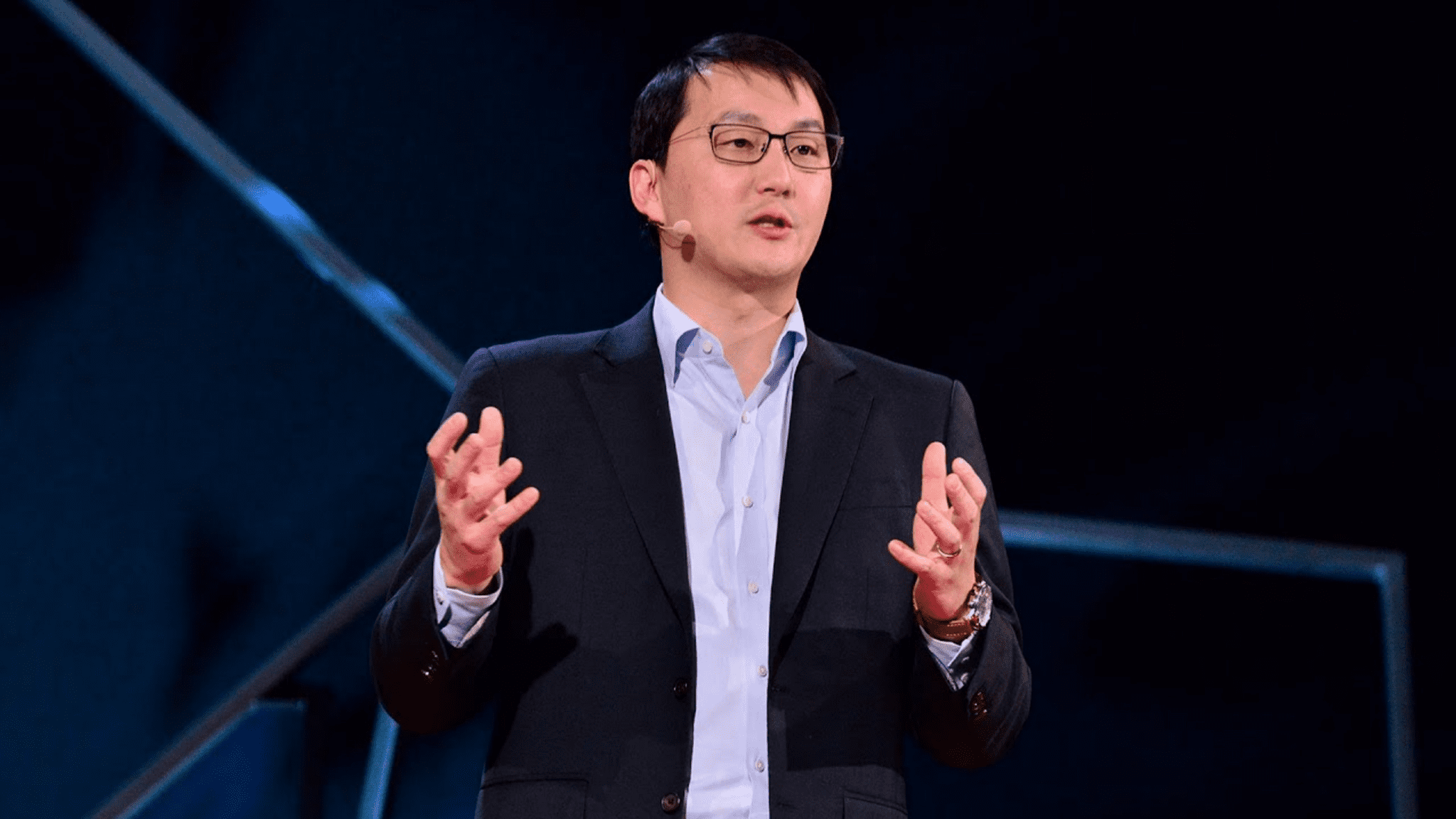

Tim Lu via TED Talks (TED Conferences)

Tim Lu takes Senti and its gene circuit tech public in $296M deal riding on Omid Farokhzad's SPAC

Omid Farokhzad didn’t have to travel far to find a private biotech he wanted to take public with his $200 million blank-check company.

Senti Bio …

Sign up to read this article for free.

Get free access to a limited number of articles, plus choose newsletters to get straight to your inbox.