Whale watching: What a decade of change at Big Pharma taught us about corporate phenotypes

Biotech Voices is a collection of exclusive opinion editorials from some of the leading voices in biopharma on the biggest industry questions today.

Authored by Ivan Burkov1,2, Asiya Giniatullina1, Geert-Jan Mulder1, Sander van Deventer1,3,4

Affiliations: 1: Forbion; 2: Inkef Capital; 3: uniQure biopharma BV; 4: Leiden University Medical Center

Confronted with decreasing R&D productivity and scarcity of true new blockbusters, pharmaceutical companies continuously seek growth opportunities by adopting new organizational structures and business strategies. These changes can be distinguished into global adaptive trends within the industry, such as the development of transformative therapies for rare diseases, and pharma-specific approaches, for instance the choice between relying on organic growth or increasing partnering and business development activities.

Understanding the drivers behind strategic changes within the pharmaceutical industry is of significant interest to numerous stakeholders, including venture capitalists. Therefore, we have attempted to capture and explain recent key change events for several companies within the big pharma league. This “whale watching” exercise has revealed interesting insights regarding the industry and helped us to identify key behavioral patterns of big pharma companies.

In our analysis, we have studied a representative sample of some of the largest multinational public pharma companies, looking at three key types of events that happened over the past decade: mergers and acquisitions (M&A), divestments, and key corporate development events (such as restructuring and strategy shifts). We have made use of the Global Data and publicly available resources to compile the dataset. Below we describe our findings and discuss their relevance in light of the ongoing evolution of the pharmaceutical and biotech industries.

Mergers and acquisitions

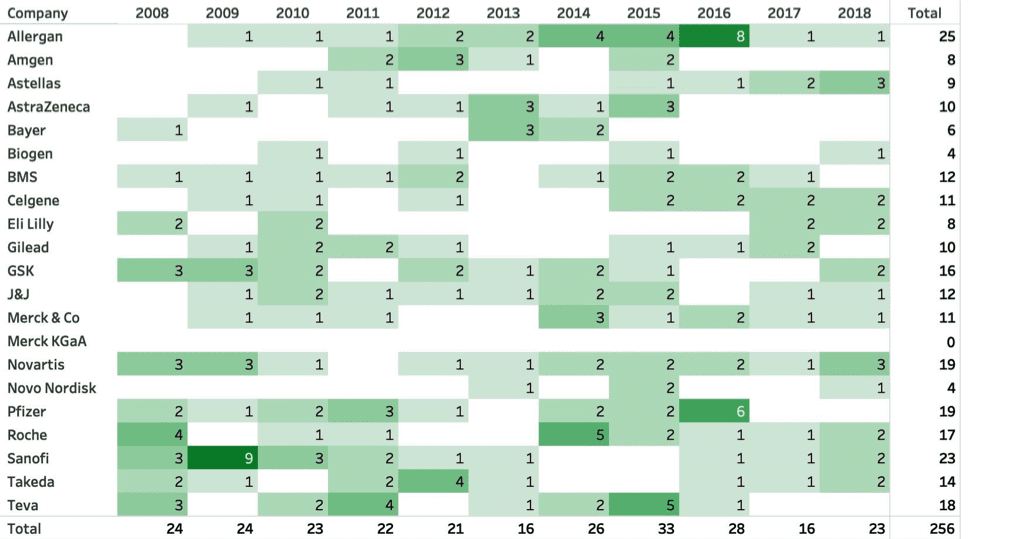

Since several companies (such as Bayer, J&J or Roche) in our selection have business units or subsidiaries that operate beyond pharmaceutical and biotech business, we decided to analyze both overall and pharma/biotech specific deal-making trends. In both analyses, cumulative M&A activity within our sample was relatively stable within the 11-year period studied, with two notable dips around 2013 and 2017 and a spike in 2015 (see Fig. 1 and Fig.2)

Fig. 1. Completed pharma/biotech M&A deals, 2008-2018, accounted by the announcement date

Sign up to read this article for free.

Get free access to a limited number of articles, plus choose newsletters to get straight to your inbox.