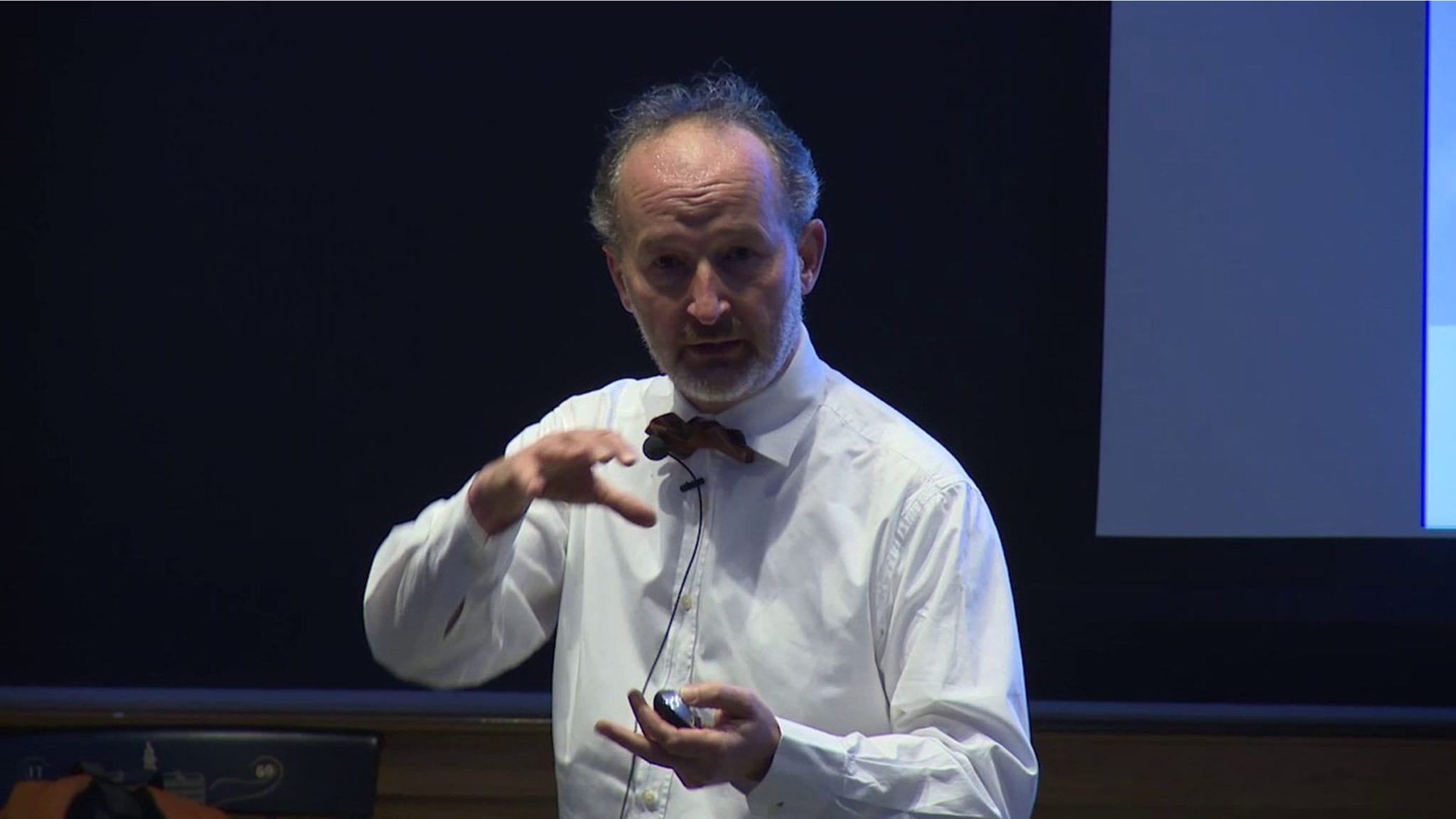

Tillman Gerngross, Adagio Therapeutics CEO

GV steps up to back Tillman Gerngross’ new antibody play against Covid-19 — and he’s already thinking about the IPO

Tillman Gerngross had two good reasons to celebrate on Monday.

First, he felt that Pfizer’s upbeat assessment of its pivotal Covid-19 vaccine data marked …

Sign up to read this article for free.

Get free access to a limited number of articles, plus choose newsletters to get straight to your inbox.