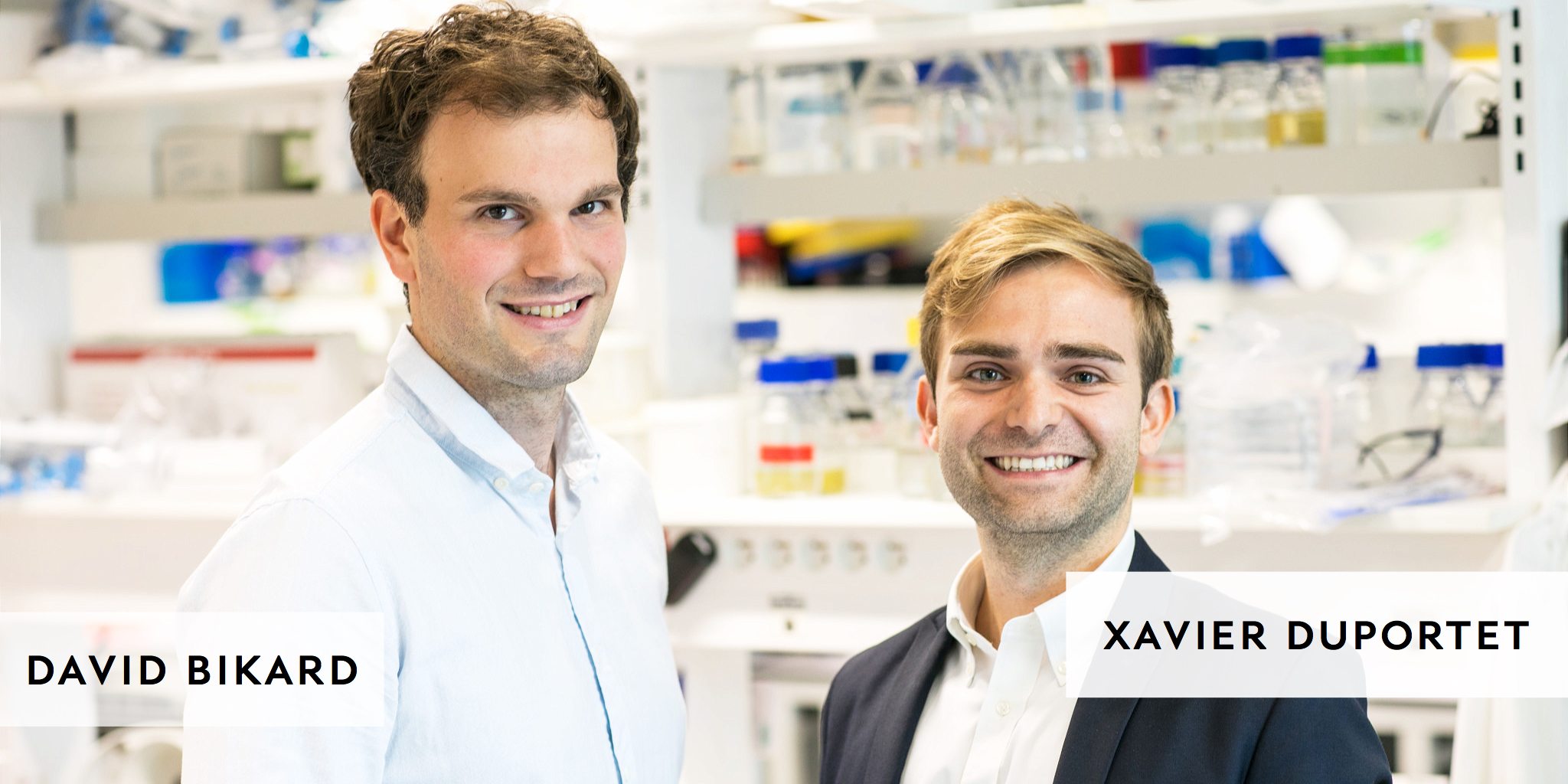

Two young scientists bag $20M to perfect their CRISPR attack on disease-causing bacteria at upstart Eligo

What if you could find a way to deliver new technology like CRISPR into the teeming microbiome regions inside the human body, delivering instructions to …

Sign up to read this article for free.

Get free access to a limited number of articles, plus choose newsletters to get straight to your inbox.