Overwrought marketing? Ads, not research, create some pharma best-sellers

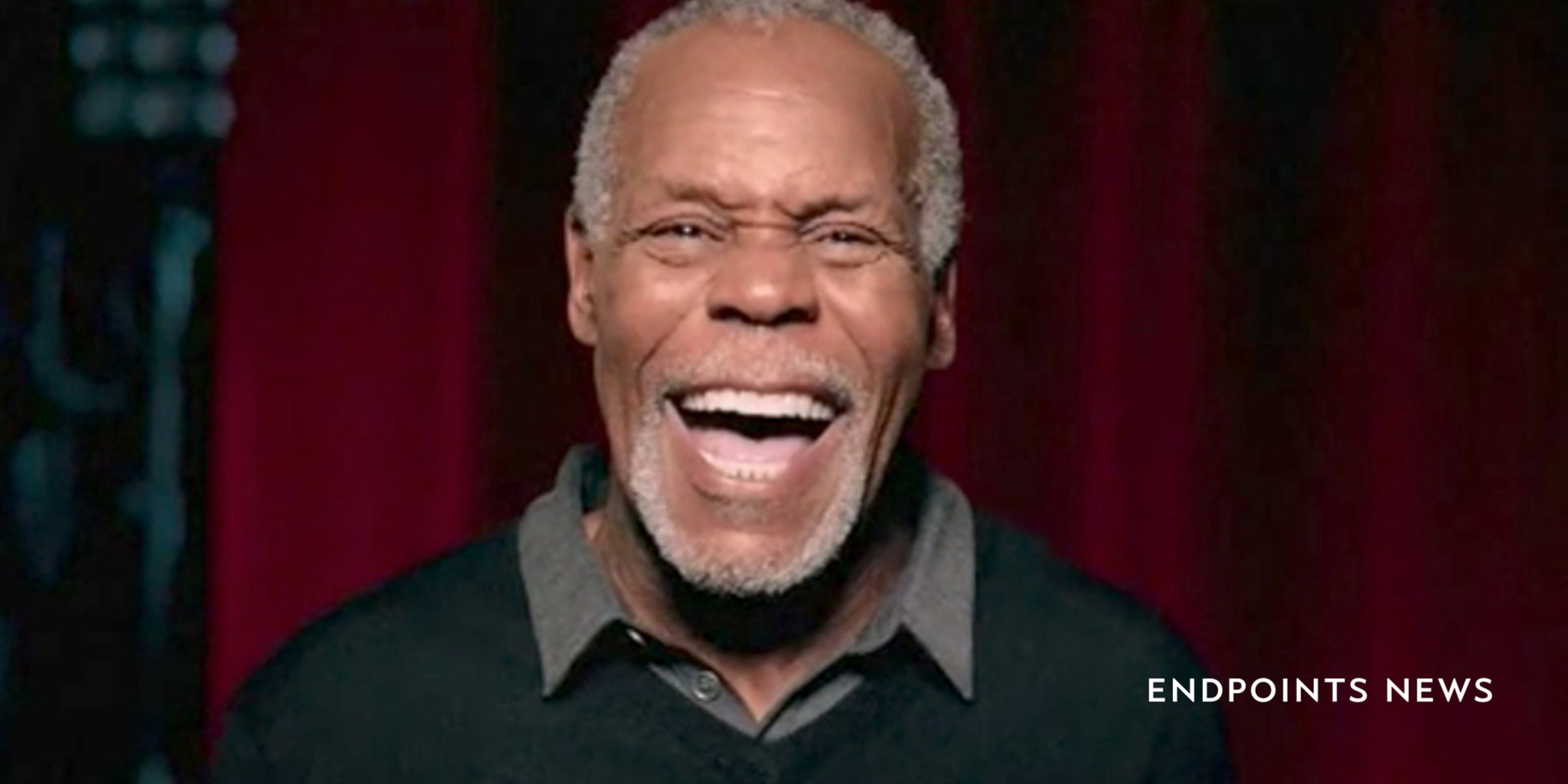

An overhead light drawing attention to his face, actor Danny Glover starts to cry, dropping his head into one hand — then, he abruptly switches over …

Sign up to read this article for free.

Get free access to a limited number of articles, plus choose newsletters to get straight to your inbox.