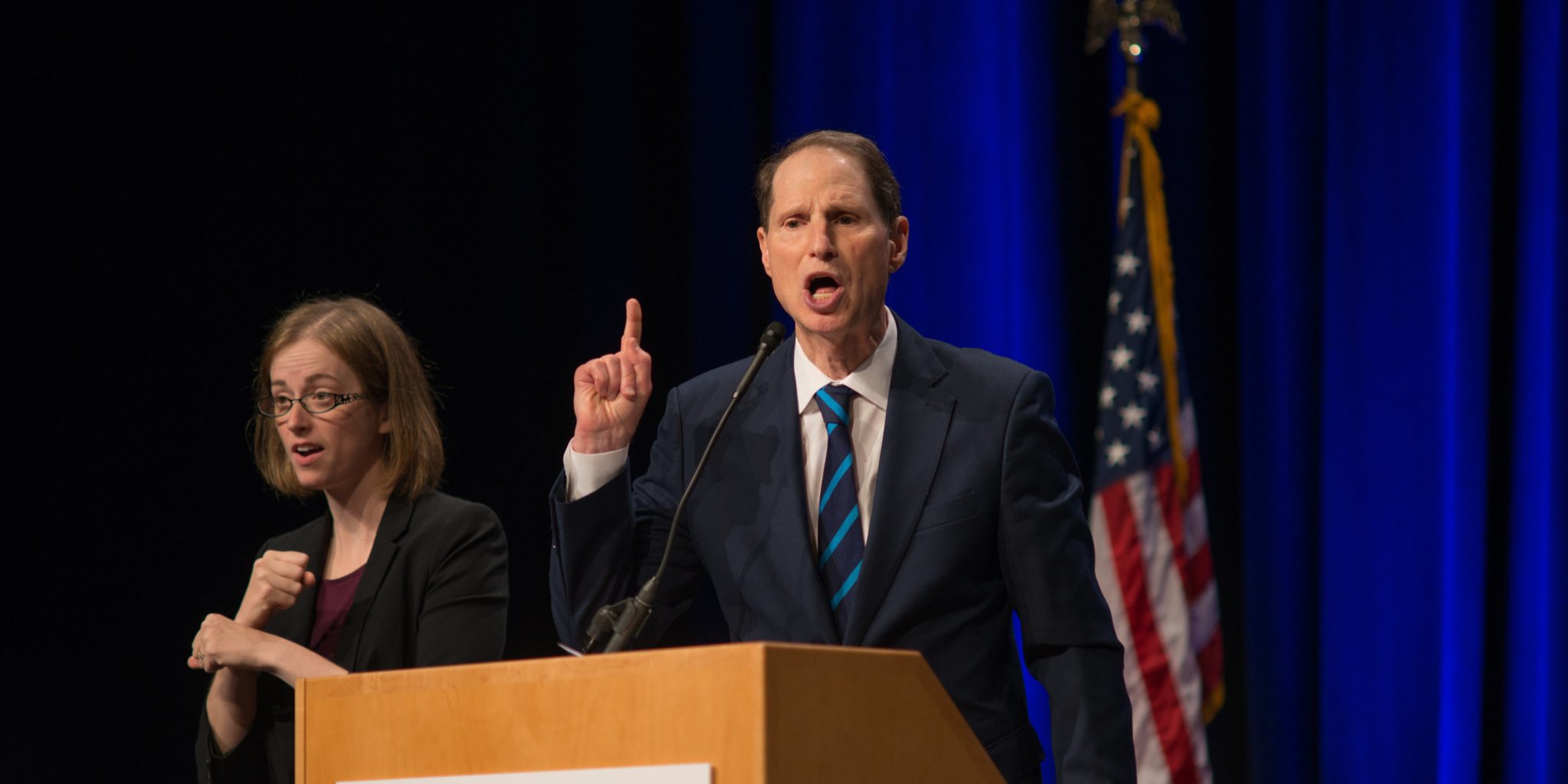

Senators Wyden, Murray launch Novartis probe: 'What America has seen here raises the specter of corruption'

US Senator Ron Wyden (D-OR) has opened up an investigation of Novartis’ $1.2 million in payments to Michael Cohen, President Donald Trump’s personal attorney …

Sign up to read this article for free.

Get free access to a limited number of articles, plus choose newsletters to get straight to your inbox.