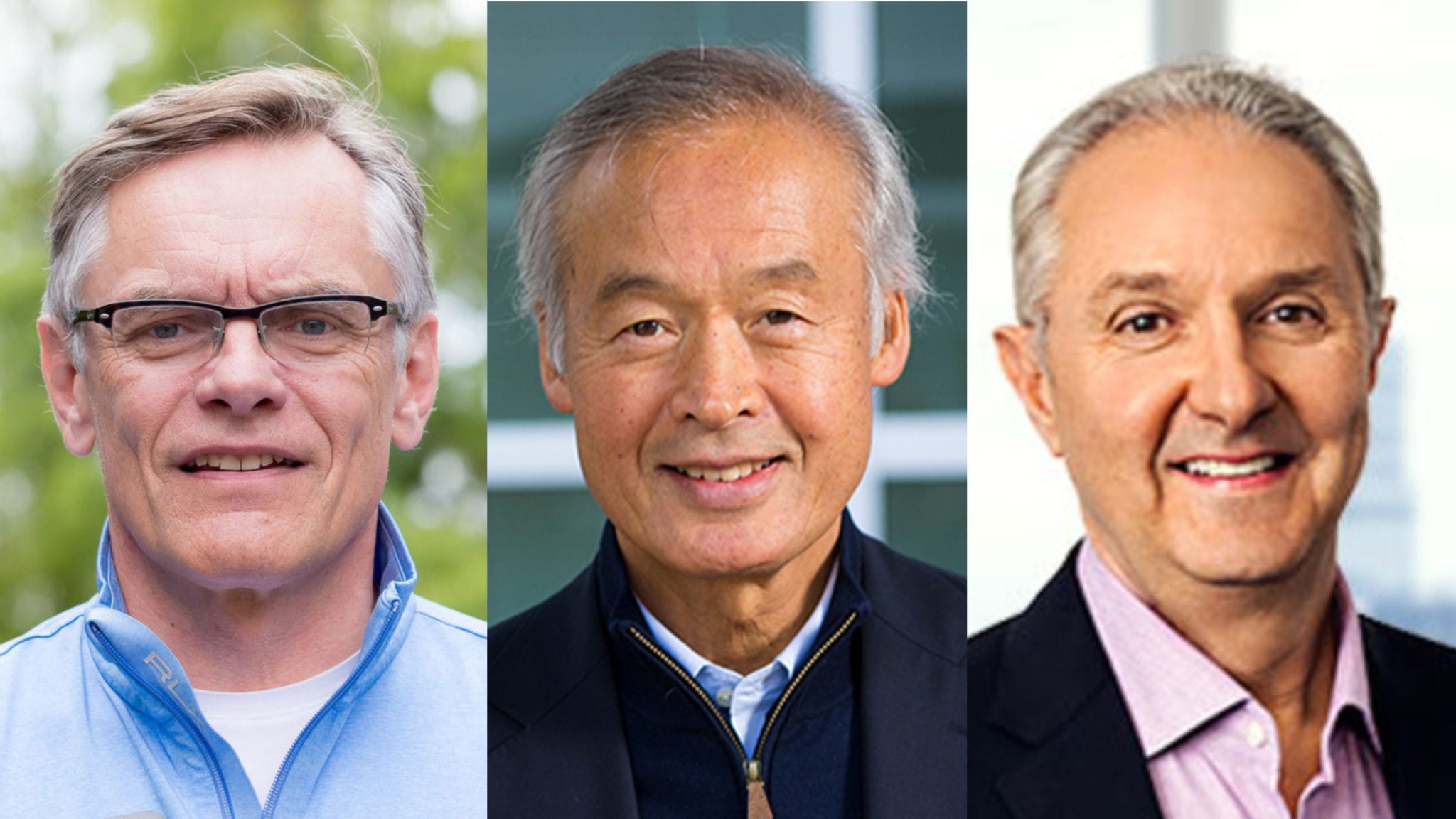

Jim Wilson, Tachi Yamada, Stephen Squinto

How much does it cost to bootstrap a gene therapy startup? Not too much if you're Jim Wilson, per Passage Bio's $125M IPO filing

Days ago when Deerfield partner Bruce Goldsmith jumped to helm Passage Bio, he cited a few reasons why it’s an “extremely exciting time” to …

Sign up to read this article for free.

Get free access to a limited number of articles, plus choose newsletters to get straight to your inbox.