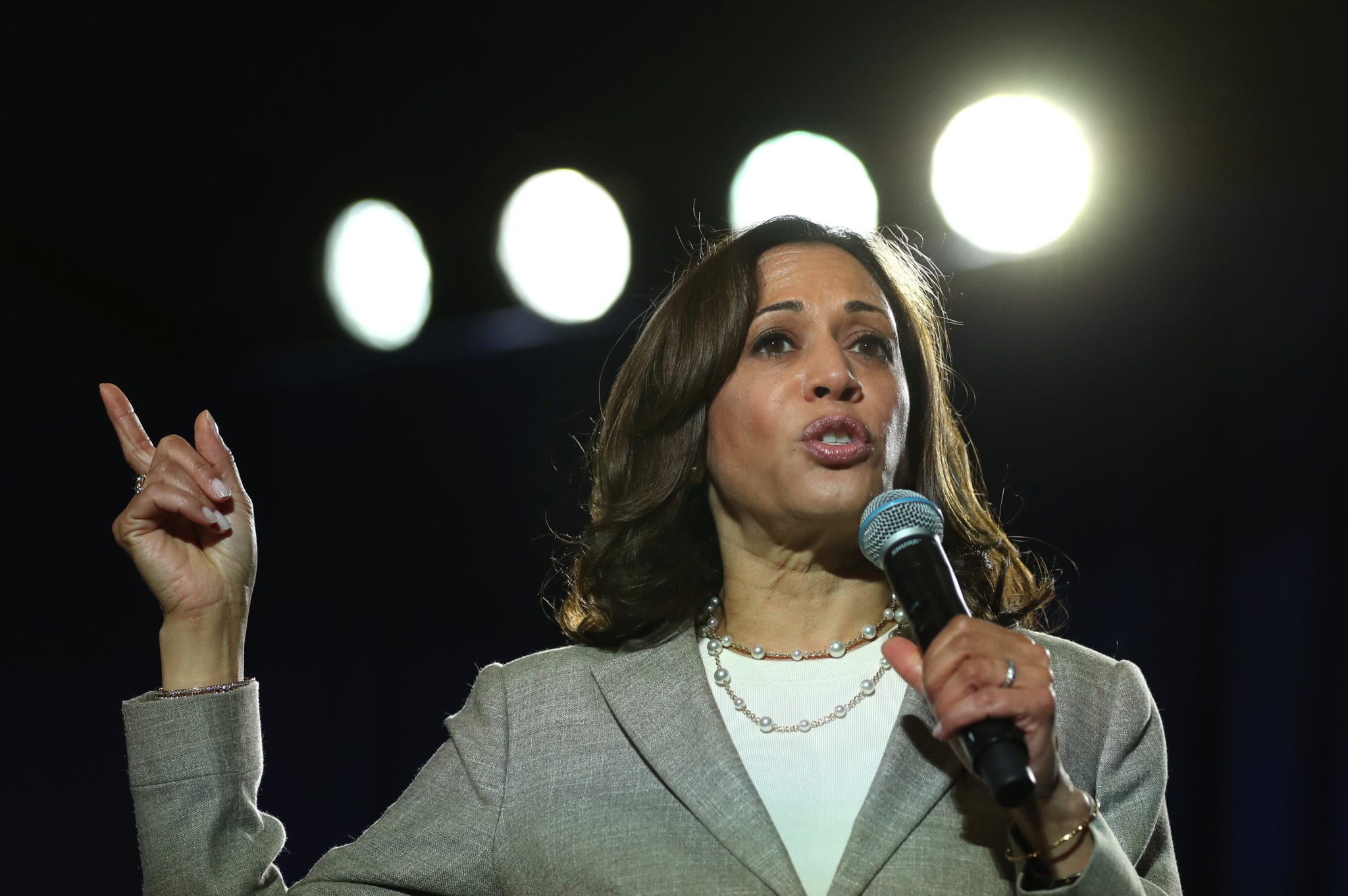

Kamala Harris speaking yesterday at the Des Moines Register Iowa Presidential Candidate Forum [via Getty]

Who’s the toughest on drug prices? A game of political one-upmanship is driving the policy debate in Washington

Earlier this week we got a look at Senator Kamala Harris’ position on drug prices. She’s proposing that HHS take an average price from single …

This article is available only to Premium subscribers

Upgrade to Premium for unlimited access and Premium exclusives.