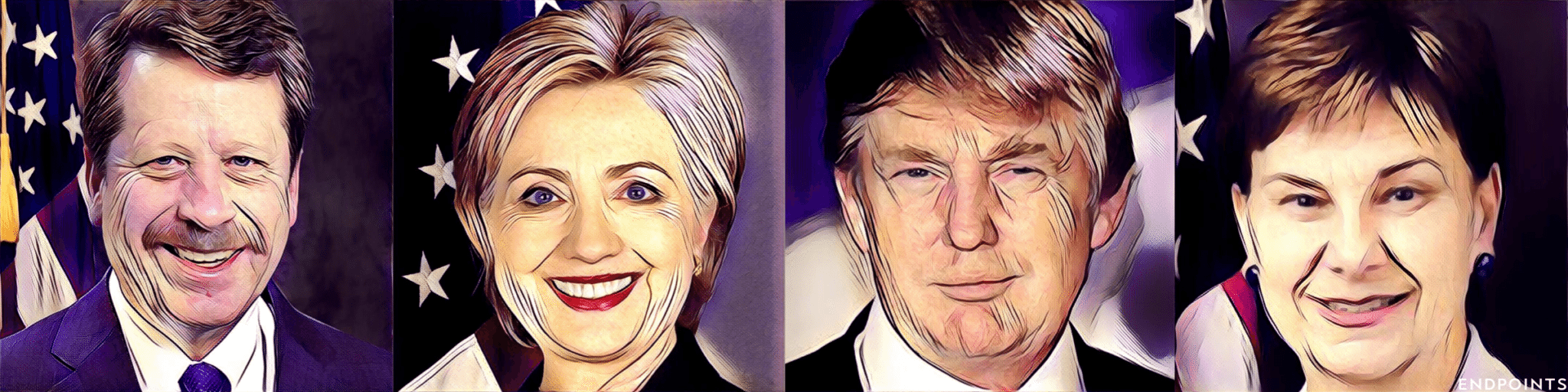

The Endpoints poll: Clinton v Trump and widespread fretting that the FDA just blundered badly

Who would be a better president for biotech? Hillary Clinton or Donald Trump? Is there even a difference? And what did the industry think of …

This article is available only to Premium subscribers

Upgrade to Premium for unlimited access and Premium exclusives.