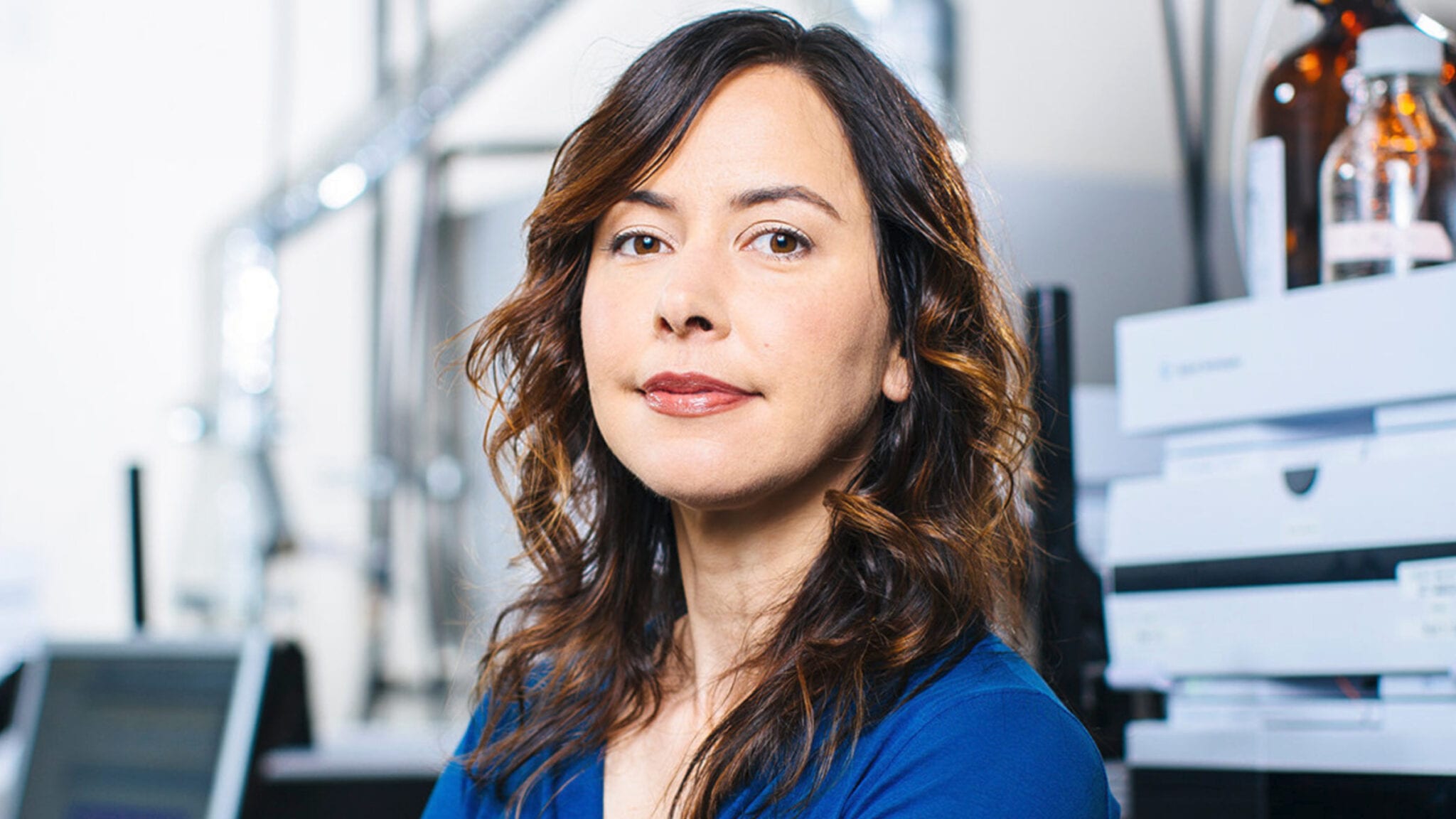

Christina Smolke, Antheia CEO

Say goodbye to plants: Synbio player Antheia earns new backers in quest to redesign flora-derived medicine manufacturing

The age of synthetic biology is officially upon us with super-unicorns like Ginkgo Bioworks changing the game in terms of how investors view those cell …

Sign up to read this article for free.

Get free access to a limited number of articles, plus choose newsletters to get straight to your inbox.