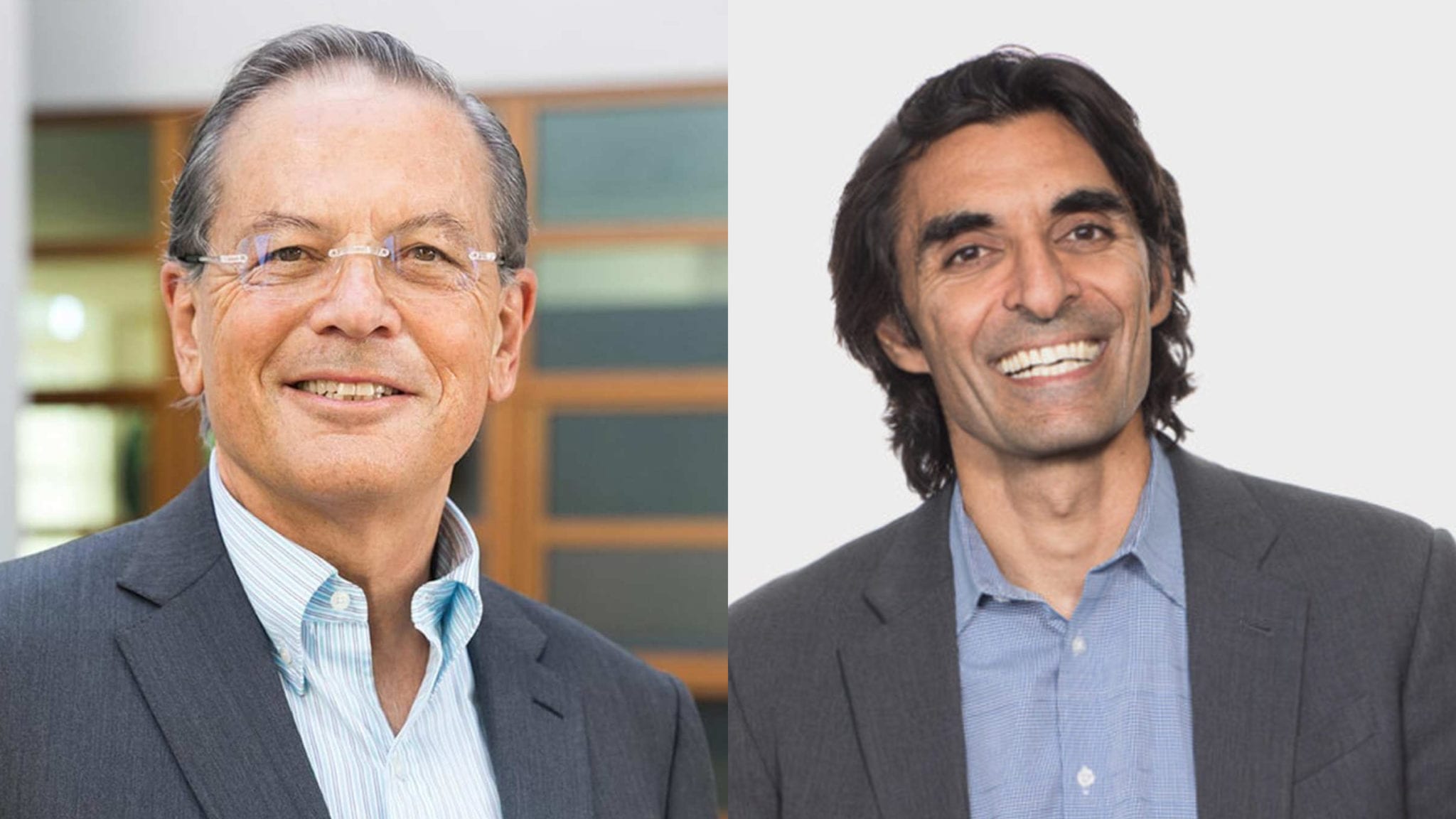

Arie Belldegrun (L) and Amir Nashat

Hooked by the science, Arie Belldegrun joins a group of influentials who believe Dewpoint may have the key to the next big thing in biotech

Amir Nashat knew he had years of preclinical work to do when he talked to me at the beginning of 2019 about Dewpoint Therapeutics …

Sign up to read this article for free.

Get free access to a limited number of articles, plus choose newsletters to get straight to your inbox.