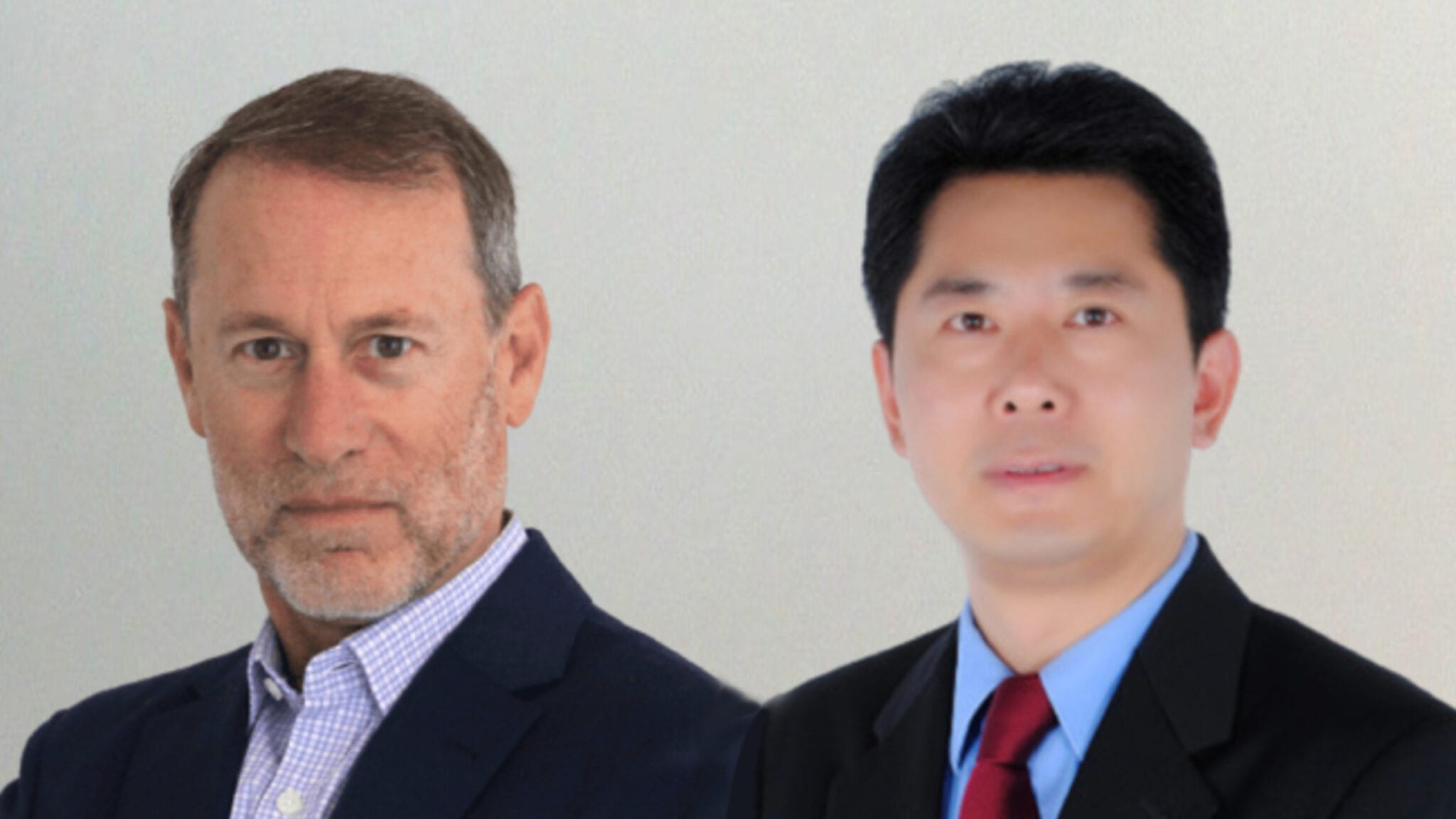

Xencor says goodbye to its former lead drug, selling all rights to Lonnie Moulder's new startup

More than three years after its lead program failed a Phase II study, Xencor is passing off the drug to an up-and-coming Hong Kong biotech.

Xencor sold exclusive worldwide rights for obexelimab, a bispecific targeting FcγRIIb and CD19 to treat autoimmune diseases, to Lonnie Moulder’s Zenas BioPharma, the companies announced Sunday evening. In exchange, Xencor gets a slice of equity equaling 15% of Zenas’ shares following its next financing round, up to $480 million in milestones and royalties.

Unlock this article instantly by becoming a free subscriber.

You’ll get access to free articles each month, plus you can customize what newsletters get delivered to your inbox each week, including breaking news.