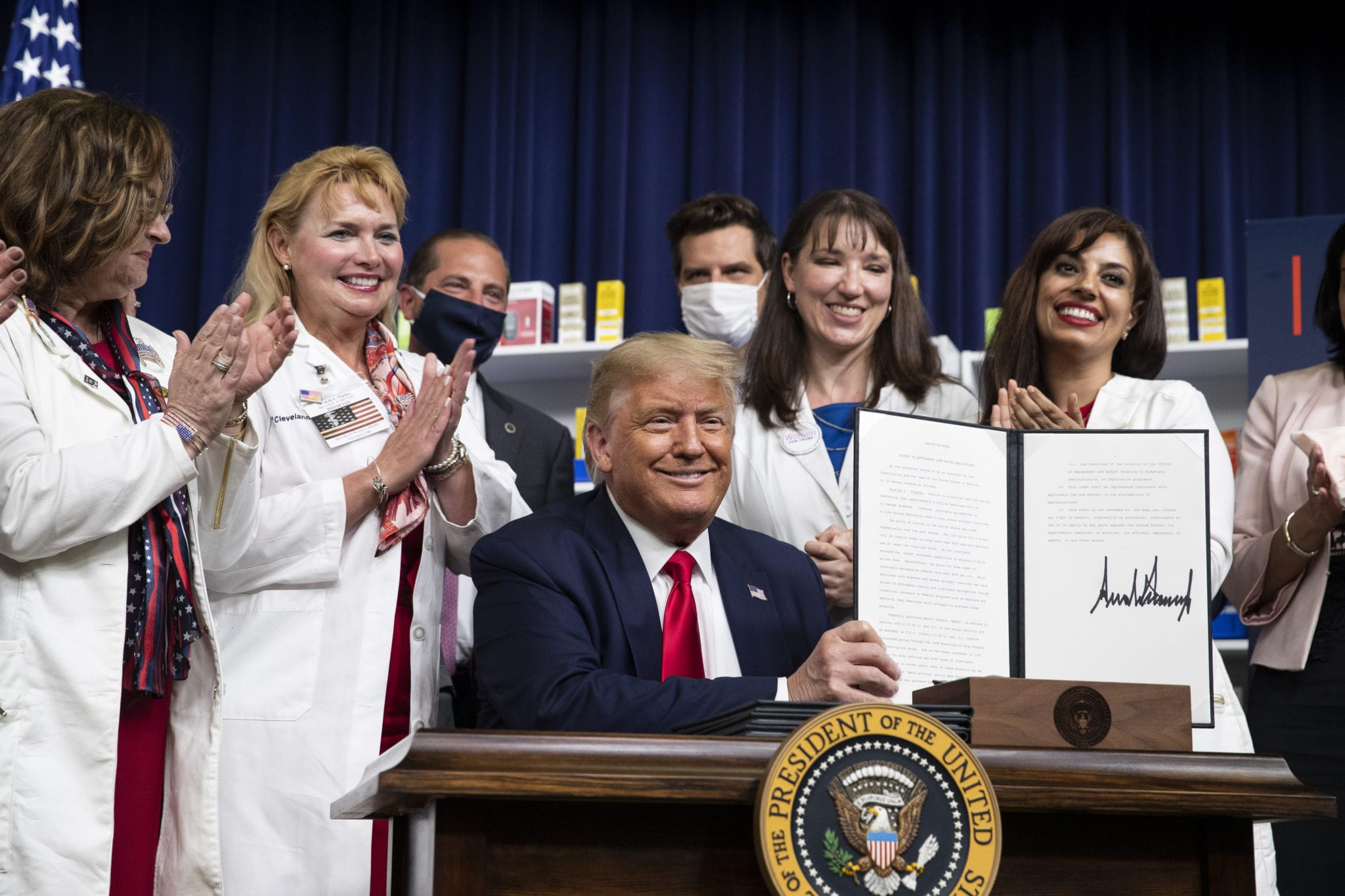

Donald Trump holds up a signed executive order in the South Court Auditorium in the White House complex on Friday, July 24, 2020 (AP Photo/Alex Brandon)

Trump looks to hammer down drug prices with 4 executive orders

President Donald Trump signed 4 executive orders targeting the pharmaceutical industry Friday afternoon, four months before voters head to the polls.

The presidential directives are …

Sign up to read this article for free.

Get free access to a limited number of articles, plus choose newsletters to get straight to your inbox.