Focus on targeted value creation and increased strategic management is key to address challenges with R&D biopharmaceutical precompetitive collaborations

Collaboration is top of mind for biopharmaceutical R&D executives, with 55% listing collaboration as the greatest opportunity to enhance their organization’s R&D capabilities.1 Within pharmaceutical R&D, a wide range of ecosystem collaborations are used to fuel innovation and create increased value for the patient, including start-up partnerships, co-development with other biopharmaceutical companies, or academic collaborations.

In addition, biopharmaceutical companies are embracing precompetitive collaborations (PCCs) across the R&D value chain to tackle common problems. One of the factors driving this willingness to work with competitors is that the problems being tackled by these PCCs are often hard to achieve by companies independently, in part due to economies of scale and the complexity of the challenges. PCC participants are seeking benefits such as shared costs, pooled resources and effort, knowledge sharing, and accelerated delivery timelines.

However, there are two factors complicating the value that these R&D collaboration organizations and biopharmaceutical companies can achieve together: 1) landscape visibility and 2) R&D PCC differentiation.

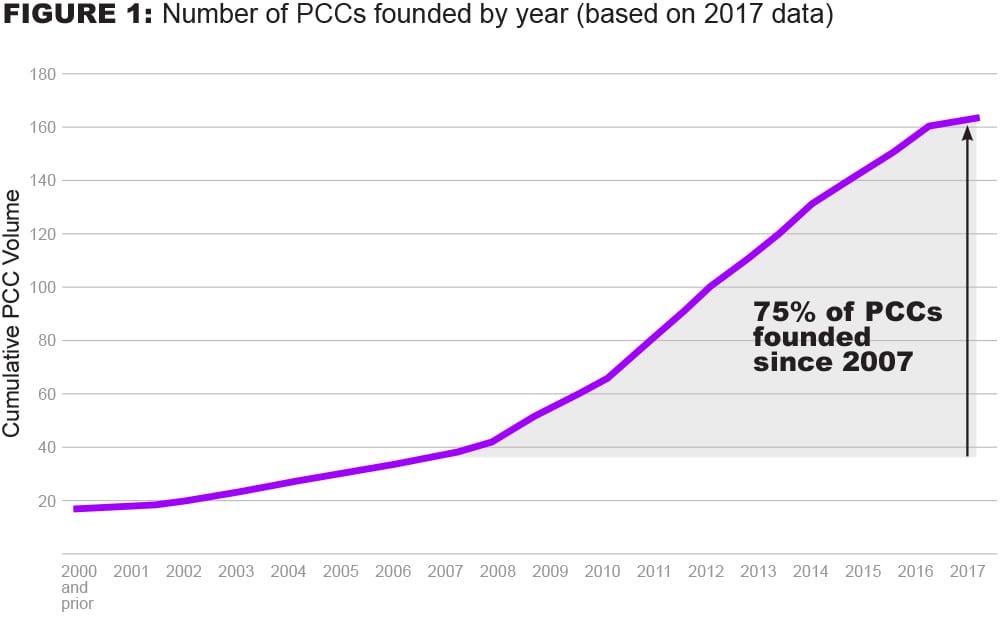

The global ecosystem of PCCs in biopharmaceutical R&D has significantly increased in size over the past 10 years at a consistent pace, with 75% founded since 2007.2

First, the volume and complexity of the PCC landscape have grown rapidly, which has limited full visibility for biopharmaceutical R&D ecosystem players. In addition to not being fully aware of all the PCCs that exist, we believe R&D leaders may struggle with how best to align the objectives of the PCC organization itself with their company’s own strategic objectives – making it difficult for these leaders to determine which PCCs to join.

Second, biopharmaceutical companies may not be able to fully understand the differentiating factors between each PCC, due to lack of transparency in their individual scope, value creation and operating model. There is often a lack of visibility into key insights that would explain how the PCC will support an R&D organization’s strategic objectives, including what the PCCs are investing in; their cross-functional governance structure; and if they have a structured commitment to knowledge-sharing.

The combination of these two factors across the PCC landscape – lack of landscape visibility and differentiation – increase the risks for commitment to a PCC and make it difficult for both biopharmaceutical companies and the PCC organization itself to know where to invest together versus on the individual company basis.

To address this complicated situation, the PRISME Forum and Accenture joined forces to conduct in-depth research of the R&D PCC landscape. More than 400 life sciences collaborations were identified through research of publicly available data; more than 160 of these were R&D PCCs, defined as an active, member-based PCCs with more than five legally distinct life science entities (containing a minimum of one biopharmaceutical company); open for others to join; with a primary focus on biopharmaceutical R&D; and operating with a primary goal of pre-competitively addressing a challenge (or challenges) common to many. Each of these R&D PCCs were individually contacted and 53 participated in an online survey and/or 1-hour phone interview to address 70+ questions related to the landscape visibility and differentiation factors.

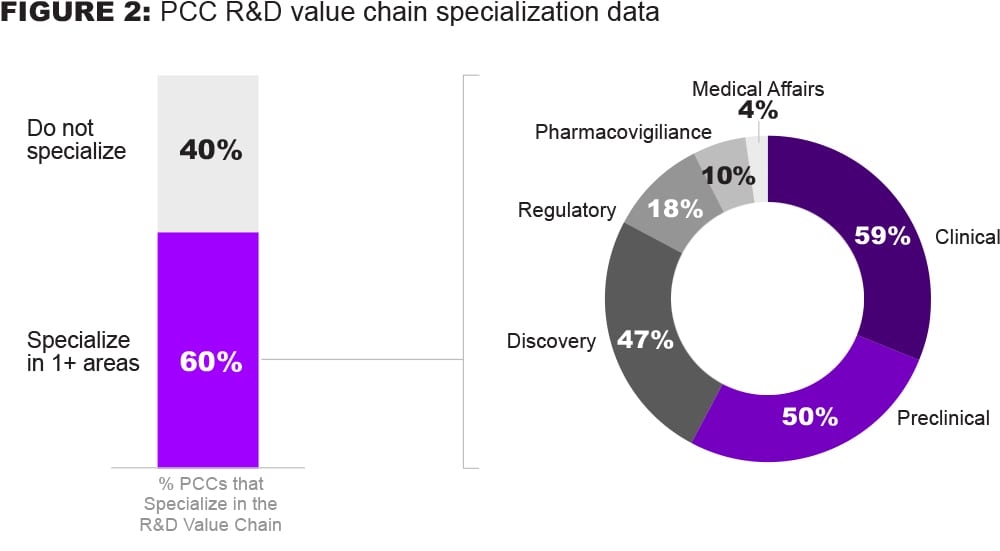

Despite the ‘precompetitive’ intent of these collaborations, many also focus on3 the more competitive parts of the value chain, including Clinical (59%), Preclinical (50%), and Discovery (47%). Surprisingly, not many R&D PCCs cover more regulated parts of the value chain, such as Regulatory Affairs (18%), Pharmacovigilance (10%) and Medical Affairs (4%).

Based on these data, we believe there is additional collaboration potential to be realized across the entire R&D value chain – particularly within regulatory, pharmacovigilance, and medical affairs.

Although many biopharmaceutical companies are increasingly focusing their R&D efforts to fewer therapeutic areas (TAs; each of which may pose their own unique challenges), 60% of R&D PCCs are not focusing on specific TAs, but instead address TA-agnostic challenges. For those PCCs that do focus on a specific TA, most are concentrated in oncology, central nervous system, and immunology.

From a differentiation perspective, one would expect that the more focused an R&D PCC’s mission, vision and related initiatives, the more likely it is to be able to differentiate itself from other PCCs, create unique value for its members and the industry, and capitalize on its strengths. However, we found 85% of PCCs focus on two or more fundamentally different initiative types (e.g. data sharing, standards definition, etc.) and 53% lack general awareness of other PCCs that may be working on similar initiatives. Together, these factors make it more difficult for biopharmaceutical companies to understand an individual PCC’s value proposition and differentiation.

In addition, 84% of PCCs require cash and/or resource investment in return for membership, while at the same time many biopharmaceutical companies seem to lack an overarching strategy and associated governance for PCC investments.5 Individual functions within biopharmaceutical companies are often free to participate in PCCs of their choosing, contingent only on availability of budget, without measuring value creation/return on investment or coordinating across functions. Internal silos and/or a lack of visibility into internal investments in PCCs can also mean positive synergies between initiatives may be overlooked, such as leveraging outputs from PCCs that complement each other. In addition, lack of strategy and governance within the biopharmaceutical companies can also lead to inappropriate or inconsistent sharing of internal data with PCCs.

Although the majority of R&D PCCs require membership investment, many struggle to deliver value that is measurable. On average, 61% of PCCs believe that they are largely competent at identifying new areas for collaboration, mobilizing/executing new initiatives, and rolling out deliverables. However, many are not operating in a way that is focused on value creation measurement, with only 19% measuring uptake of outputs. This makes it even more difficult for both the biopharmaceutical companies and the PCCs to determine what value is created – thereby diminishing the ability of biopharmaceutical companies to identify the best PCCs for investment.

Our research also identified a range of suboptimal conditions that many PCCs and biopharmaceutical companies are coping with, which will impact the value creation of the PCC that they engage in. Based on our analysis, we identified four recommendations for the leaders of PCCs that will help them increase their impact and value:

- Ensure Your PCC’s Focus. PCCs with a clear focus and scope (i.e., coverage of a selected area of emphasis) are more likely to generate impact for their members and the industry. Questions: Does your organization have a clear mission? Are its strategic objectives and current initiatives aligned with its mission?

- Nurture Your Brand.To maximize value, your PCC needs to be known to others in the industry. Your leadership and members should invest in speaking at industry events, publishing in key trade publications and raising awareness of the program. Questions: How do biopharmaceutical companies learn about your PCC, its initiatives and the value it creates?

- Play to Your Differentiators. Play to your organization’s strengths to generate the highest impact. Identify any competitive organizations and identify how yours is different. Questions: Is your focus specific and different enough from other PCCs? If similar, did you consider partnering or integrating with another PCC? Is your differentiation aligned with its key participants’ expertise?

- Manage Your PCC Strategically. Include short- and long-term planning with clear activity owners, an effective governance model and operational support (e.g. dedicated, skilled project management to ensure deliverables are finalized on time and on budget). Be focused on value creation for members and the industry and timely delivery of your commitments. Questions: Do you have a strategy and multi-year roadmap in place? Do you model value creation and track this across your members and the industry through uptake?

For biopharmaceutical companies, we identified three recommendations to maximize PCC return on investment:

- Align PCCs to Your Strategic Objectives. Biopharmaceutical companies need to define their PCC approaches to meet specific R&D strategic objectives and in specific R&D areas and determine how PCCs can fit into each of them. Questions: Do the PCCs create the value that you are after? How does the resource and cash investments relate to the financial benefits gained?

- Govern Your PCC Participation & Investments.Consider using an internal team or external partner to institute a stronger and centralized governance for new and ongoing PCC investments to avoid slow leaks of money and resource over time. Gauging the effectiveness of PCC investments demands processes that track and measure value from all external partners, including the PCCs, and adjust spend commitments based on progress and return on investment. Questions: How are the PCC participation-related metrics tracking? Is there ongoing visibility of how other PCCs relate to current investments made?

- Manage Your Data & Insights From and Across PCCs: Define a robust approach to data management. PCC participation entails information sharing, creating risks related to core intellectual property. Moreover, many PCCs establish data sharing platforms which – when participating in multiple data sharing PCCs – complicates the data landscape for an individual biopharmaceutical company. Questions:Do you know what data you share with what PCC and the rules that govern that sharing? What data you cannot share elsewhere? Are those constraints managed across functions?

Following these recommendations will ensure that both PCCs and biopharmaceutical companies are able to gain value from their relationships, both for the advancement of a company’s strategic goals and R&D improvements across the life sciences industry.

Sources/Notes:

- Industry at a Crossroads: The Rise of Digital in the Outcome-Driven R&D Organization (Accenture)

- This statistic is based on publicly available data

- PCCs could cover multiple parts of the value chain in which case they were counted for each part

- This statistic is based on a combination of survey data and publicly available data

- Based on Accenture industry experience; not a research finding

Authors: Nicole Cohen, Managing Director, Accenture – Life Sciences; Nicole van Poppel, Senior Manager, Accenture Strategy – Life Sciences; Ashley Schwalje, Manager, Accenture Consulting – Life Sciences