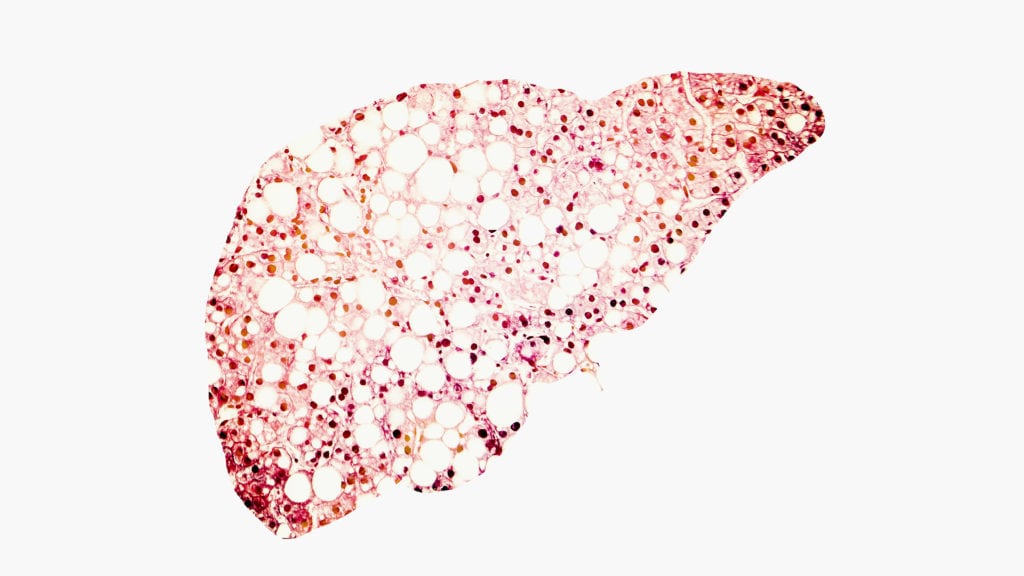

Fatty liver conceptual image, 3D illustration showing fatty liver silhouette made from micrograph of liver steatosis (Shutterstock)

The path to NASH: understanding the role of severe obesity in a complex, multi-system disease

Biotech Voices is a collection of exclusive opinion editorials from some of the leading voices in biopharma on the biggest industry questions today.

We often think a person’s transition from a healthy to a diseased state is binary. But that’s often not the case. In reality, the onset …

Sign up to read this article for free.

Get free access to a limited number of articles, plus choose newsletters to get straight to your inbox.