FDA grants ‘breakthrough’ status to antibiotic alternative as ContraFect rushes to join fight against superbug

An experimental drug that promises to be the first anti-infective agent to prove superior to vancomycin — an antibiotic approved in 1958 — has notched the FDA’s “breakthrough” status.

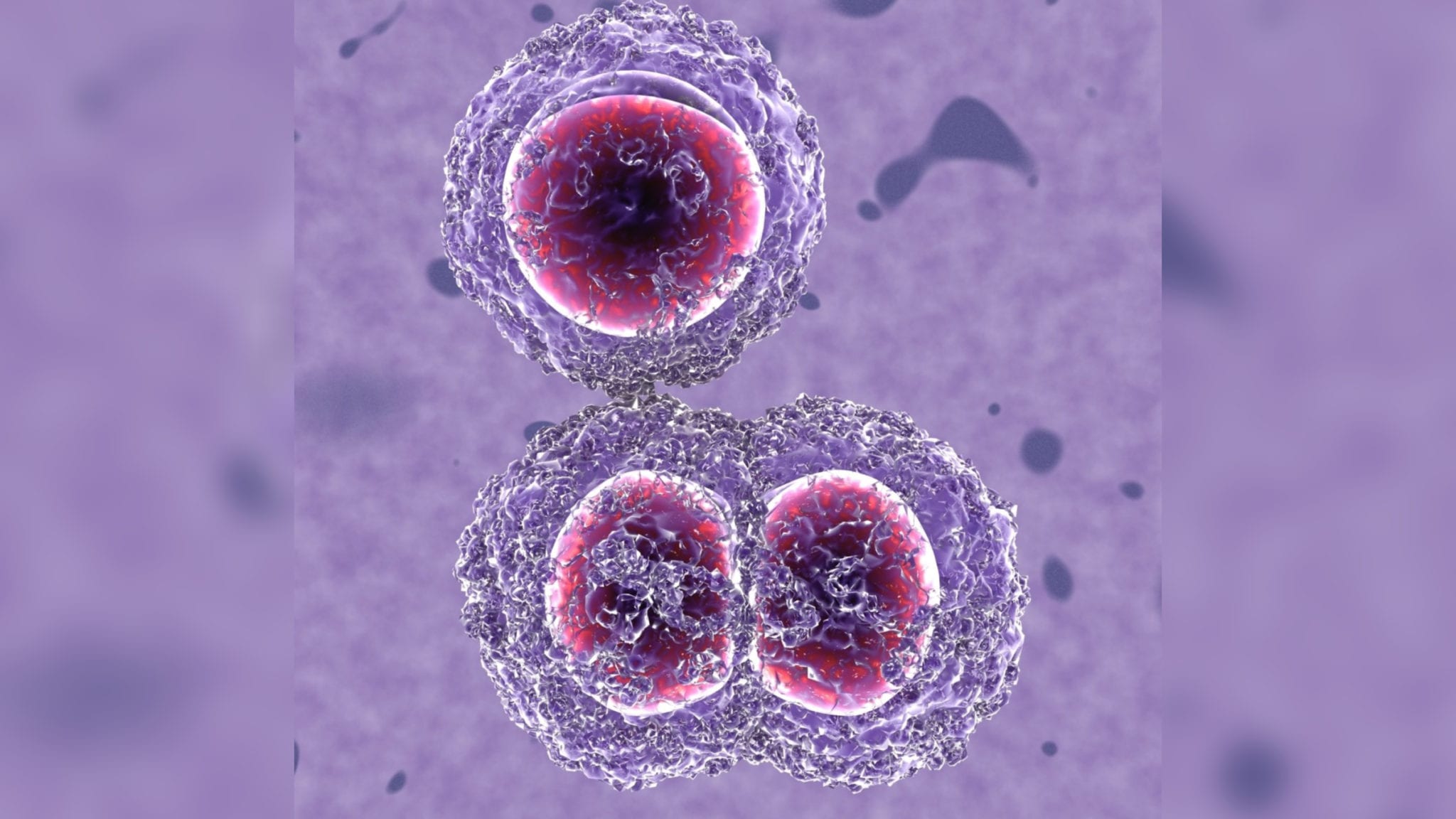

ContraFect said the designation was based on Phase II data in which exebacase was tested against a superbug known as methicillin-resistant Staph aureus, or MRSA. In a subgroup analysis, the clinical responder rate at day 14 was 42.8% higher than that among those treated with standard of care, the company said (p=0.010).

Unlock this article instantly by becoming a free subscriber.

You’ll get access to free articles each month, plus you can customize what newsletters get delivered to your inbox each week, including breaking news.