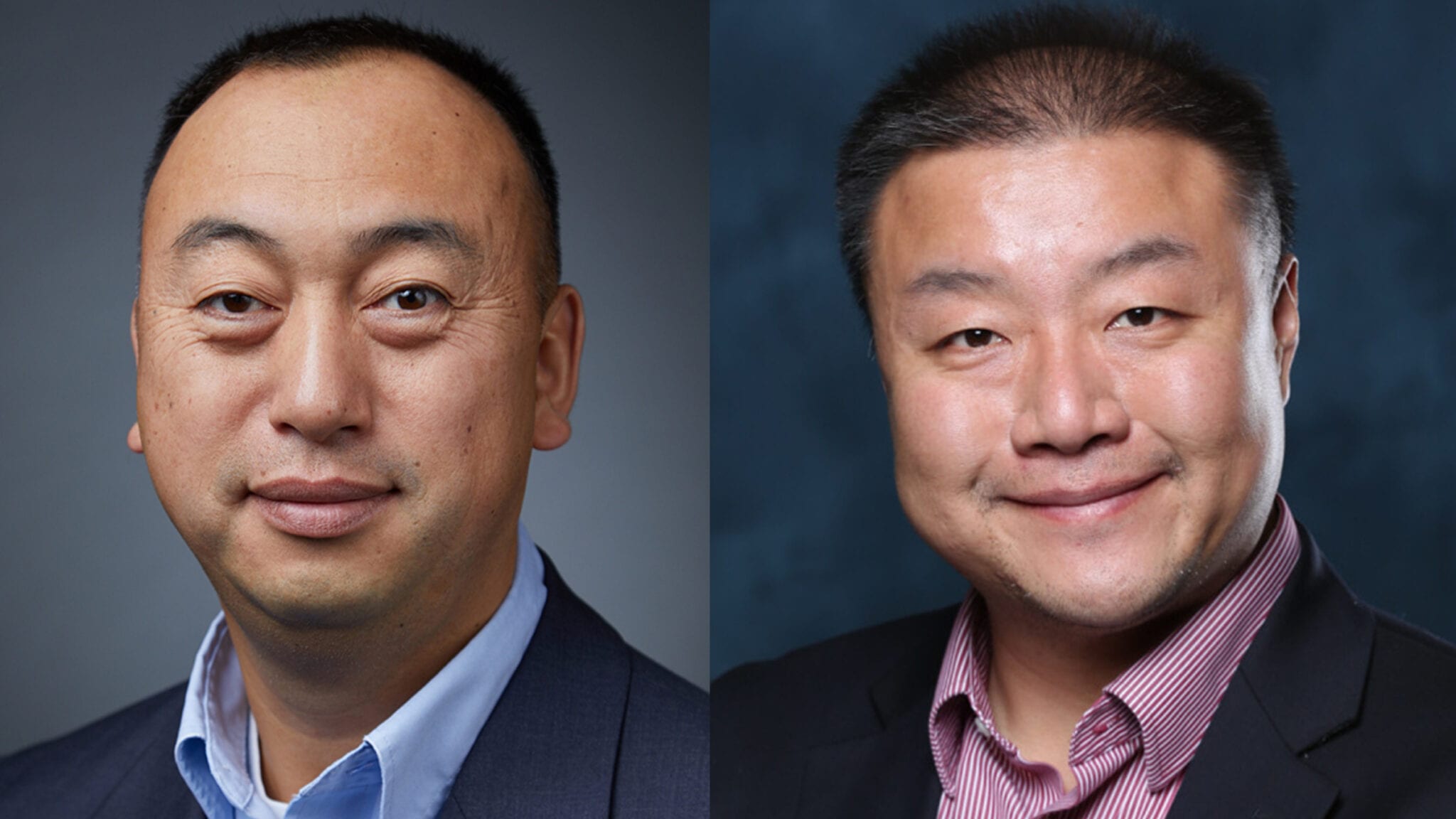

Baiteng Zhao and Tae Han (ProfoundBio)

With Eli Lilly's backing, a team of Seagen veterans with ADC chops is looking to crash the Chinese oncology party

With an industrywide pipeline quickly gathering steam, the Chinese oncology market has become a red-hot market for Western investors as well as Big Pharma partners …

Sign up to read this article for free.

Get free access to a limited number of articles, plus choose newsletters to get straight to your inbox.