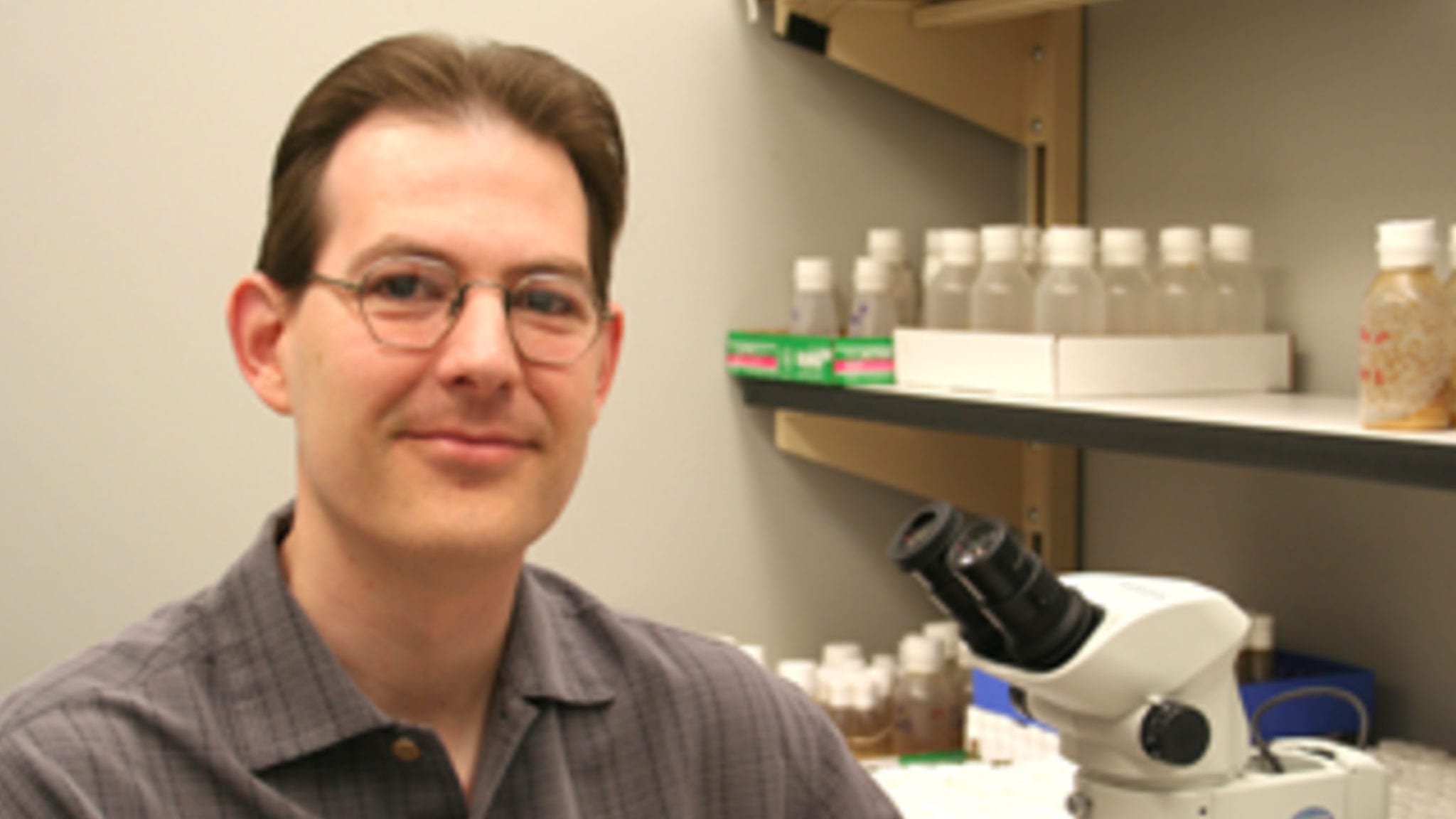

Charles Nichols, LSU School of Medicine

Could psychedelics tackle the obesity crisis? A longtime researcher in the field says his latest mouse study suggests potential

Psychedelics have experienced a renaissance in recent years amid a torrent of preclinical and clinical research suggesting it might provide a path to …

Sign up to read this article for free.

Get free access to a limited number of articles, plus choose newsletters to get straight to your inbox.