Avoiding Cell Therapy Manufacturing Gridlocks — a Do’s and Don’ts Guide

How can developers prepare for the most vulnerable aspects of the cell therapy process? What steps are needed to demonstrate product comparability, with a rapid scale-up to manufacturing? When does it make sense to partner with a custom manufacturer and how can they help throughout the regulatory process? Developers must orchestrate a complex set of steps to move preclinical molecules through the clinic and manufacture therapies at scale – all while meeting regulatory guidelines and protecting patient safety. In this report, we will offer a guide to these issues and more, with commentary from consultants and manufacturers who have successfully navigated these waters. If you are working to bring a cell therapy to clinic, this guide is for you.

DON’T … forget that timing is everything

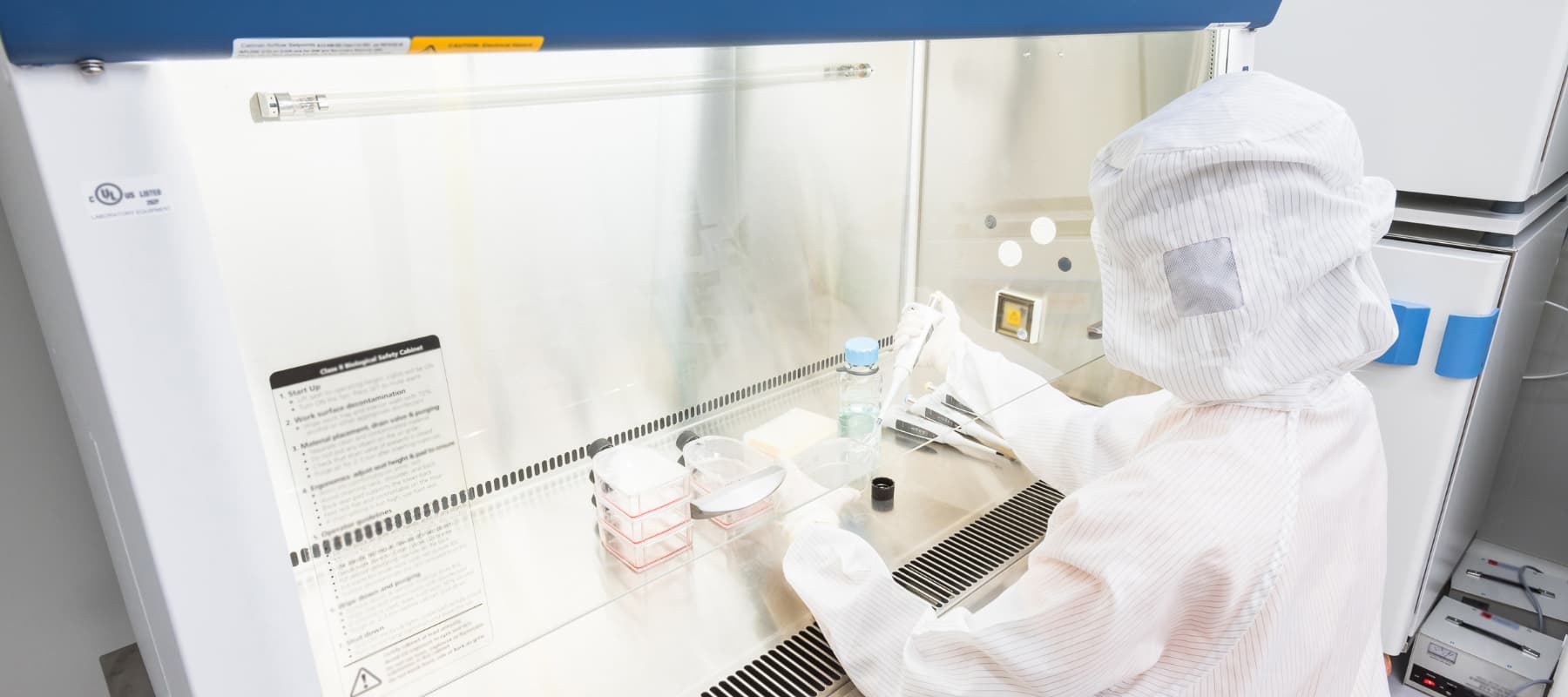

While small molecule and biologics manufacturing readily make drug products to stock, allogeneic cell therapies demand manufacturing facilities that can handle everything from intricate product development to the logistics required in producing these ‘off-the-shelf’ therapies. Autologous cell therapies manually process and deliver personalized, made-to-order products for each patient. Autologous therapies have a short shelf life, so developers also face unique delivery challenges — such as minimizing vein-to-vein time to safeguard the fresh product.

When strategizing treatment for autologous cell therapy patients — many of whom are battling terminal diseases — timing is everything. “Patients who are prescribed cell therapies often aren’t candidates for other drug products that are higher in the queue,” says Anthony Davies, Ph.D., founder and CEO of Dark Horse Consulting. “Right now, any length of manufacturing turnaround for these personalized medicines can mean life or death in some cases.” Planning a trial with autologous cell therapy requires mapping out a series of crucial and rapid steps with your manufacturer to optimize treatment goals for the patient, as well as overall clinical goals for the trial.

What are the main challenges with allogenic cell production? Amongst others are filling, freezing and storing hundreds of product vials. Allogene Therapeutics Chief Technology Officer Alison Moore, Ph.D. recommends developers plan for either a central storage location or strategically positioned sites in order to to optimize transportation routes. Doing so will help ensure a well-characterized, consistent release of product at scale for patients in need.

Innovators should also be mindful of GMP-compliant practices in their early phase studies. A little bit of foresight can go a long way because it’s easier to implement – rather than to later adapt – cost-saving measures like automation and analytical strategies in the front end versus upending the entire process downstream. Preemptive planning can also reduce comparability and bridging issues in the clinic.

The field continues to grow at a rapid pace, so developers can expect increasing demand for commercial manufacturing support to bring these therapies to market. Whether it is a technical transfer or a manufacturing restart, Kim Raineri, Chief Manufacturing and Technology Officer at AVROBIO, advises developers to plan for capacity as far out as possible. “People are often optimistic with an expectation that you can reboot in a short period of time, but it always takes longer than expected,” says Raineri. “Think with a long-term approach, even for clinical material.”

DO … plan for supply chain issues

After the pandemic wreaked havoc on cell therapy supply chains, it is vital to have back up vendors in place for all critical materials used in the process. “We do have limitations on that end where certain material is available only from a single source,” says Madhavi Anumula, Director of Process Development at Catalent. “But wherever possible, explore backup options to test and qualify reagents.” She adds that supply limitations are particularly cumbersome with viral vector manufacturing, noting production snags faced by several major companies whose CAR-T drugs struggled to keep pace with demand.

Developers conducting manufacturing or clinical trials in multiple locations must be mindful that supply chains vary across countries. A component that is available in the U.S., for instance, may not be readily available in Europe or Asia. Selecting a material that is available across the world, or partnering with a global manufacturing partner, can avoid comparability challenges later.

Using different equipment across multiple manufacturing sites can also elevate the risk profile during regulatory approvals. Much like a baker will discern changes using different tools for the same recipe, Davies notes that developers can expect using a 10-liter storage tank at one facility and a 100-liter tank at another will alter product comparability. By thinking about the end of the process and working backward, developers can accelerate timelines to clinic and commercial scale as programs progress across the drug development spectrum.

For companies in preclinical and phase 1, late-stage challenges can be mitigated by creating a solid data infrastructure and a culture that emphasizes product and process learning from the very start. Moore recommends building collaborative relationships with manufacturers, vector suppliers, and contract testing labs involved with later-stage production and release. “Enabling the learning from external parties to be incorporated into the growing body of knowledge around the product and process is important,” she says. “It’s never too early to initiate these activities.”

For best results and to stay ahead of the curve, plan your scale-up early on with an experienced manufacturing partner. Many comparability issues are the result of poor timing, which is why companies that plan to scale-up in later stages would be wise to instead start early. Doing so will help preliminary clinical data align with later stage data. From Davies’ perspective, this failure to plan is one of the reasons cell therapies can excel during phase 2 trials with exceptionally promising data, but stall during phase 3 with deficient CMC screenings.

DON’T … put off thinking about ‘build vs. buy’

When it comes to build versus buy, constructing realistic scenarios are essential for long term planning.

Companies that opt for in-house manufacturing require significant upfront capital to build, staff and qualify the facilities. Down the line, in-house manufacturing can reduce long-term costs, provide more flexibility and yields better control of intellectual property. While the decision to build affords complete production control and a detailed understanding of the process and product under development, companies must be fully committed to a commercially capable compliance environment. “Should a company choose to build, they ultimately need to foresee a future in which the company-owned plant is well utilized in order to deliver efficient cost of goods manufactured,” says Moore.

Anumula recommends that companies with early phase trials partner with a custom manufacturing organization. “If a drug fails in clinical trials, an in-house manufacturing infrastructure would be difficult to repurpose,” she says. “This also gives them an opportunity to focus on their R&D pipeline rather than sinking funds into a manufacturing facility.”

Some companies are finding new ways to streamline the cell therapy manufacturing process by trying new solutions. “There’s a newer model emerging where some companies will rent a cleanroom facility to have their own people and processes in place but avoid brick and mortar expenses,” says Raineri.

Decisions made in the early stages of discovery are key to avoiding risk, lowering costs and protecting the overall quality of the product. Careful, informed selection of raw materials, strategic automation and controlled Critical Process Parameters (CPPs) and Critical Quality Attributes (CQAs) can ensure a consistent, scalable product at the end of the process.

DO … consider how to sustainably scale

“When your product sees a spike in manufacturing demand, many startup companies simply aren’t prepared to start building right away.” says Davies. “CDMOs certainly have a unique role to play.”

Offering very specific domain knowledge, custom manufacturing organizations can provide the right infrastructure and expertise to ensure cell therapies have the same characteristics throughout the cycle. Mature manufacturing partners leverage knowledge from the established biologics space and emerging therapies realm to position cell therapies for success throughout each stage of the process. With fully integrated teams in place across the development cycle, Catalent provides product filing and response support from pre-IND to product commercialization — and draws from regulatory and filing support knowledge in the biologics business along with the facilities and compliance expertise in the cell therapies space.

“If you are a small biotech company, make sure you choose a partner that has the capabilities, resources and financing to grow with you as you move through each clinical phase and as product demand increases,” advises Raineri. Developers should opt for a manufacturing partner that can support autologous therapies with a location in proximity – and allogeneic therapies with cryogenic facilities for storage and cold chain management for shipment. According to Moore, it is vital that allogeneic therapies are delivered by trusted, ultra-cold chain logistics providers that use custom-designed shipping containers. “Ensuring robust and cost-efficient cold chain logistics, environmental control and continuous monitoring via ‘control tower’ technologies throughout the process are also a key consideration for the last step of patient delivery,” she says.

In a dynamic market such as cell therapy, custom manufacturing organizations are evolving from a capacity and capabilities perspective to meet the growing demand of innovators and regulators. As more cell therapies emerge, manufacturing partners will bridge excess capacity as they continue to make significant investments and strategic acquisitions in this area. Catalent, for example, has executed on a series of expansions and acquisitions in recent years to elevate capacity and integrate capabilities from plasmid DNA, viral vector, cell therapy manufacturing to clinical supply solutions. Additionally, the company is committed to continued manufacturing innovations in next-generation modalities like induced pluripotent stem cells (iPSCs), exosomes and more.

DON’T … lose sight of the regulatory end game

While manufacturing is a challenge, if the product is to be kept on track throughout the cycles then it is important for developers to prioritize measures like potency assays from the start to keep the product on track throughout the cycle.

“We are looking at a potency assay matrix where we essentially have multiple shots on goal,” says Raineri. “That way we can evaluate different aspects to properly characterize the product, and then correlate it to the mechanism of action and clinical efficacy. If you are doing that right, that is what regulators want to see.”

If companies are lax with their potency assays, they run the risk of regulatory pushback if the data does not correlate strongly with the clinical efficacy and mechanism of action. After monitoring the regulatory trends, industry analysts are signaling more stringent assays will be forthcoming to better control for cellular variability. In fact, the FDA’s 2011 guidance indicates that “…a single biological or analytical assay may not provide an adequate measure of potency. If one assay is not sufficient to measure the product attribute(s) that indicates potency, then an alternative approach could be used, such as developing multiple complementary assays that measure different product attributes associated with quality, consistency and stability.”

Certainly, companies must be prepared to demonstrate exactly how their product works amid all the variables that can arise. “In engineering, what you can’t measure, you can’t control,” says Davies. “Analytics characterization has typically lagged in this field, and especially for cell-based therapies, one test in particular is throwing many for a loop. That is the potency assay. Ignore these at your own peril.”

To avoid losing sight of these assays, Anumula advises developers to follow a phase-appropriate approach across the product’s life cycle. “During the preclinical stage, developers should focus on the development and optimization of release methods. As the product moves through phases 1 and 2, continuous optimization is required – along with setting acceptance criteria and method qualification,” she says. “Full assay validation should be implemented during phase 3 when processes are locked, and product is in its final matrix.”

Testing and characterization methods are also important strategies in understanding cell therapy products. Moore recommends developers closely partner with outside testing laboratoies that share, along with their results, method performance information – and also cultivate relationships with companies developing novel testing and sequencing technologies. “Developers should also prioritize talent within the Attribute Sciences disciplines, as the types of methods required to characterize an allogeneic CAR-T product can be very diverse and require broad scope and deep expertise for appropriate development, execution and interpretation,” she notes.

DO … connect the dots to regulatory alignment at each stage of the process.

In addition to COVID-19 manufacturing considerations issued in January 2021, the FDA released six guidance documents in 2018 and two additional guidance documents in 2019 for cell and gene therapy products (CGT). Considering that CGT didn’t have a licensed product until 2017, regulators are marching onward to keep up with the evolving market. Regulatory agencies are continuing to dedicate resources to help progress cell therapies into the clinic and to commercial maturity.

Mechanisms like the Regenerative Medicine Advanced Therapy (RMAT) designation in the U.S. and the Initial Targeted Engagement for Regulatory Advice on CBER products (INTERACT) meetings can facilitate both product development and regulatory approval. The FDA has also issued guidance for innovative trial designs, such as the August 2018 guidance document “Expansion Cohorts: Use in First-In-Human Clinical Trials to Expedite Development of Oncology Drugs and Biologics Guidance for Industry” and subsequent “Master Protocols: Efficient Clinical Trial Design Strategies to Expedite Development of Oncology Drugs and Biologics.”

Companies that engage with regulators early and often, and learn the recommendations for each stage, will be better prepared to meet regulatory standards. For instance, allogeneic CAR-T therapies require the inclusion of raw materials from a healthy donor source and (source). “These aspects are relatively new inclusions into production processes and so the biology around what constitutes a ‘healthy donor,’ and the safety considerations of gene editing, are relatively fresh areas for both the industry and our regulators,” says Moore. “Alignment of approach with regulators is ideal and can be achieved via INTERACT meetings or during development in the normal course of regulatory interactions.”

Rather than procrastinating with CMC timelines, companies that dial up these activities in advance will save on costs, time and regulatory gridlock down the line. “If you are in the cell and gene therapy space, you should always be watching what is happening on the regulatory front,” says Raineri. “That said, there’s not much mysticism as to what companies need to do to get through the regulatory pipeline. Above all, its important that companies follow existing guidance, understand their product, and ensure CMC is buttoned up before filing a Biologics License Application (BLA).”

In an interview with Cell & Gene, Dr. Jiwen, Chief Regulatory Officer, Regulatory Affairs and Quality Assurance at Renovacor, suggests that stakeholder engagement can also go a long way in sustaining these therapies in the regulatory realm and beyond. “Alliance groups, public-private partnerships, and consortia on various initiatives are all making progress and contributing to the sector’s growth. Patient advocacy groups, in particular, are integral to helping with therapy development, patient care and management and ultimately patient access to innovative treatment for unmet needs.”

Sponsored by Catalent,

The global leader in enabling pharma, biotech, and consumer health partners to optimize product development, launch, and full life-cycle supply for patients around the world. With broad and deep scale and expertise in development sciences, delivery technologies, and multi-modality manufacturing, Catalent is a preferred industry partner for personalized medicines, consumer health brand extensions, and blockbuster drugs.

marketing@catalent.com

US +1 888 SOLUTION (765 8846)

EUROPE 00800 8855 6178