5 Patient Engagement & Recruitment Trends, and How to Keep Up with Them

Some trends come and go, and some are here to stay. We’ll take a look at five top trends shaping the pharmaceutical industry and assess their effect on patient engagement and recruitment.

Trend 1: Decentralized & hybrid trials

The advent of COVID-19 changed the way clinical trials are conducted, moving from site-centered research to decentralized trials (DCTs) and hybrid options. However, as the study referenced below indicates, resistance to change and managing multiple vendors are among the top five hurdles to implementing these non-traditional trials.

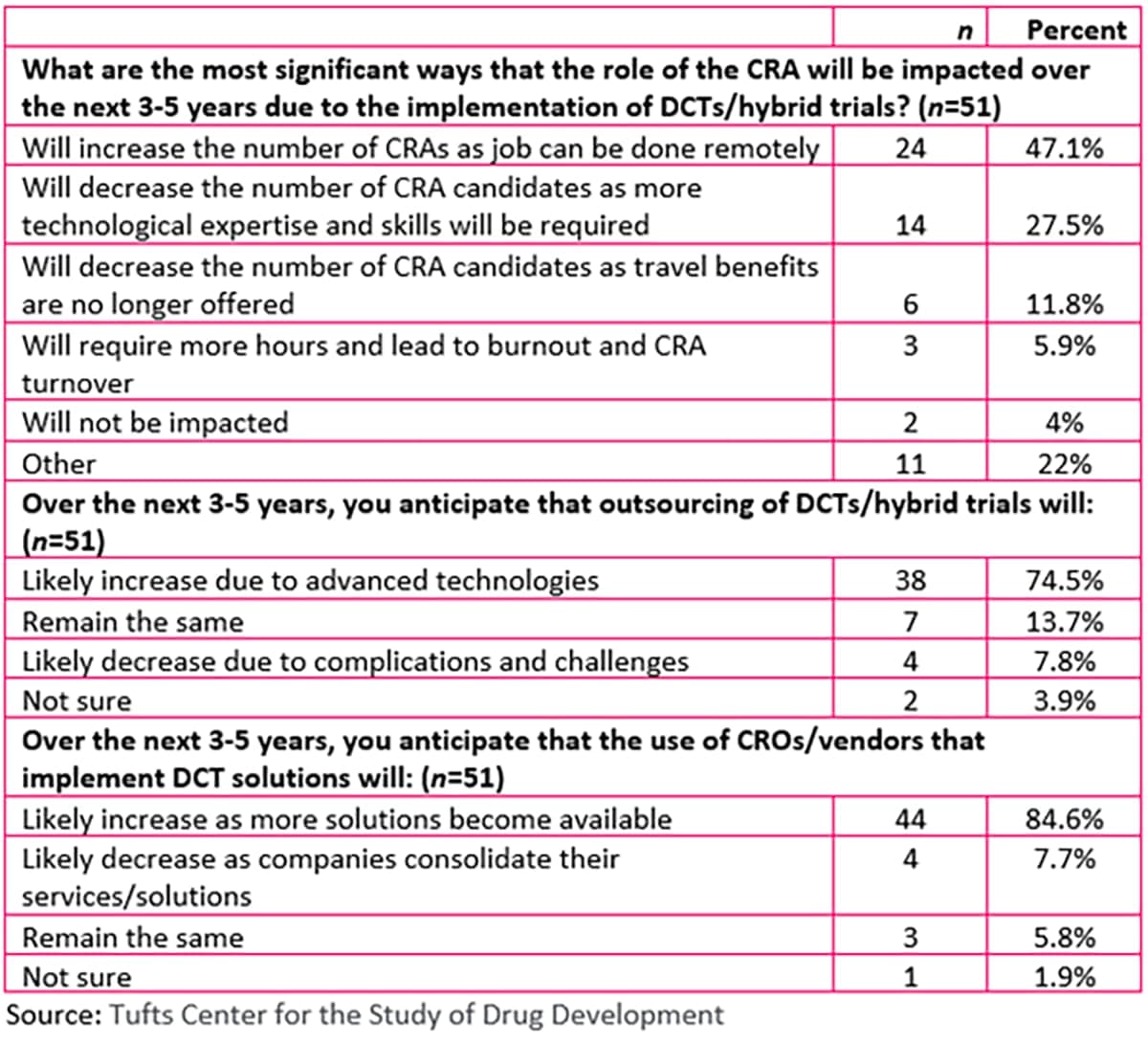

A study by The Tufts Center for the Study of Drug Development (Tufts CSDD) examined the impact of both decentralized and hybrid trials on collaborations between sponsors and contract research organizations (CROs)/clinical research associates (CRAs). According to the study, CROs and vendors also cited main barriers to implementation of DCT and hybrid trials as country challenges, varied site capabilities with respect to novel technologies, and data collection.

The Decentralized Trials and Research Alliance (DTRA) also has identified barriers to DCT adoption and promotes collaboration as a way to counteract them:

- Removing siloed approaches with standardized models and KPIs

- Sharing best practices to reduce risk and improve outcomes

- Gathering data from across the clinical trial community to provide educational resources for all stakeholders

It’s important for sponsors to educate patients about the opportunities that DCTs represent, and they also must seek out partners open to new ways of conducting clinical trials. Conversely, potential DCT partners must adequately communicate their strengths and how they can ease the burden both for sponsors and site staff.

Trend 2: Post-COVID adoption of technology

Going hand in hand with DCTs is the increased use of technology. While DCTs may not necessarily be fully remote, virtual or site-less trials take the concept to a whole new level. And with that flexibility comes the technology needed to pull it off.

New technology often creates new headaches for users. A Society for Clinical Research Sites (SCRS) survey revealed that technology adds an average of 17.5 hours in training per study per site per month; one principal investigator (PI) reported having more than 300 unique passwords and logins. Some clinical research coordinators (CRCs) report using eight or more systems for each study assigned.

Since sponsors can’t escape the explosion of technology surrounding trials, they should surround themselves with vendors that can talk the talk and walk the walk. Just as it’s important for sponsors to use plain language when sharing clinical trial details with patients, tech vendors must simplify terms when explaining their services. The goal is to avoid the glazed-eyes response that often comes with the territory.

Trend 3: Patient centricity

This trend has been around for quite some time, but only recently has it begun to be actionalized by the pharmaceutical community. Communication is key to patient centricity before, during and after the clinical trial. Maintaining communication is only part of the answer; consistent communication makes participants feel in the loop and valued. Of course, the communication itself must be relevant, and how the message is delivered cannot be overlooked. Is it easy to understand? Is it in a format that’s accessible?

Trial participants must be treated like individuals, not “subjects.” In fact, the pharma industry has, fortunately, moved away from that verbiage when referring to study participants.

When sponsors go through the vendor vetting process, checking off must-haves, patient centricity should be toward the top of the list. Vendors should be prepared to provide examples, such as customer or patient testimonials, that reflect their prioritization of and commitment to patients.

Trend 4: Clinical trial diversity

We couldn’t talk about drug development trends without mentioning clinical trial diversity. The statistics say it all. Census figures from 2021 show that ethnic and racial minorities comprise over 40 percent of the U.S. population; however, according to the Federal Drug Administration’s (FDA) 2022 data snapshot on diversity and inclusion among clinical trials, whites comprised the majority of patients enrolled in clinical trials.

This represents a challenge―and an opportunity―for study sponsors to level the playing field, so to speak. And the diversity dilemma is not limited to the U.S.; it is a global problem.

Grassroots efforts have proved successful in encouraging those from minority populations to enroll in clinical trials. Disease support groups also are a good way to reach these individuals, as they have established trust, which is crucial to overcoming hesitancy to participate.

Trend 5: Increased use of real-world data (RWD)

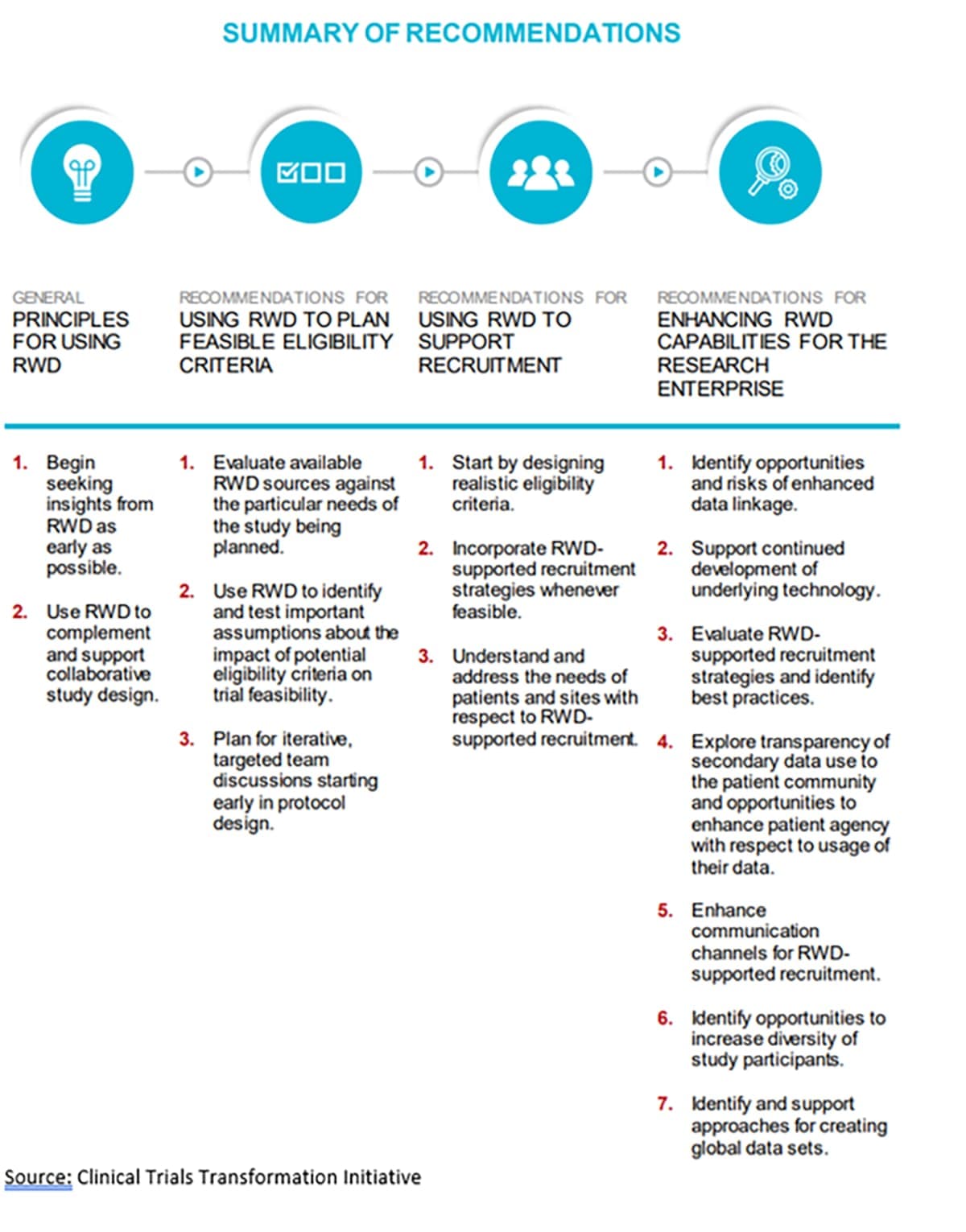

Everywhere you turn in the pharma world, you run into the phrase “real-world data,” and patient engagement/recruitment is no exception. The Clinical Trials Transformation Initiative (CTTI), a public–private partnership cofounded by Duke University and the FDA, has issued recommendations on using RWD in setting eligibility criteria and enhancing recruitment:

While RWD expands opportunities for patient recruitment, it must be used with caution. Procedures should be in place to protect sensitive data and ensure patient privacy.

The use of RWD is most effective when it is drawn from a variety of sources. Likewise, before embarking on the use of RWD for recruitment, sponsors should engage with a full range of stakeholders, from patients to institutions and institutional review boards (IRBs). Potential recruitment partners are wise to alert sponsors to the value of their own datasets.

Unpacking the impact

In addressing the issues raised by these trends, the onus is not solely on sponsors. All stakeholders would be well advised to capitalize on the benefits of collaboration. As the saying goes, “it takes a village” — this applies to the clinical trials realm more so than ever. Connecting with a variety of partners increases reach for both sponsors and partners alike. While working with new partners may lighten the load for overworked site staff, there’s still the task of managing multiple partners. This is particularly true in terms of patient engagement and recruitment, which is why a single platform such as Citeline Connect can consolidate efforts, making the whole process exceedingly more manageable.