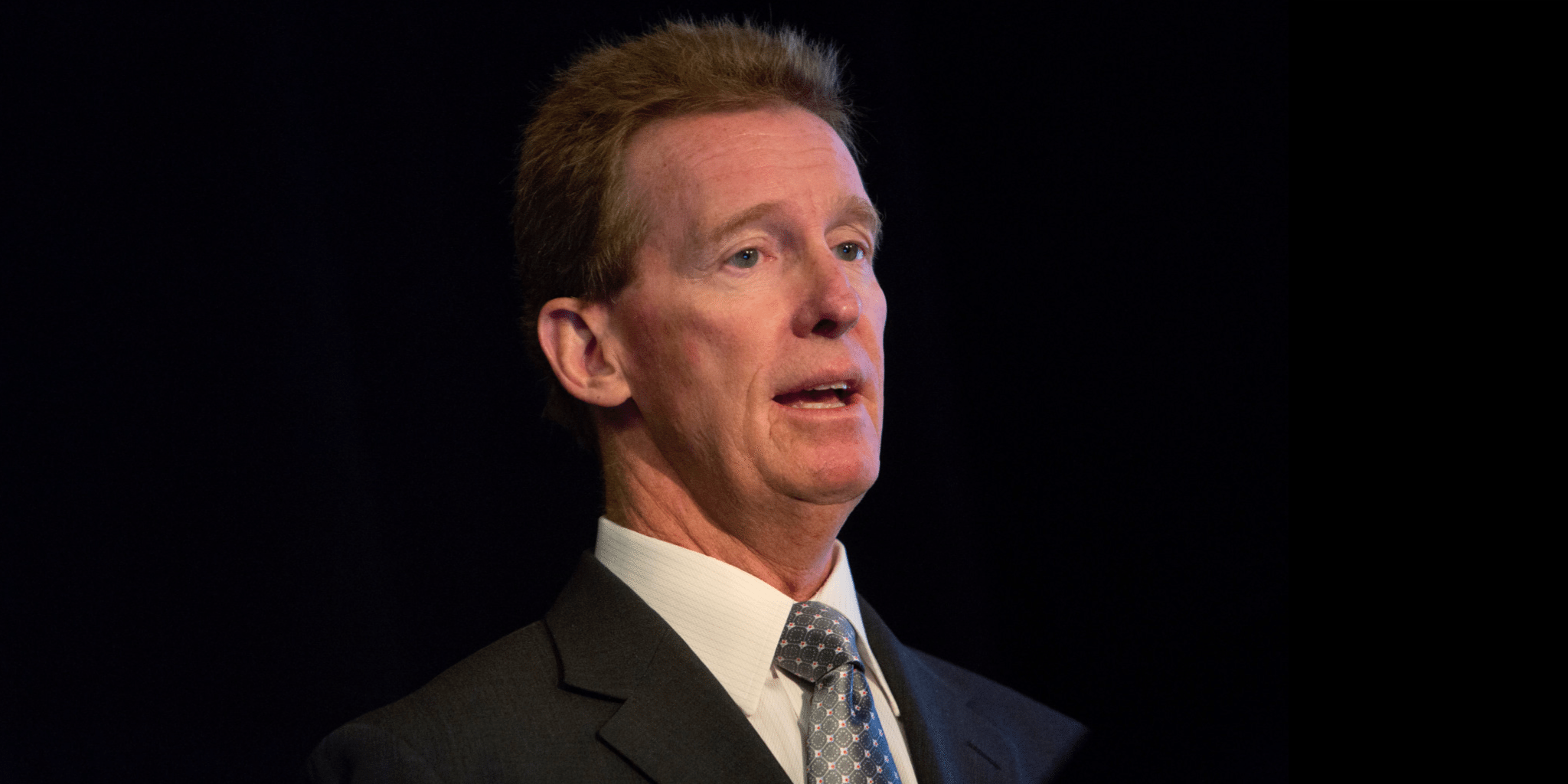

Kevin Gorman, CEO of Neurocrine Biosciences, presents at a Jefferies investor conference in 2013. Bloomberg/via Getty Images

The FDA has followed through …

Sign up to read this article for free.

Get free access to a limited number of articles, plus choose newsletters to get straight to your inbox.