With Amgen hot on its heels, Radius races to get a jump on osteoporosis drug rivalry

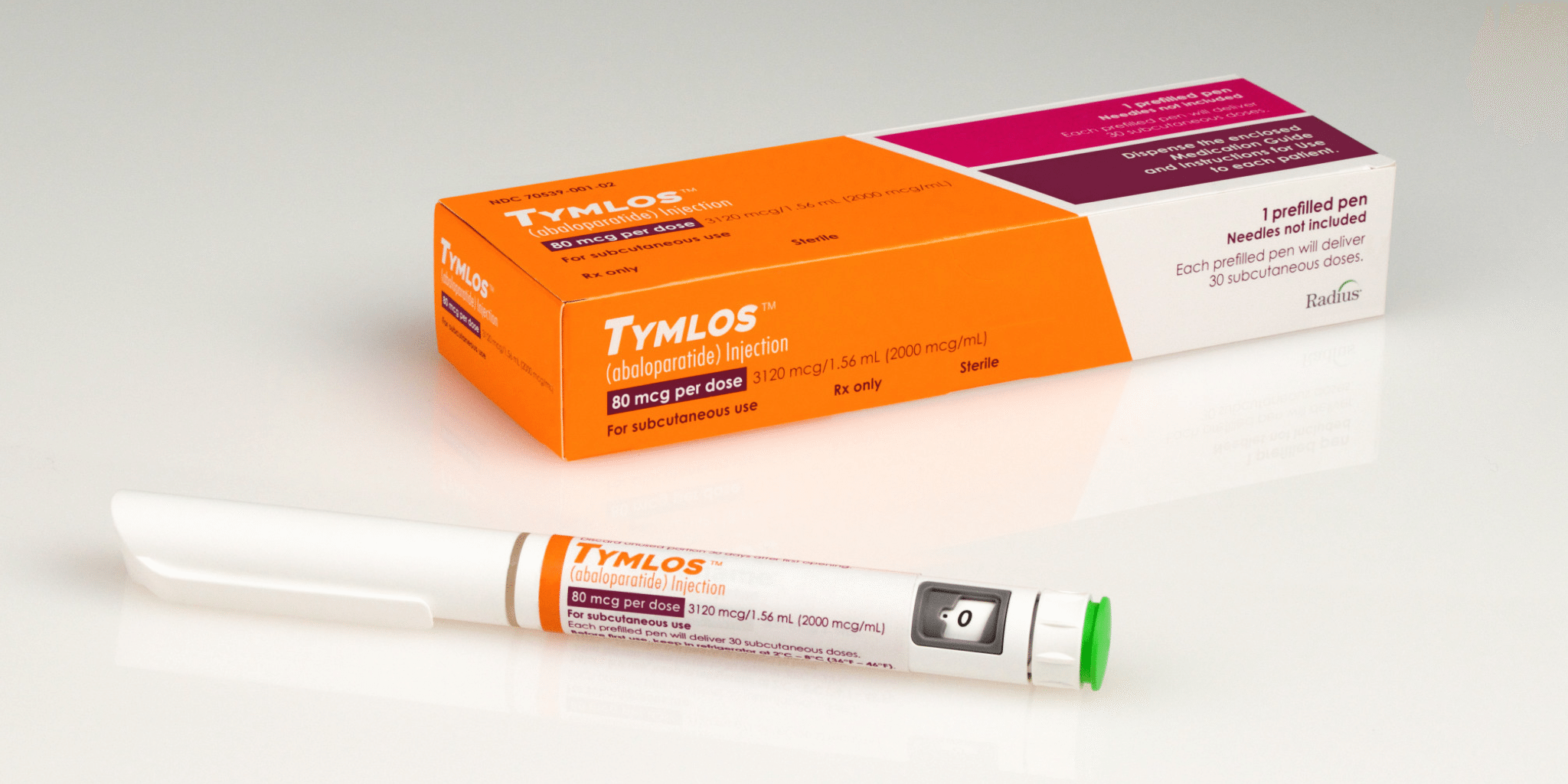

This week, Radius Health $RDUS will open a brand new chapter in its history, armed with an FDA approval for its osteoporosis drug

Sign up to read this article for free.

Get free access to a limited number of articles, plus choose newsletters to get straight to your inbox.