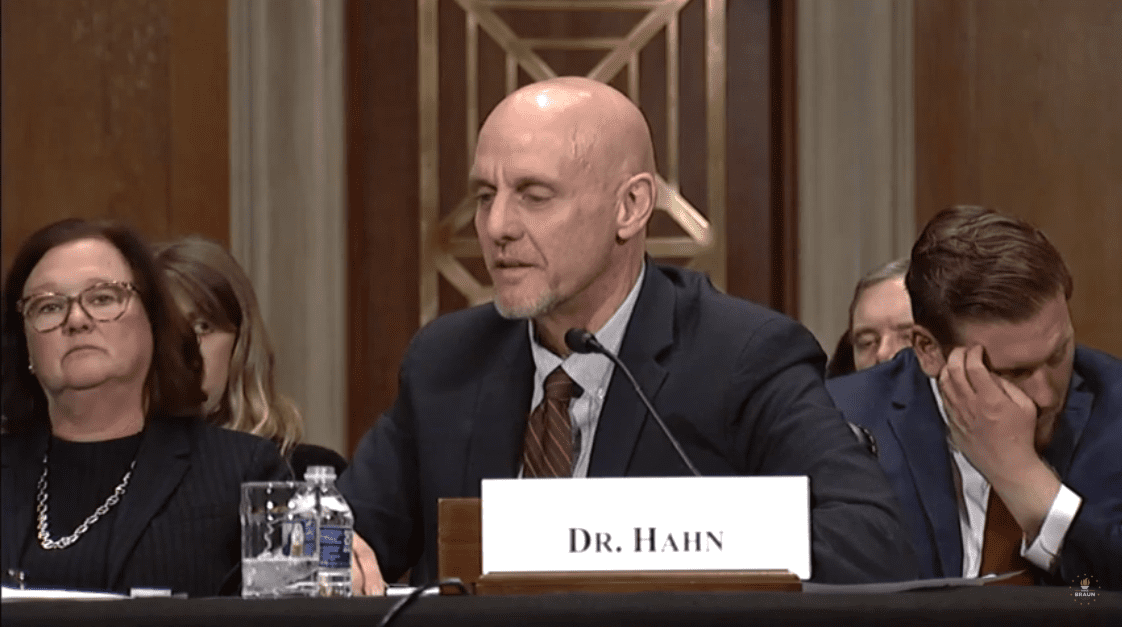

Stephen Hahn gets through Senate’s softball job interview — but mostly plays dodgeball on the issues facing the FDA

Anyone looking for fresh insights on what kind of FDA commissioner Stephen Hahn will be got precious few clues during Wednesday’s Senate hearing on the nomination.

Over more than 2 hours of exchanges, Hahn repeatedly stood behind his devotion to “science and data congruent with the law.” But he carefully steered clear of taking any stand that might upset the White House, avoiding the chance to voice a clear call to ban flavored e-cigarettes — at a time President Donald Trump is reportedly balking at the move.

This article is for premium subscribers only

Upgrade to a premium subscription plan for unlimited access, and join our community of key biopharma players.