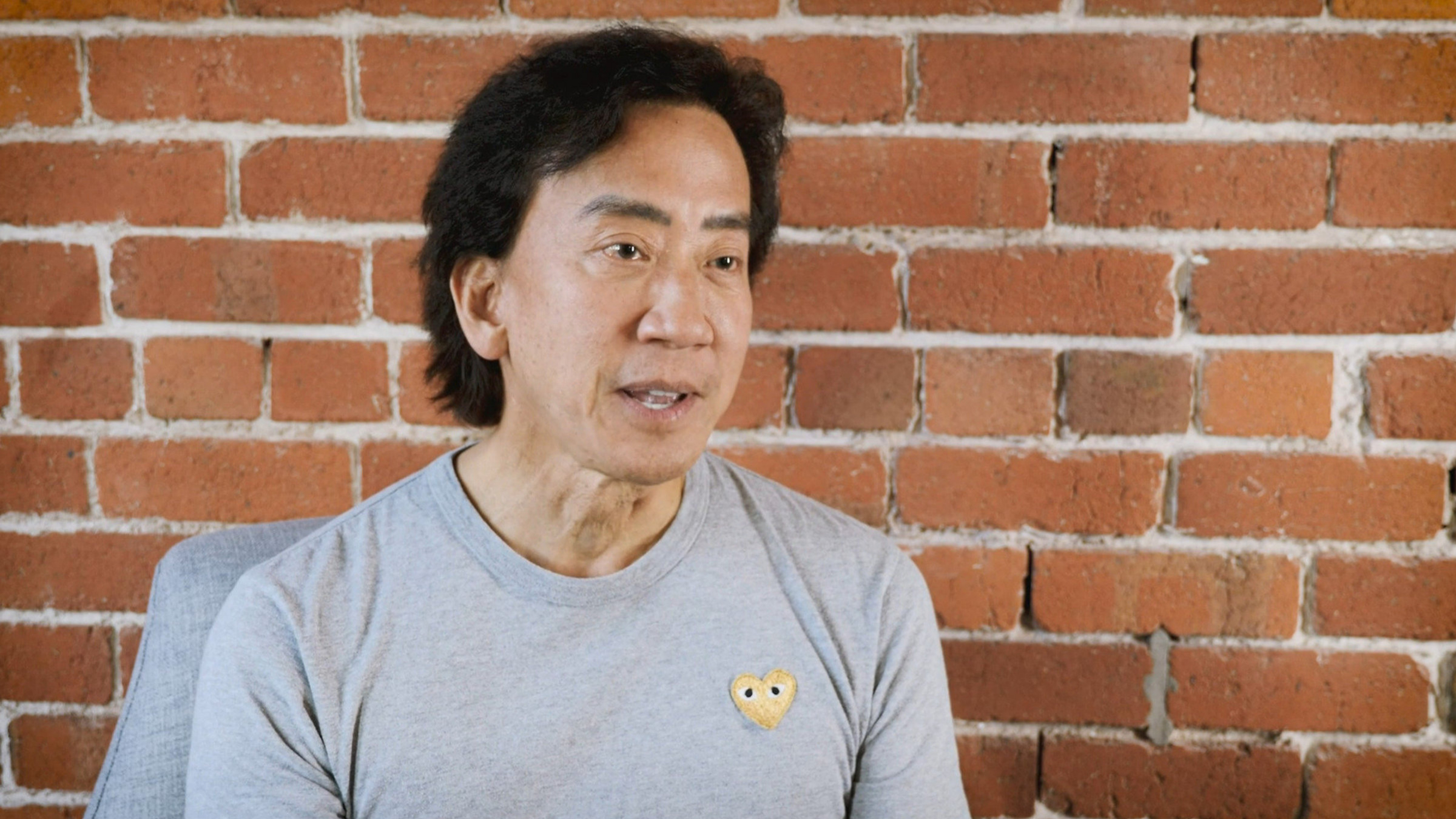

David Hung's Nuvation Bio axes clinical program, lays off 30 after researchers say they can't manage the side effects

The latest biotech to sound the alarm comes from a David Hung startup, and it comes a little over a month after receiving a series of FDA holds.

Nuvation Bio announced Monday it would discontinue development on one of its early-stage clinical programs after regulators halted a handful of studies in late June. On top of this, Nuvation plans to lay off 30 employees, representing about 35% of its workforce, according to an SEC filing.

Unlock this article instantly by becoming a free subscriber.

You’ll get access to free articles each month, plus you can customize what newsletters get delivered to your inbox each week, including breaking news.