The Tech-Enabled Model Reshaping Healthcare

Transforming the US healthcare system will be complex, but an emerging class of tech-enabled providers are poised to support a breakthrough. Learn why the move to value-based care offers a potentially huge market opportunity, despite being in its early stages.

Perverse incentives drive soaring cost

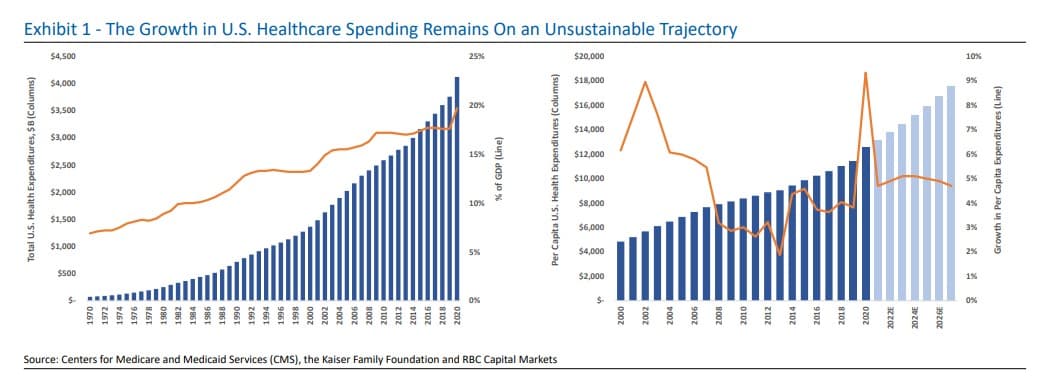

The unsustainable nature of US healthcare spending has long been a widely accepted fact, and expenditures touched 19.7% of GDP in 2020. The country now spends an estimated $12,318 per person on healthcare annually – far above Germany, the next biggest spender at $7,382 per head.

This might be more acceptable if outcomes for patients were improving at the same pace. But, the US lags behind many other developed nations in terms of both access to healthcare and quality.

The soaring costs are a burden on federal and state governments, on the employers who subsidize insurance and increasingly on individuals, who are now being required to pay a bigger proportion toward their care.

While many factors are in play, a key driver of spending growth is the way the payment system creates perverse incentives. Providers are rewarded for higher prices and volume, rather than the quality of outcomes or value. The result is a healthcare system with inefficient encounters and procedures, many of them redundant.

Barriers to change removed

Government-led efforts are underway to address cost and quality. Initiatives focus on reducing waste, engaging higher-risk patients and shifting care to lower-cost settings.

The Centers for Medicare and Medicaid Services (CMS) are using two main mechanisms to try to effect these changes. One is greater empowerment of patients. The other is a modernization of the payment system, linking healthcare reimbursements to value, not volume.

So far, the adoption of this latter idea has been slow. While it makes sense to pay for healthcare based on quality and patient outcomes, the fee-for-service model is deeply entrenched. Transformation would overturn the way providers have always worked – for them, it is disruptive, complex, costly and risky.

However, progress is accelerating. Previous barriers, notably around poor data and IT systems, have been removed. And alternative payment models are learning from experience and gaining traction, with regulatory support from CMS.

Now a growing group of tech-enabled providers – combining providers, payers and healthcare IT players – are helping to push forward the transformation of care delivery and clinician payment.

Value model benefits all

Through the creation of accountable care organizations (ACOs), CMS sets a benchmark for the total cost of care per member. If a provider is able to care for that member and keep costs below that benchmark, they get to keep a portion of the savings; if not, they pay part of what’s overspent.

The CMS approach has been to migrate providers gradually towards the position of bearing overspend risk. However, some emerging companies are now offering medics turnkey solutions to take part in full-risk programs.

Offerings vary, but programs can involve providing the clinicians with tech and service support, handling the complexities of payer contracting and regulatory compliance and absorbing some or all of the risks linked to the new payer arrangements.

These models represent a win for all those involved. Patients get better care, doctors can be paid more and payers lock in better margins.

A competitive and promising market

The rush of new and innovative players in the market is creating a competitive landscape and spawning a variety of approaches. Some players are involved in care delivery, while others offer supporting services; some build brick-and-mortar facilities or directly employ medics, while others work in partnership; and there is a range of approaches to improving outcomes and lowering costs.

The transition to new models is still in its early stages. Payments based on a fee-for-service model still represent the vast bulk of reimbursements being made in the US – for now, fewer than 10% of payments are meaningfully tied to value.

However, progress is likely to be boosted by recent CMS initiatives. The commitment of the Biden administration to the concept – and the necessity of change to the national economy – make value-based care an inevitability.

The market potential is huge. The US spends $4 trillion per year on healthcare. With adoption still in a nascent stage, this is a space investors should monitor closely.