Trump's 'sweeping action' to lower drug prices mocked by analysts as relieved investors trigger rally in Big Pharma stocks

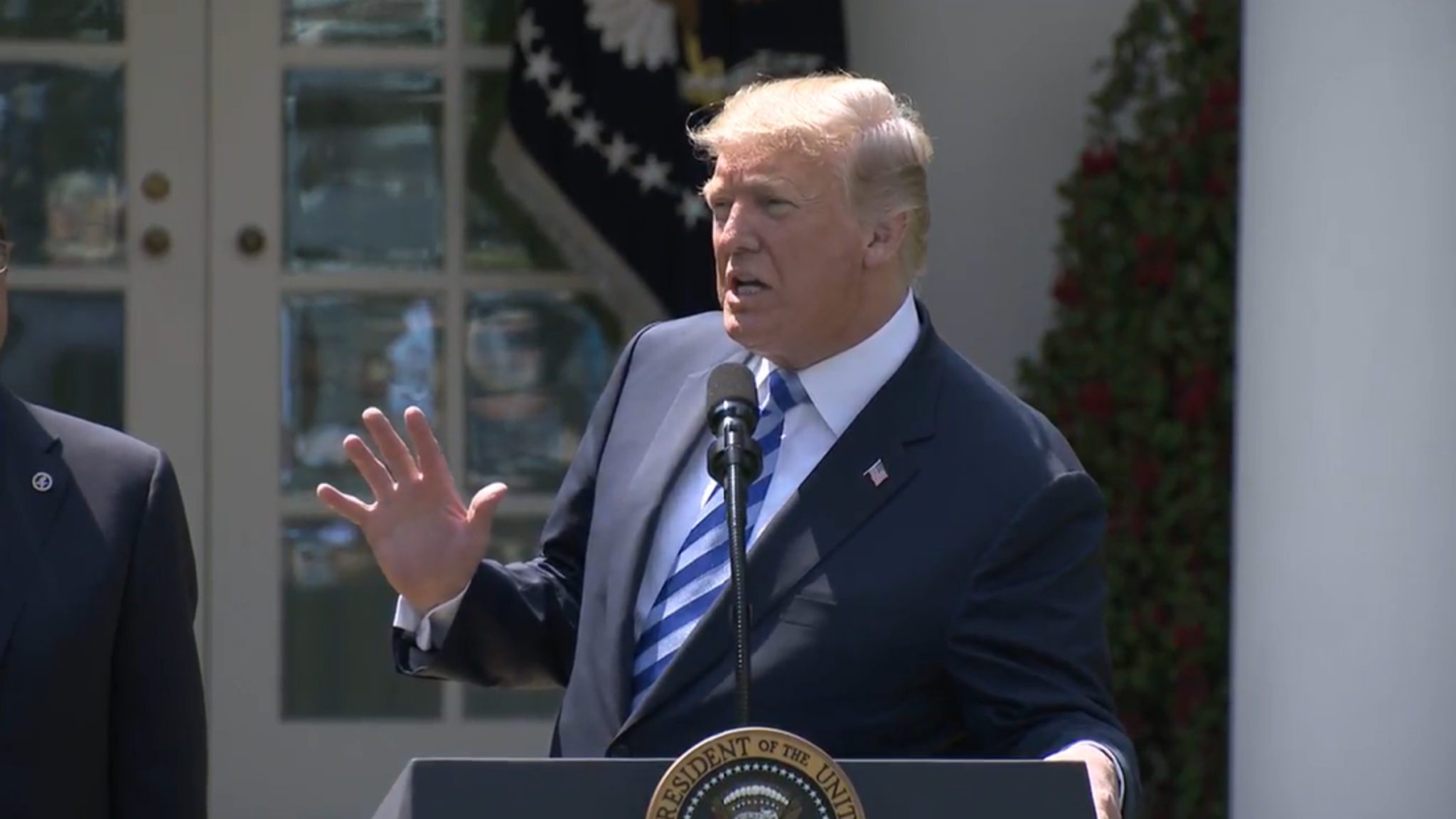

President Donald Trump took to the bully pulpit today to steer a package of proposals into existence that he claimed is “the most sweeping action …

Sign up to read this article for free.

Get free access to a limited number of articles, plus choose newsletters to get straight to your inbox.