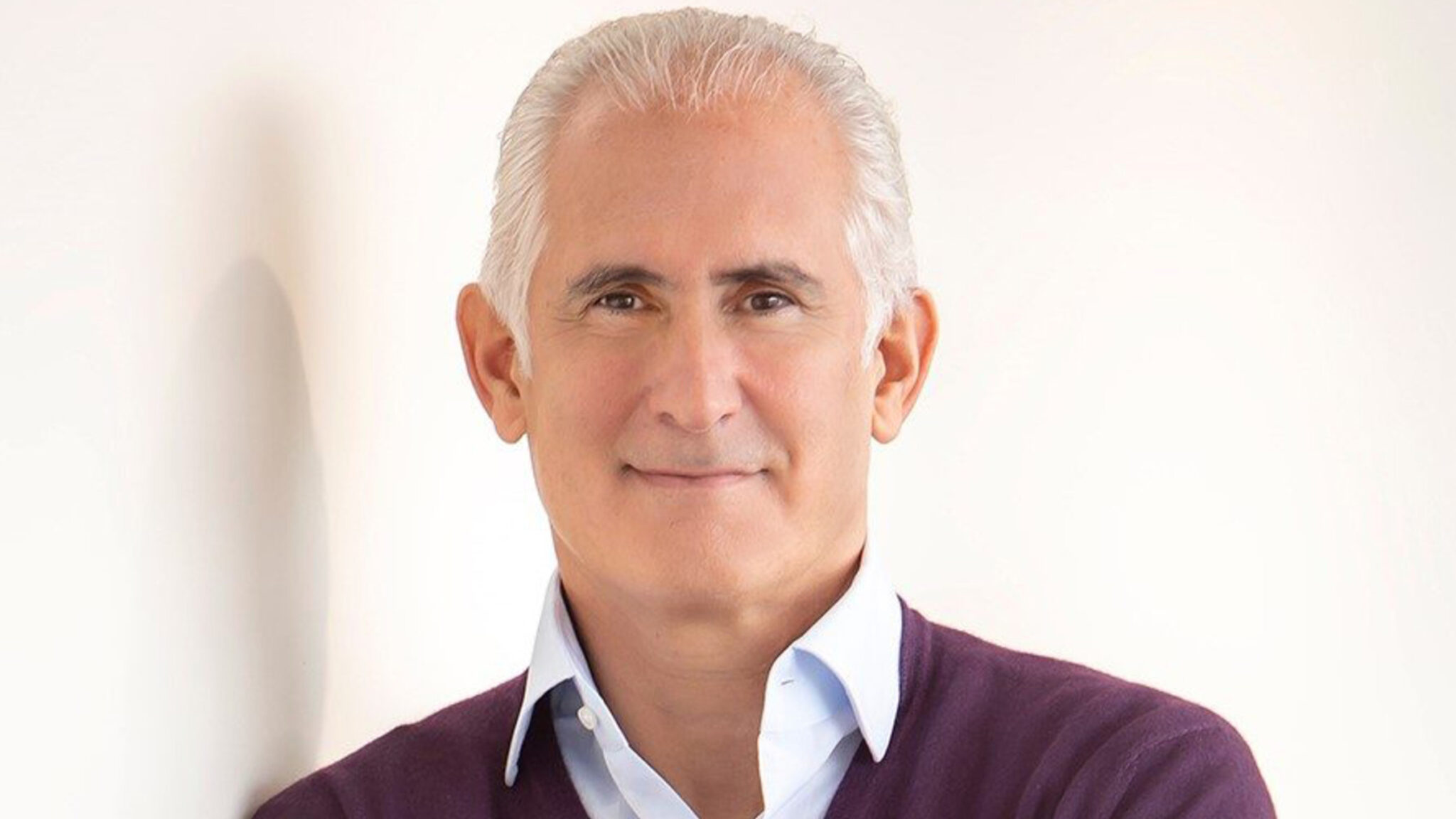

Kevin Ali, Organon CEO

Organon inks $103M deal for pertuzumab and denosumab biosimilars

Organon is looking to boost its biosimilar portfolio with two well-known brand copies in development by Shanghai-based Henlius Biotech.

The women’s health pharma is paying …

Sign up to read this article for free.

Get free access to a limited number of articles, plus choose newsletters to get straight to your inbox.