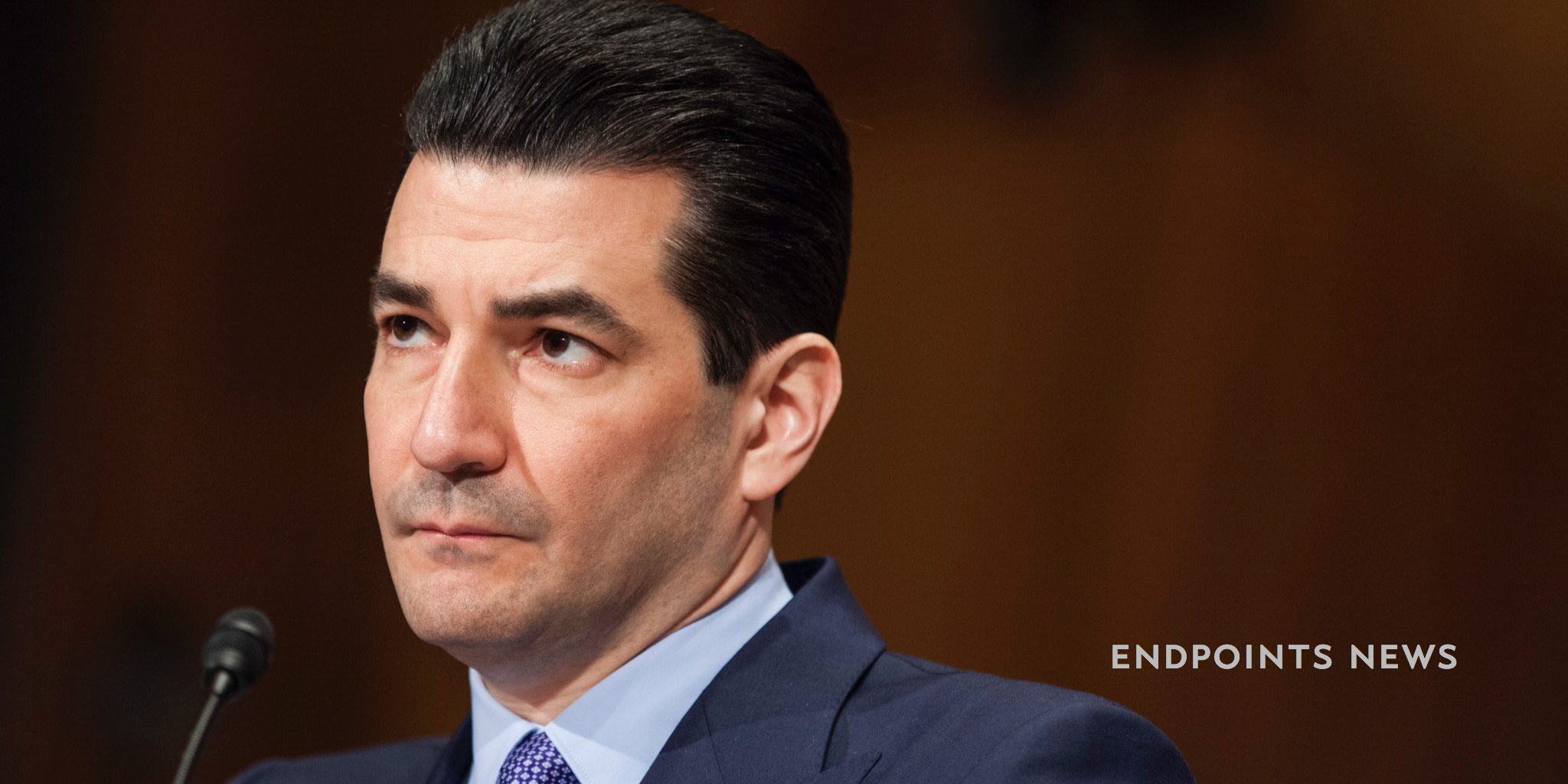

WATCH: Scott Gottlieb vows to shake up the FDA, backing a trend toward faster drug development

FDA commissioner Scott Gottlieb has sounded a crystal clear warning over the high — and growing — cost of drug development. And in a speech to regulatory …

Sign up to read this article for free.

Get free access to a limited number of articles, plus choose newsletters to get straight to your inbox.