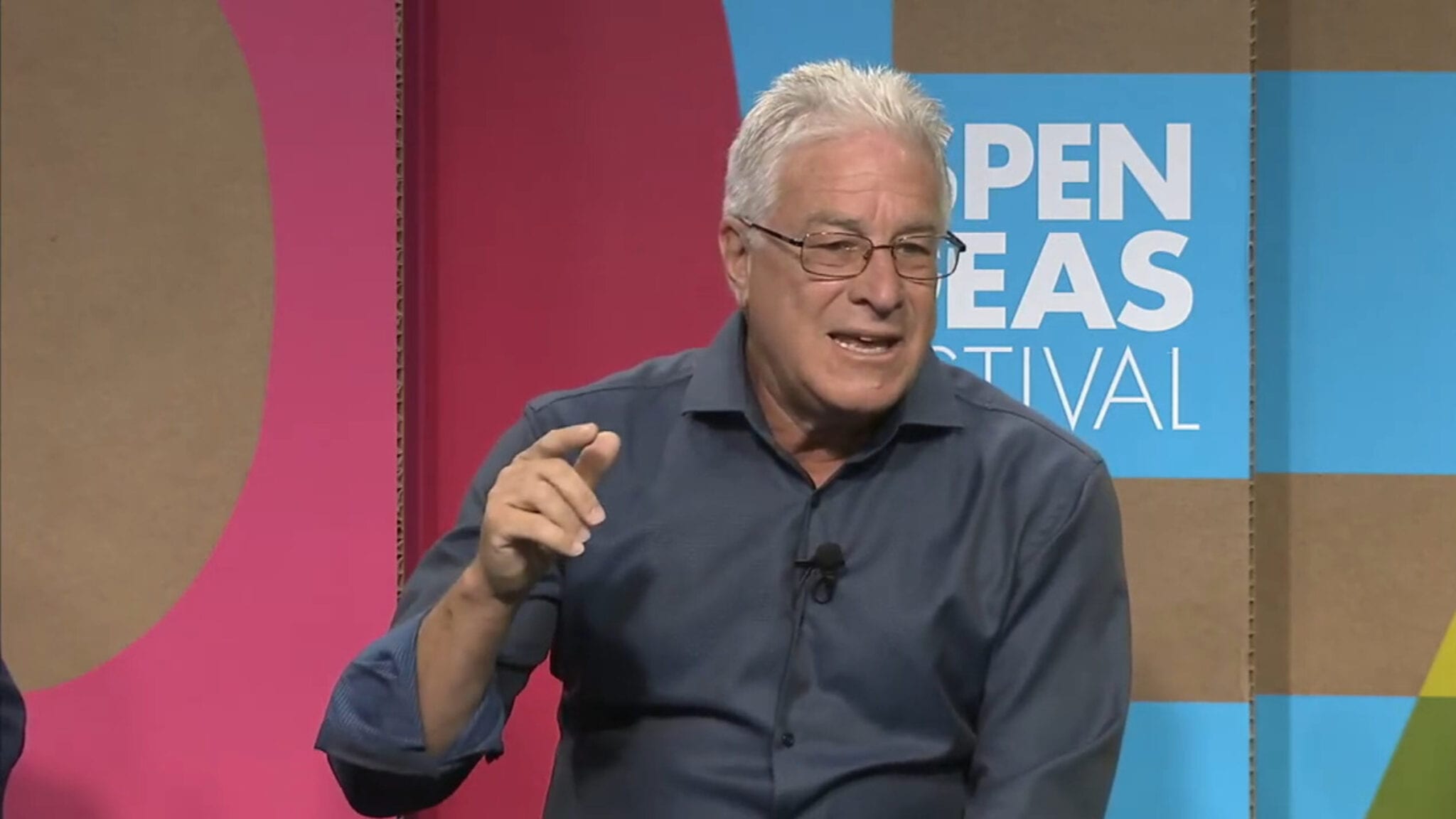

Rick Klausner (Aspen Institute via YouTube)

Rick Klausner's crew of T cell specialists wraps $425M IPO, hitting Nasdaq alongside Verve, Molecular Partners

It’s harvest day for a pair of biotech startups with lofty goals to break new ground in cancer and coronary heart disease — and their high …

Sign up to read this article for free.

Get free access to a limited number of articles, plus choose newsletters to get straight to your inbox.