CMIC: Japan’s first and largest CRO continues 30-year evolution to help global sponsors navigate the complex local market

Japan’s clinical trial landscape has vastly expanded over the last 30 years and CMIC has been at the forefront of the country’s evolution in drug development. In the 80s, as foreign companies faced difficulties entering the Japanese market, CEO and founder Kazuo Nakamura saw opportunities to convert his consultancy business into Japan’s first CRO in 1992. As customer needs expanded, CMIC also adapted, later adding CDMO, SMO and CSO arms to the group. Now, with over 7,500 employees and operations around the globe, CMIC has firmly established itself as the go-to player for international companies seeking to better understand the regulatory and commercial nuances of the Japanese and APAC markets.

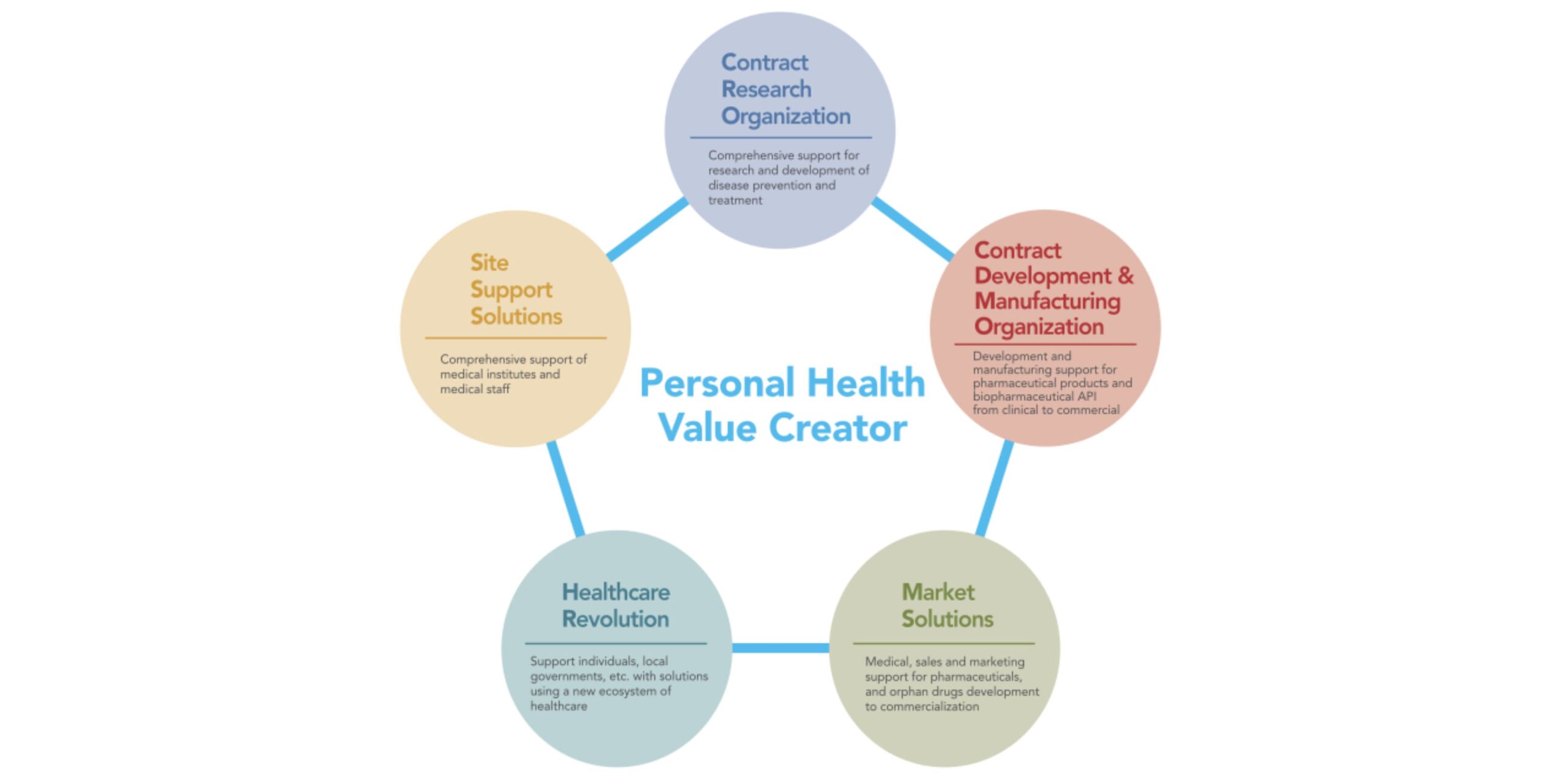

As CMIC looks to continue its growth, it is leveraging its Personal Health Value Creator (PHVC) business model to promote patient-centric drug development with its therapeutic expertise and patient support solutions. CMIC also aims to continue innovating with new technology platforms that support digitalization of the healthcare market. The company’s approach to drug development is based on the Japanese-originated concept IKIGAI, helping patients “live life to the fullest.” CMIC hopes to partner with international companies determined to achieve that objective for patients.

Kazuo Nakamura, CEO and founder, and Keiko Oishi, president and COO, share their insights into CMIC Group’s unique story, while outlining their vision for the future.

Interviewer:

- Arsalan Arif, Publisher & Founder, Endpoints News

Interviewees:

- Kazuo Nakamura, Ph.D. – Founder & CEO, CMIC Group

- Keiko Oishi, President & COO, CMIC Group

Endpoints: Kazuo, as the founder of the firm, can you tell us a little about the pharmaceutical service market in Japan 30 years ago and what drove you to create Japan’s first CRO?

Kazuo Nakamura: In the 80s, Japanese pharmaceutical companies were in the top echelon of global drug development with top 10 sales figures worldwide. Towards the end of the 80s, biotech companies were launching products like erythropoietin – which is when CROs started to play a crucial role in biotech drug development and approvals. In the 90s, biotech companies like Genentech emerged with researchers who were recent college graduates – and who preferred to create new therapies rather than handle downstream processes like trials and approvals.

Seeing the success of Genentech and investment groups like Goldman Sachs supporting such activities, I felt a pressing need to make this happen in Japan. As a former research scientist I thought of running my own biotech, but it required big capital investments. The CRO idea emerged because it matched with my global market and regulatory experience. While Japan’s regulatory bodies didn’t ban the idea of CROs, it was a brand-new business model without precedent and it took us five years of negotiation and communication to start the CRO business.

Japan was lacking the infrastructure for outsourcing at that time, so I started working as a consultant for US-based biotech Amgen and helped them enter the Japanese market. It took a lot of time and effort to build the CRO business here from scratch, but as barriers prevented foreign CROs from entering the Japanese market, we seized the chance to establish the first CRO in Japan. In the following years, we built the Site Management Organization (SMO) and Contract Development and Manufacturing Organization (CDMO) businesses in the same way.

While fast global expansion models go for M&A in an earlier stage, I would say the real value for Japanese CROs is through the Pharmaceutical Value Chain (PVC) business model I devised to make us the best CRO in our market. I also worked with founders from Quintiles, PPD and Parexel who respected that I started the CRO business in Japan from scratch.

Endpoints: How has CMIC grown and its mission expanded over the last three decades, particularly around shifting market dynamics? Can you share some important milestones?

Kazuo Nakamura: The biggest milestone was when we started our business in Japan in a small “rabbit hatch.” The founder of a leading global CRO invited us to his grand villa and offered to acquire our business. I thought diligently about his persistent offer, but I wanted to preserve my originality in the business and chose not to sell the company. By not focusing on global expansion and clinical trials, we had more vectors of expansion for how the CRO business model could be established in Asia. Seeing what we have achieved, I’m relieved about my choice.

Keiko Oishi: CMIC started as the first CRO in Japan in 1992. We expanded the business to include the SMO, CDMO and Contract Sales Organization (CSO) over the past 30 years, and established the Pharmaceutical Value Creator (PVC) business model to support pharma and biotech drug development through the entire value chain. Our company has grown to meet the customers’ needs and to adapt to the changing regulations.

We currently have over 7,500 employees and 26 subsidiaries – with offices and facilities in 14 countries including the US, Japan, China, South Korea, Singapore, and more. CMIC is listed on the Prime Market of Tokyo Stock Exchange. As of September 30th, 2022, our annual sales grew 26.4% to 108.461 billion JPY on a consolidated basis.

Endpoints: What would you say are some key differentiators or unique offerings that CMIC has versus other providers in Japan that clients value the most?

Keiko Oishi: CMIC Group is the only end-to-end solution provider in Japan with CRO, CDMO, SMO, CSO services. CMIC’s CDMO business started in 2005 when full-outsourcing of drug manufacturing was approved in Japan. It was a challenging decision to enter the CDMO market knowing it requires up-front investment for infrastructure and equipment, but we’ve since expanded our CDMO business with four manufacturing sites in Japan, one in South Korea and one in the US.

In Japan, we are the only service company that provides end-to-end solutions from nonclinical to clinical, from drug formulation to commercial manufacturing, and from market access to post-market support. We continue to support our clients’ needs across patient-centric solutions for drug development and provide therapeutic expertise in oncology, CNS and orphan drug studies. We also conduct decentralized clinical trials (DCT), linking real-world data through the CMIC harmo® and nanacara® platform and address local patients’ needs through our Patient Support Program.

Kazuo Nakamura: Our CDMO business has had a particularly advantageous journey. In the past, foreign countries’ CDMOs tried to produce drug-active ingredients and products at low costs leading to alarming quality issues. This led to many pharma companies from around the world seeking alternatives and coming to CMIC for manufacturing. We feel blessed to have built this quality, trusted and world-class business in Japan.

Endpoints: As the largest CRO in Japan, how much involvement do you have in new drug development in the country?

Keiko Oishi: Today, CMIC Group is involved in close to 80% of new drug development and filings in Japan. We are also involved in nearly 70% of new oncology drug development. CMIC is the leading ICCC (In-Country Clinical Caretaker) with the largest number of studies among CROs in Japan. We are also in the top three of largest CDMOs and top two of largest CSOs in Japan.

Endpoints: What type of sponsors does CMIC usually work with and are there any therapeutic areas or stages of drug development that the firm has particular strengths/success in?

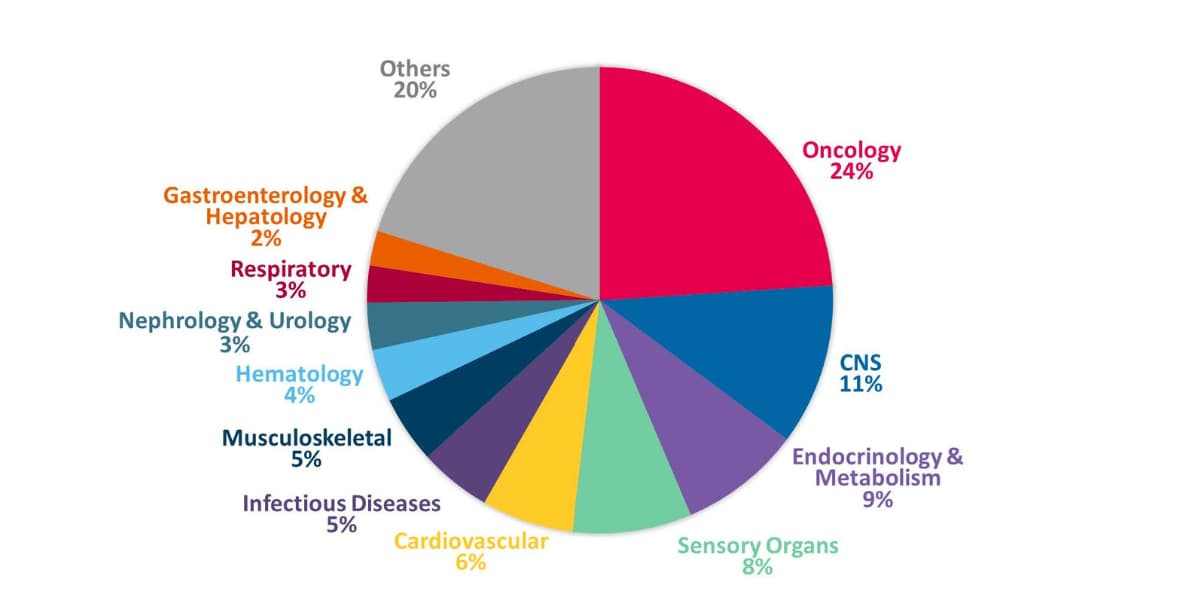

Keiko Oishi: Half of our clients are local Japanese companies varying from small-to-large sized firms. We also work with a broad range of global clients, from multinationals to small and medium-sized enterprises and biotech companies. CMIC can act as an ICCC for foreign sponsors, conducting procedures for regulatory authorities, medical institutions, etc., on the sponsor’s behalf. As the Japanese CRO with the most ICCC study experience, we understand the regulations, can best navigate discussions with Japan’s regulator (PMDA), and leverage our network to interact with the KOLs. In relation to therapeutic areas, 24% of our monitoring experience is in oncology, followed by CNS. As mentioned earlier, we are involved in nearly 70% of new oncology drug development in Japan.

We are also focusing efforts on digitalization and constructing infrastructure for the implementation of DCTs in Japan. CMIC has three separate platforms contributing to the firms efforts in digitalization: harmo®, an electronic prescription record service collecting prescription data of study participants in real time; Knock on the Door (KOD), a patient support platform for rare diseases allowing greater insight into a patient’s health status; and OKEIOS, a blockchain technology paired with personal data store (PDS) platforms to ensure the authenticity, confidentiality and traceability of personal health information.

Kazuo Nakamura: In the early days, as our mission was not widely accepted in Japan, we only had a few Japanese clients. We received the most interest from US companies looking to enter Japan and were enthusiastic about our offerings. We naturally started with overseas clients, while Japanese clients followed shortly after. Our business DNA is to keep doors open to international companies and support their Japan market access journey.

Endpoints: What are sponsors often surprised to learn about when bringing drugs to market in Japan?

Keiko Oishi: Sponsors are always surprised to learn of regulatory nuances, particularly the study documentation required in Japan. Dealing with clinical sites and signing contracts to initiate clinical trials is also distinct from other countries like the US. In addition, investigators and site staff are highly engaged with a strict work ethic, and this leads to a unique level of quality and compliance in regards to clinical trial conduct.

Kazuo Nakamura: There has always been a general culture adjustment for sponsors coming to Japan, particularly with sponsors coming from more laid-back working environments. It has been important to deeply understand a sponsor’s culture and professional approach to build transparent and trustworthy partnerships. The standard Japanese approach appears to be somewhat rigid – strictly following regulations and precedence with little room for any deviation. International sponsors are often more confident to push the envelope with new endeavors and challenges, but this can be harder than expected to achieve in Japan. At CMIC we have adapted our professional approach to consider all options and “possibilities,” while outlining various risks to clients through an open communication channel. Our flexibility and adaptability has resulted in foreign sponsors choosing to work with CMIC on Japanese trials. Regulatory requirements are also a learning curve for clients given that most sponsors prioritize FDA requirements as a default and may not pay close attention to regulatory updates from other authorities. Japan has its independent authority (PMDA), which is closely watching its international peers, particularly the FDA. The PMDA regularly reviews and revises its regulatory requirements, which we always carefully explain to our international clients. Despite market entry hurdles, Japan is a reliable market for commercialization following approvals.

Endpoints: What are the most persistent challenges when it comes to conducting clinical trials in Asia-Pacific? How is CMIC helping sponsors overcome those challenges?

Kazuo Nakamura: While challenges are quite common across the APAC region, there are some nuances with each country’s approach to drug development and commercialization. As CMIC launched its CRO in Korea (1996) and China (2002), there have been some learnings around shifting market priorities and regulatory alignments – specifically around companies choosing to align with either the Japanese or US regulator depending on which markets were preferable for commercialization. CMIC realizes the importance of deeply understanding the company’s objectives to help navigate and align nuanced regulatory requirements with R&D and commercialization goals. As such, many Korean and Chinese companies are reaffirming their relationship with CMIC. Aside from regulatory issues, something that may surprise sponsors is that Japan has become a relatively cost-effective place to conduct trials vs other APAC countries (e.g. Korea and China), but still maintains high levels of speed and quality compared to peers around the world.

Endpoints: What’s unique about CMIC Group’s approach to prevention and treatment?

Kazuo Nakamura: While supporting the operation of clinical trials is one objective, I think the true mission of a CRO is also to support the identification of new promising drugs and be a strong partner for bio-venture businesses. We want to support continued innovation to bring more effective and affordable solutions to patients and empower them to optimize their healthcare journeys. This led us to the concept of Personal Health Value. New personalized medicines along with digital technologies such as wearable devices may enable us to better utilize personal health records when developing more personalized medicines. Right now, we are collaborating with municipalities to utilize healthcare data to help realize this vision as a “next-generation CRO.”

Endpoints: How has CMIC expanded its global footprint and presence to build deeper relationships with multinational sponsors?

Keiko Oishi: Since 1992, CMIC Group has gradually expanded its global presence in Asia (Korea, China, Singapore and Taiwan) and since 2013 our APAC footprint has grown significantly to help meet client needs – e.g. accelerate patient recruitment. In 2007, we expanded in the US with a CDMO operation and also launched a bioanalysis operation in 2015. Our Australia office was established in 2018, where we currently run Phase I trials.

Endpoints: What can we expect to see from CMIC Group in the next 10 years?

Keiko Oishi: With further innovation of AI and technologies, I expect more efficiency in the future. I anticipate that the way we run/manage the clinical trials, the roles of our staff and how we operate will change. For example, AI may develop in the future to perform what data scientists are doing today, however, project managers will still be required. CMIC Group aims to be the top CRO in Asia by staying ahead of the trend and setting up an efficient operation implementing these innovations.

Kazuo Nakamura: In the future we hope to help innovate drugs and medical devices that address complicated diseases. We will continue to support sponsors to achieve this, but the way we support them might change, particularly with the use of innovative digital platforms to monitor patients and get a better understanding of their health status. We also hope to help lead the charge to standardize optimal treatment practices, by collecting patient data and raising physician and hospital awareness on new treatments. Additionally, at CMIC we uplift the concept of “one family, one health,” and could also explore new innovations extending to family pets. Our approach is not only for the purpose of curing diseases or longevity, but to focus on the objective of living life to the fullest – a Japanese concept known as “IKIGAI.” We hope this concept and our company values will encourage more companies to partner with us and hopefully we will become a bigger and more international company.

Endpoints: Any last words for overseas pharma/biotech/healthcare companies?

Kazuo Nakamura: We believe that rather than focusing on competition and a race to approval, the industry should be more collaborative to bring the best drugs to patients. We have access to a large amount of accurate information about Japan’s healthcare system, patients and drugs, and we are open to sharing such information with companies interested in entering the Japanese market. As mutually agreeable discussions are of high importance to us, we hope to engage with more companies focused on leveraging post-marketing information to develop drugs that help patients for longer periods of time. We hope to continue doing all this as a Pharmaceutical Value Creator.